5 Silver Price Updates Today, Precious Metal Investment Options Besides Gold in 2026!

Jakarta, Pintu News – Amidst the market’s focus on gold, silver is now being looked at as an alternative investment instrument that has attractive growth potential in 2026. As a precious metal with a much more affordable price, silver offers convenience for novice investors to start building a portfolio of physical assets without large capital. Today’s silver price dynamics are strongly influenced by the needs of the global manufacturing industry as well as the movement of the rupiah exchange rate, which is currently stable at IDR 16,937.

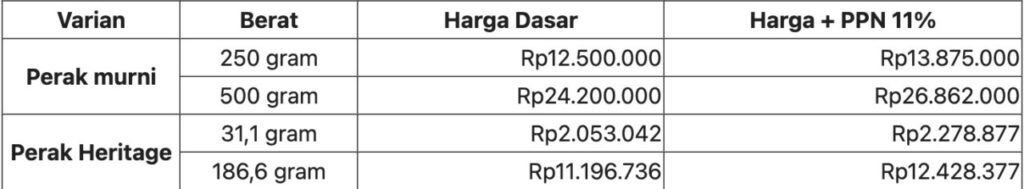

Silver Price Analysis Per Gram Today

Silver liquidity in the domestic market is also very good, where investors can easily resell their collections at various jewelry stores or precious metal specialty outlets. These daily price movements reflect market participants’ optimism towards silver’s increasingly massive use in the technology and renewable energy sectors.

For people who want to preserve the value of their wealth, buying silver in the form of bars or pure coins remains a very logical financial strategy amidst dynamic economic conditions.

Also Read: 5 Diamond Price Updates per Gram and Carat 2026, Some Penetrate Rp5 Billion!

Silver’s Role in the Global Technology Industry

One of the main drivers of silver’s price stability in 2026 is its irreplaceable role in the electronic device and electric vehicle component industries. Silver is the best conductor of electricity among all metals, so its demand continues to surge as the adoption of green technology accelerates around the world. This gives silver a strong fundamental value, where the price of this asset is not only driven by market speculation, but also by the real needs of the industrial sector.

In Indonesia, demand for silver for the solar panel industry is also at a record high, which directly impacts the price per gram on the local market. In contrast to purely speculative assets, silver’s close association with technological advancement makes it a relatively safer asset to hold in the medium to long term. Analysts predict that as global mining supplies become increasingly limited, silver prices have the potential to continue to gradually strengthen in the future.

Silver Investment Comparison with Crypto Assets

In the modern investment ecosystem, many investors are now combining physical assets like silver with digital assets like Bitcoin (BTC) or Ripple (XRP). While cryptocurrencies offer transaction speed and the potential for large returns, silver provides tangible physical security and does not rely on internet infrastructure. Including silver in your portfolio can be an effective counterbalance when digital asset markets are experiencing turmoil or sharp corrections.

Compared to meme coins such as Popcat (POPCAT) whose prices are heavily influenced by social media trends, silver prices are much more stable and scalable. Silver’s characteristics as an asset thathedges against inflation make it an ideal choice for investors who want long-term capital security. With a conventional value that has been recognized for thousands of years, silver remains a relevant symbol of wealth despite the rapid development of financial technology.

Getting to know Types of Silver 925 for Jewelry Collection

If you’re interested in collecting silver in the form of accessories such as rings or necklaces, make sure to always choose standard 925 silver or sterling silver. This code indicates that the product contains 92.5% pure silver and 7.5% reinforcing metals so that the jewelry does not bend or scratch easily when worn. Jewelry with this grade usually comes with an official “925” stamp as a quality assurance for buyers in both international and local markets.

The advantage of collecting 925 silver is that it can be easily cleaned and polished to look like new even after a long period of storage. Many craftsmen in Indonesia, especially in Bali and Yogyakarta, are now presenting modern silver designs with world-class craftsmanship. Buying silver jewelry is not just a matter of style, but also a form of micro-investment that is functional and has a competitive resale value in 2026.

Safe Tips for Buying Silver Today

For those of you who want to start buying silver, it’s important to check the credibility of the seller and ask for a certificate of authenticity if buying in bulk. Always monitor daily price movements through trusted platforms so that you don’t miss out on the ideal buying price point. Diversification is key, so consider owning silver in different forms, whether pure bars for savings or jewelry for daily use.

Be sure to store your silver assets in a dry and airtight place to avoid the oxidation process that can cause the silver color to turn black or dull. With proper care, your silver investment will stay shiny and provide security for your family’s future financial planning. Silver is no longer just “poor man’s gold”, but a smart investment instrument that offers strategic value in the digital economy era of 2026.

Also Read: Shocking Prediction: Bitcoin (BTC) Will Take 20 Years to Beat Gold, Says Willy Woo

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

- Door News. Silver Price Today: Silver Price Update 925 Per Gram and Investment Strategy. Accessed February 19, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.