Nvidia’s Breakthrough! Injects IDR 506 Trillion into OpenAI to dominate AI market

Jakarta, Pintu News – Tech giant Nvidia (NVDA) is reportedly finalizing a strategic move by diverting its massive investment plan in OpenAI. Instead of continuing its initial $100 billion commitment, the Jensen Huang-led company chose to inject $30 billion or equivalent to Rp506.6 trillion. This decision was made to balance financial risk while still securing Nvidia’s position as the main hardware supplier for the ChatGPT developer.

New Strategy: Smaller, Safer, Stay Dominant

Nvidia’s move to cut the investment figure from $100 billion to $30 billion is seen by analysts as a very financially savvy “decoupling” move. The new investment will take the form of anequity stake in OpenAI’s latest funding round, which targets a valuation of $830 billion. With this scheme, Nvidia is no longer tied to the thousands of trillions of rupiah worth of rigid infrastructure development commitments that were previously feared to strain the company’s balance sheet.

Although smaller in value, the deal still ensures that OpenAI will reinvest most of the capital into buying Nvidia’s latest GPUs. This creates a win-win ecosystem where Nvidia gains ownership exposure in one of the world’s most valuable AI companies while guaranteeing long-term demand for its products. Investors also welcome this flexibility, given the fast-changing dynamics of the AI market and the regulatory risks involved.

Also Read: Warren Urges Fed and Treasury to Reject Crypto Billionaire Bailout, Afraid to Favor Trump?

Impact on NVDA Shares and Market Sentiment

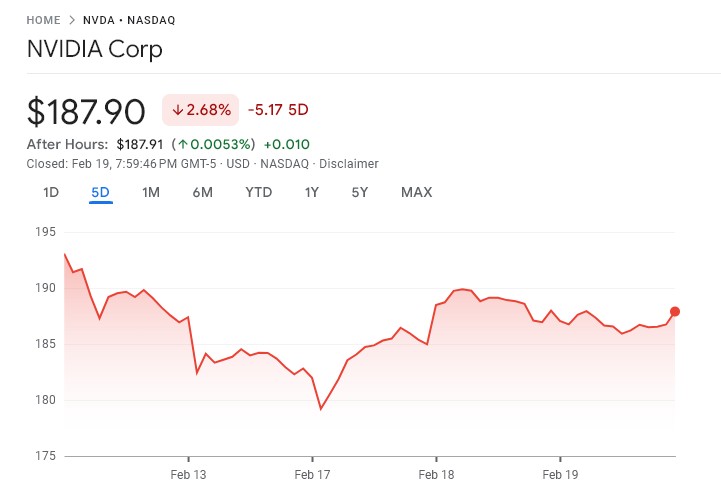

Nvidia (NVDA) shares experienced high volatility in early February 2026, hitting a six-week low of $177 on concerns over export restrictions to China. However, the announcement of the $30 billion investment helped trigger a recovery in the share price towards the $180s area as market confidence returned. Analysts project that this move is a long-term bullish signal that shows Nvidia’s dominance remains unwavering at the center of the global artificial intelligence infrastructure boom.

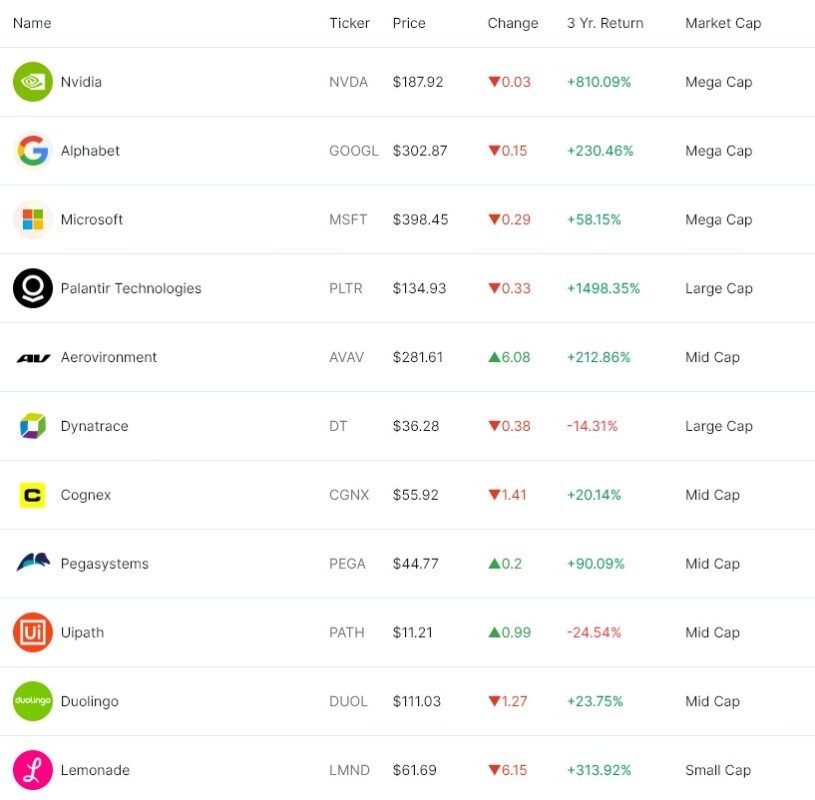

In addition to the investment in OpenAI, Nvidia also strengthened its position through a massive chip supply deal with Meta Platforms for millions of AI processor units. Market focus is now on the fourth quarter earnings report scheduled for February 25, 2026, where data center revenue growth is expected to remain strong at 14% per quarter. For those of you who follow NVDA stock, this investment in OpenAI is a reminder that Nvidia is not just a chip manufacturer, but a key player controlling the direction of the world’s AI ecosystem.

The Future of Global AI Infrastructure

OpenAI CEO Sam Altman dismissed rumors of a rift with Nvidia as “madness” and insisted that his company will remain a major customer for Nvidia products. OpenAI itself plans to use the fresh funds to build its next-generation computing facilities, including the utilization of Nvidia’s new Vera Rubin platform. This synergy proves that competing in the development of increasingly sophisticated AI models requires massive and sustainable hardware support.

This investment also puts competitive pressure on other competitors such as AMD as well as Google and Amazon’s in-house chip initiatives. By owning a stake in OpenAI, Nvidia is effectively locking one of its largest customers into their ecosystem amidst the emergence of new AI chip alternatives. While the market is still wary of a potential AI “bubble”, Nvidia’s concrete step of injecting Rp506 trillion shows that the biggest digital infrastructure development in history is far from over.

Also Read: Tron (TRX)’s Glory in 2026: King of Transactions and Digital Payment Infrastructure

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

Trading US Stock Tokens on the Door

Imagine being able to buy shares of big companies like Nvidia (NVDAX), Amazon (AMZNX), Meta (METAX) in tokenized form for just a few thousand dollars. The good news is that you can now buy/sell tokenized US stocks from xStocks and Ondo at Pintu.

By leveraging blockchain technology, you can now enjoy a faster settlement process for tokenized US stocks, more affordable start-up capital, and a more global investment experience.

CHECK THE PRICE OF US XSTOCKS HERE!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Mohammad Shahid/BeInCrypto. Nvidia Dumps $100 Billion Plan for a Much Smaller OpenAI Investment Bet. Accessed February 20, 2026.

- Ananthu C U/Invezz. Nvidia nears $30B investment in OpenAI, ditches earlier plan: report. Accessed February 20, 2026.

- Carlos Méndez & Krystal Hu/Investing.com. Nvidia close to investing $30 billion in OpenAI’s mega funding round, source says By Reuters. Accessed February 20, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.