3 Altcoins Facing Potential Liquidations This Week

Jakarta, Pintu News – The crypto market entered the third week of February with a noticeable recovery in a number of altcoins. However, the overall negative sentiment has yet to improve, leaving open the possibility of liquidation for overconfident or overly optimistic traders.

According to a report by BeInCrypto, altcoins such as XRP, DOGE, and TAO have been in the spotlight this week due to important developments. However, they also come with the following risks.

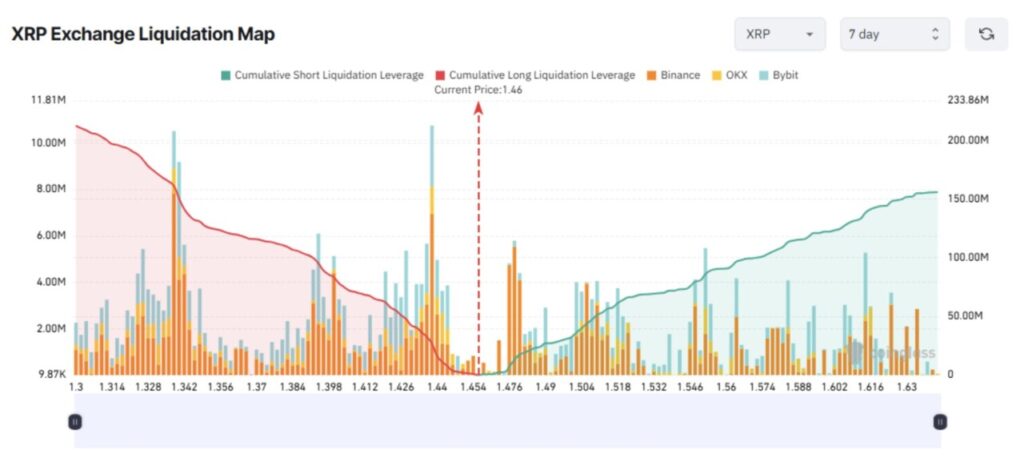

XRP

The XRP (XRP) liquidation map shows that the total volume of liquidation of Long positions is slightly larger than that of Shorts. This week, if the price of XRP drops to $1.30, the accumulated liquidation of Long positions could potentially surpass $200 million. Conversely, if XRP rises past $1.63, the accumulated liquidation of Short positions could reach around $150 million.

Read also: How to Play Crypto for Beginners Safely in 2026

On Sunday (16/2), XRP had risen to $1.66, but on Monday it quickly fell again to below $1.50. Dom analysts think there is selling pressure coming from the Upbit exchange, based on the XRP Spot Cumulative Volume Delta indicator.

The data shows around 50 million XRP was net sold on Upbit within 15 hours, triggering strong selling pressure. This pressure comes ahead of Chinese New Year’s Eve, a holiday period in many Asian countries that often raises concerns about a drop in liquidity.

On the other hand, XRP accounts for a large portion of trading volume on Upbit and Bithumb (South Korea). Therefore, selling pressure from Asian investors could make Long positions more vulnerable this week.

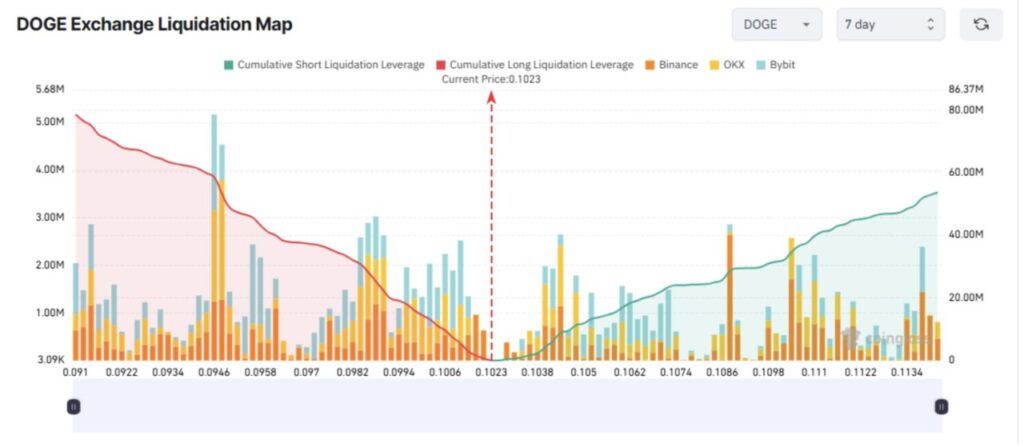

Dogecoin (DOGE)

Recent bullish talk in the community has prompted traders to allocate capital to long DOGE positions this week. If Dogecoin (DOGE) drops to $0.091, the accumulated liquidation of long positions could approach $90 million.

Meanwhile, if DOGE rises to $0.114, the accumulated liquidation of Short positions is estimated to reach around $53 million. So, why should Long DOGE traders remain vigilant? Data from Nansen shows that DOGE’s balance on exchanges (yellow line) has jumped sharply since February 12, when DOGE started to recover due to rumors related to the upcoming launch of X Money.

Many DOGE investors seem to be utilizing this rise as a moment to exit positions, by moving their tokens to exchanges. If this trend continues throughout the week, DOGE could potentially correct and move closer to liquidation levels for long positions.

Read also: 5 Catalysts that Could Push Dogecoin to $0.20 by February 2026

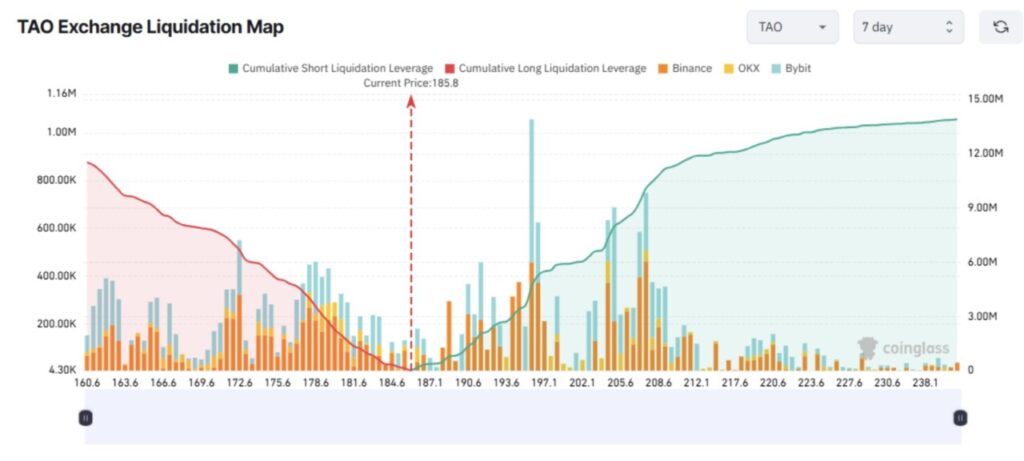

Bittensor (TAO)

TAO’s listing on South Korea’s Upbit exchange on February 16 could potentially provide a new impetus supporting price recovery.

The liquidation map shows that if TAO rises past $283 this week, the liquidation of Short positions could surpass $13 million. Conversely, if TAO drops to $160, the liquidation of Long positions could reach $11.5 million.

As the crypto community’s discussion on AI continues to grab a lot of attention in the market, and as Bittensor (TAO) corrects near the long-term support zone, analyst Michaël van de Poppe expects a strong rebound.

He said he considers projects at the intersection of AI and crypto to be “must-have” assets in the portfolio, and he is happy to have added funds to this position. In his opinion, the market has the potential to show continued strength, at least a mean reversion to around $300.

The new liquidity from Upbit, plus Michaël van de Poppe’s views, could put TAO’s Short position at higher risk.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Facing Major Liquidation Risks in the Third Week of February. Accessed on February 20, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.