Debunking Five Main Criticisms of Crypto Assets

Until now, crypto assets faced skepticism from investors and the general public. However, given the significant advancements in the crypto industry over the past years, it’s worth reevaluating the relevance of these criticisms. What are the primary concerns raised about crypto assets? The following article will discuss the five main criticisms of crypto assets and the answers to these criticisms.

Article Summary

- ❓ As a relatively new investment asset class, crypto assets have been subject to various criticisms that often arise from security concerns or a lack of understanding.

- 🙅♂️ The main criticisms of crypto assets are that there is no regulation, no use-case, low scalability, similar to gambling and that the technology is complex and difficult to understand.

- 🏁 As the crypto industry evolves, some arguments suggest that many of these criticisms are now less relevant or have been debunked.

Debunking Criticisms of Crypto Assets

The acceptance of crypto assets as a new asset class has not been universal among both professional investors and the general public.

These criticisms encompass concerns such as the lack of regulation, having no use-case, extreme price volatility akin to gambling, limited scalability, and the intricate, often challenging-to-grasp technology behind crypto assets.

Criticism of crypto assets is fair and understandable. After all, some of these criticisms stem from concerns or simply investor unfamiliarity. But are all the criticisms true? The following are answers and explanations to these criticisms.

1. Crypto Assets Have No Regulation

The criticism that cryptocurrencies are unregulated might be very relevant in the period spanning 2015 to 2018. However, in the last five years, conditions have been very different. While not all countries have implemented comprehensive regulations for cryptocurrencies, there has been a gradual shift towards regulatory frameworks in some regions.

In 2019, the Financial Action Task Force (FATF), which covers 36 countries, released standards to combat the use of crypto assets for money laundering activities and terrorist and criminal financing. Countries such as the United States (US) have also pushed for rules to register crypto platforms like securities companies. They have also launched the Crypto Regulatory Framework.

The European Union has also issued Markets in Crypto Assets (MiCA). It contains supervisory mechanisms and consumer protection from market manipulation and financial crime. Indonesia already has regulations governing the trading of crypto assets. They also launched a Bursa Kripto Nusantara to support the crypto industry.

The steps taken by countries to regulate crypto assets show that this criticism is no longer relevant.

Recently, Hong Kong became a country that supports the crypto industry through its regulations. Find out its impact and potential here.

2. Crypto Assets Have No Use-Case

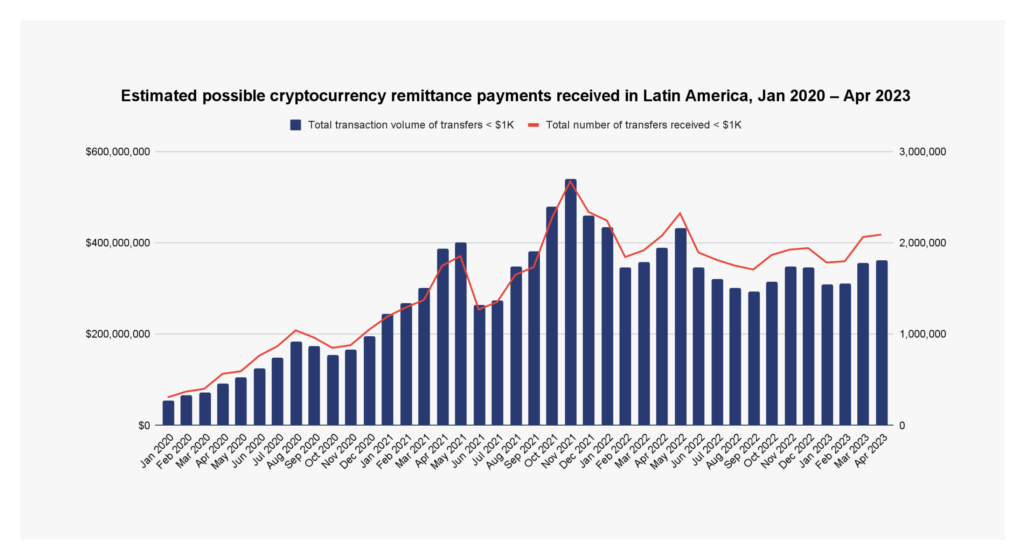

Apart from regulation, the main criticism of crypto assets is that they are considered to have no actual use case or value. Unlike stocks that reflect company performance, for example. Although its adoption has not been massive, crypto assets have use cases in several developing countries.

One of the use cases of crypto assets is in the remittance in countries such as Mexico, several Latin American countries, Nigeria, and the Philippines. In Mexico, for example, Bitso, one of Mexico’s largest crypto asset exchanges, has processed around US$3.3 billion in remittances from the US to Mexico by 2022.

Another use-case of crypto assets is for cross-border transactions. This is because it doesn’t need to go through complicated administrative processes, there are no additional fees, and it can be settled quickly.

One of the largest credit card companies in the world, Visa, started processing payments using USDC on Ethereum and Solana. PayPal did the same, but instead of opening up payments through cryptocurrencies like Visa, it created its stablecoin, PYUSD.

To say that cryptocurrencies don’t have use cases is a misplaced criticism. In recent years, crypto use cases have diversified. Even large institutions have begun to adopt it.

Make no mistake, with the current use cases, crypto assets have the potential to become global assets.

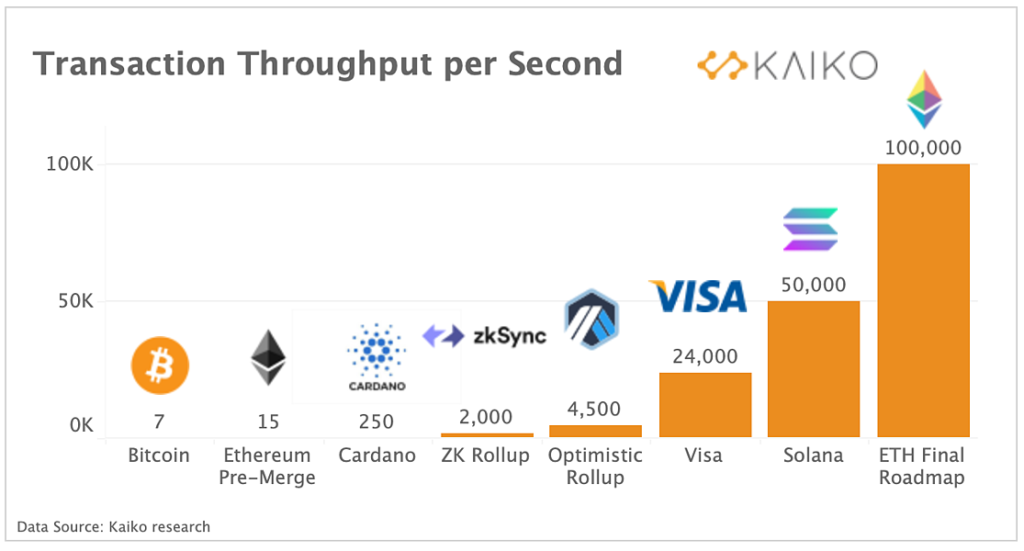

3. Crypto Assets Lack Scalability

Blockchain that does not have sufficient scalability is also one of the criticisms of crypto assets. Undeniably, this is a valid criticism. The development team has not yet found a solution to increase the blockchain’s scalability to match the centralized network’s transaction speed.

The largest crypto asset, Bitcoin, can only process seven transactions per second. Ethereum, the second-largest network, faces the same problem. The difference is that it increased its transaction speed thanks to the Shapella update. But Ethereum still faces the problem of slowed transactions and increased fees when the network is congested.

The layer-2 (L2) technology is the latest solution to the blockchain’s scalability problem. Its transaction speed can be 10-20x that of Ethereum with much lower fees. L2 is still the best solution the crypto industry can offer to solve scalability problems.

So far, the blockchain industry has been trying to come up with new solutions and innovations to solve the scalability problem. While the outcomes have not yet matched the performance of centralized networks, it’s important to consider that blockchain is a new technology. With future technological advancements in mind, there remains the potential for blockchain to evolve and ultimately address the scalability concerns.

The scalability problem on blockchain networks is inseparable from the blockchain trilemma. Find out the explanation in the following article.

4. Crypto Assets are Too Complex to Understand

Crypto assets are often criticized for being too complex and difficult to understand. This is because the underlying technology, blockchain, is a complex system that is not well understood by most people. However, it is important to remember that we use many other technologies in our everyday lives without fully understanding how they work. For instance, most of us don’t fully comprehend the technology and mechanisms underlying cross-border money transfers (SWIFT), but we use it anyway.

Basically, users don’t need to know and understand what happens behind a technology in detail. The most important thing for users is that they can and do trust the technology.

It’s the same with crypto. It is enough to understand how it generally works and what solutions the technology is trying to present. Moreover, crypto exchange platforms now have educational content, such as Pintu Academy, to make it easier for users to learn about crypto, its fundamentals, and how it works. The existence of such educational content shows that the principles and fundamentals of crypto assets are easy to understand.

Learn about all the educational articles that can help you learn about crypto assets at Pintu Academy.

5. Crypto Asset Investment is Like Gambling

The assumption that investing in crypto assets is akin to gambling is a condescending criticism. Indeed, many assets’ price movements are driven solely by speculation. However, the price movements of other asset classes can also be influenced by speculation factors. But considering it as gambling, as if ignoring other assets with value and use cases.

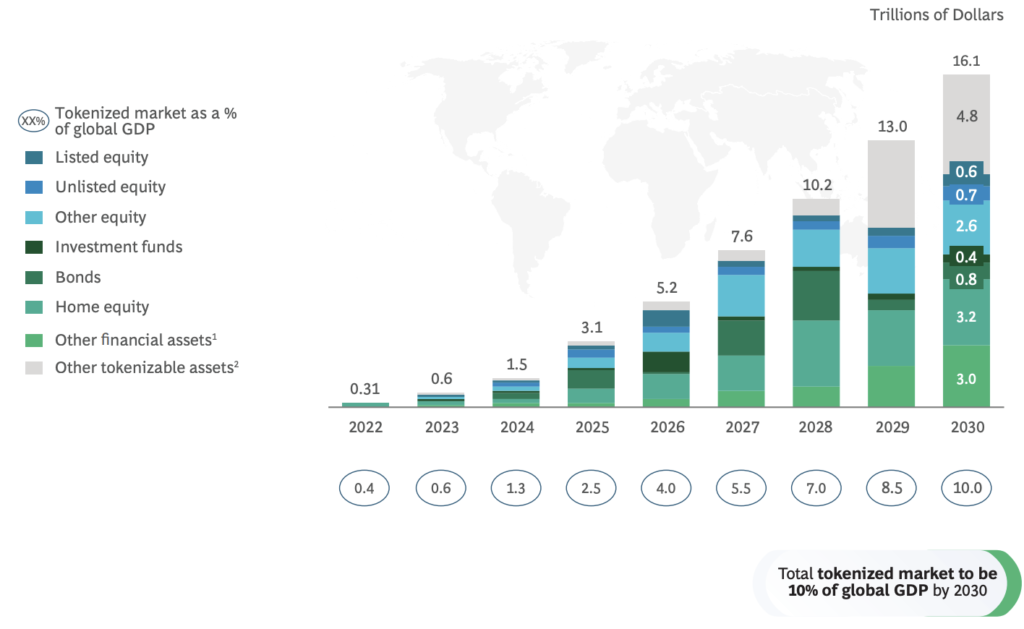

Take the example of crypto assets that encourage the tokenization of an asset, be it digital artwork (NFT) or Real World Asset (RWA). Both have the premise of simplifying while opening up the market for mainstream assets. It certainly has the potential to be successful in the long run.

Even if shitcoin and memecoin tokens are considered gambling, their prices are affected by supply and demand conditions. This means that there are variables that can be measured, not just buying and hoping that the price suddenly rises. If you buy crypto assets because you believe in their prospects and potential in the long run, it is unfair to consider them as gambling. After all, investing in other asset classes also uses the same principles.

Learn about the RWA that brings the concept of asset tokenization to the real world through this article.

Conclusion

Criticism directed towards crypto investments often stems from concerns or a lack of familiarity with the subject, but many of these issues are being addressed. First, more countries are regulating crypto, making it safer. Second, crypto now has practical uses, particularly in developing countries and for international transactions. Third, new tech like layer 2 is helping to solve scalability problems. Fourth, calling crypto investment ‘gambling’ overlooks its real value and potential. Fifth, while crypto can seem complex, educational resources make it easier to understand. So, despite some risks, crypto is becoming more accepted as a legitimate investment.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

Referensi

- Chainalysis, The Chainalysis Crypto Myth Busting Report, accessed on 12 September 2023.

Share

Table of contents