Market Analysis April 29th, 2024: Bearish Signal for Bitcoin? Empty Spot ETF Inflows Raise Concerns

Despite the recent optimism surrounding Bitcoin, its price has shown little movement after a week since the halving event. It currently sits around $60,000. A contributing factor could be the lack of investment in Bitcoin Spot ETFs. Data from Farside indicates no inflows between April 24th and 25th, 2024. Could this stagnation in fresh capital be an early warning of a potential shift in the cryptocurrency market’s momentum? The following analysis explores this further.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- ✍🏻 There are two key scenarios for Bitcoin at its current support levels: $60,000 and $70,000. A downward break from $60,000 could see a plunge to $52,000, while an upward break from $70,000 could potentially set a new all-time high (ATH).

- 🏭 S&P Global Manufacturing PMI fell to 49.9 from 51.9 during the same period, indicating a contraction in manufacturing activity.

- 📉 The S&P Global Services PMI slightly decreased to 50.9 from 51.7.

- 💼 Initial Jobless Claims in the US decreased by 5,000 in the week ending April 20.

Macroeconomic Analysis

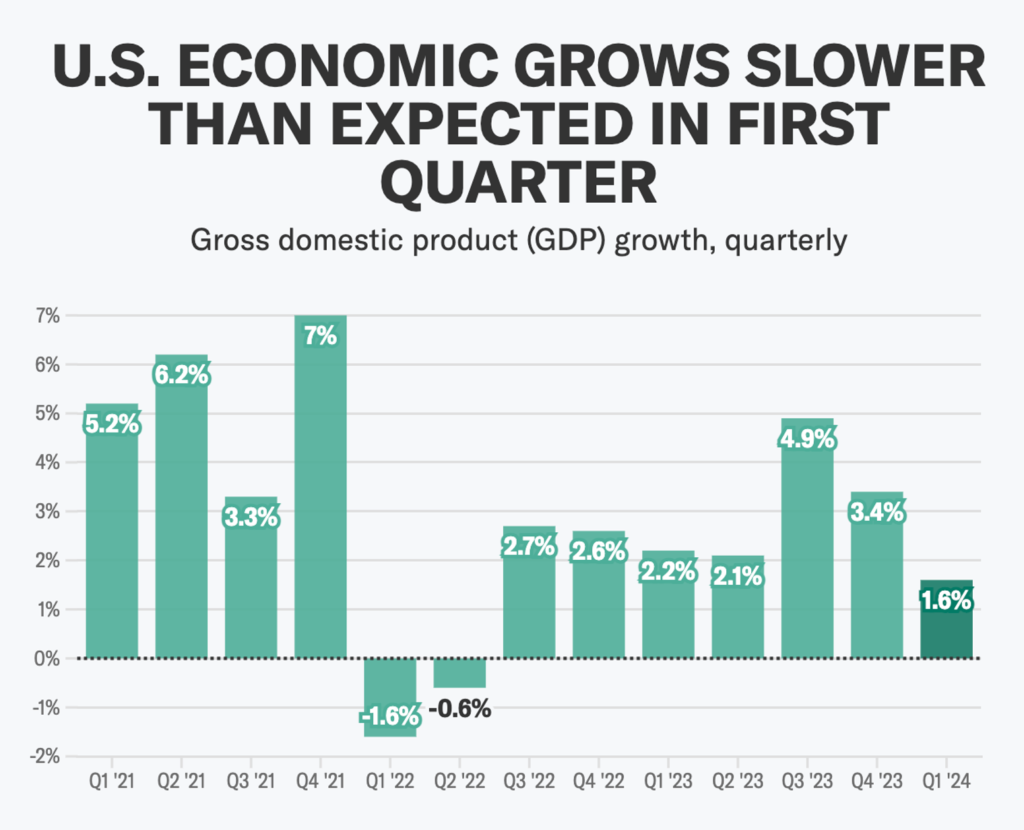

U.S Gross Domestic Product (GDP) Sees Slower Growth in Q1!

US economic growth in the first quarter was slower than expected, with GDP only rising by 1.6% at an annualized rate, significantly lower than the initial estimate of 2.5%. The data contrasts with the strong growth seen in the fourth quarter, which was revised to 3.4%. The main factors influencing this slowdown included declines in consumer spending, exports, and state and local government spending, which contracted, partially countered by an increase in fixed investment in the residential sector.

While economic growth showed a slowdown, the Core Personal Consumption Expenditure (core PCE) index, excluding volatile food and energy prices, recorded an increase of 3.7% in the first quarter, surpassing the 3.4% forecast and a significant improvement from the 2% increase in the previous quarter. This report had an immediate impact on the market with major stock indices declining after the announcement, and bond yields increasing. The yield on 10-year government bonds rose nearly seven basis points to over 4.7%, becoming the highest level since early November 2023.

Other Economic Indicators

- S&P Global PMI: The US S&P Global Composite PMI at the preliminary estimate in April showed a decline from 52.1 to 50.9. This decline indicates an ongoing expansion in business activity in the private sector, however, the S&P Global Manufacturing PMI also declined from 51.9 to 49.9 over the same period, indicating a contraction in manufacturing activity. Meanwhile, the S&P Global Services PMI dipped slightly from 51.7 to 50.9. This mixed PMI data suggests US economic growth showed signs of weakening at the start of the second quarter. April marked the first decline in new business inflows in six months, while corporate expectations for future output fell to a five-month low, reflecting growing concerns about the economic outlook.

- New Home Sales: According to government data released on Tuesday, new home sales, constituting approximately 10% of the market, soared by 8.8% last month to reach a seasonally adjusted annual rate of 693,000. This figure far exceeded the economists’ consensus of 670,000, as per a FactSet survey, marking the most substantial monthly increase since December 2022. Across the nation, sales of new homes experienced growth, with the Northeast region leading the way with a robust 27.8% surge from February. Conversely, the National Association of Realtors reported last week that sales of existing homes, which dominate the housing market, declined by 4.3% in March to a seasonally adjusted annual rate of 4.19 million, marking the steepest drop in over a year.

- Durable Goods: The U.S. Census Bureau reported today that new orders for manufactured durable goods rose for the second consecutive month in March, climbing by $7.3 billion or 2.6 percent to reach $283.4 billion. This follows a 0.7 percent increase in February. Excluding transportation, new orders saw a slight uptick of 0.2 percent. Excluding defense, new orders surged by 2.3 percent. Transportation equipment, experiencing its second consecutive monthly increase, spearheaded the growth, rising by $6.8 billion or 7.7 percent to $95.9 billion.

- Initial Jobless Claim: According to the weekly data released by the US Department of Labor (DOL) on Thursday, there were 207,000 initial jobless claims for the week ending April 20. This figure was lower than the previous week’s 212,000 and surpassed market expectations, which had anticipated 214,000 claims. Further details from the report showed that the advance seasonally adjusted insured unemployment rate was 1.2%, and the 4-week moving average stood at 213,250, marking a decrease of 1,250 from the unrevised average of the previous week. The publication also noted that the advance number for seasonally adjusted insured unemployment for the week ending April 13 was 1,781,000, reflecting a decrease of 15,000 from the revised level of the previous week.

BTC Price Analysis

On the daily timeframe, BTC’s price remains confined within the $60K to $70K range, unable to breach either boundary. Likewise, the RSI has maintained its position near the 50% threshold, indicating a balance in momentum.

Currently, the BTC price appears to be retracing towards the $60K support region. Should this level give way, a substantial decline to around $52K could ensue. Conversely, a breakthrough above $70K could signal an impending new record high in the market.

The 4-hour chart exhibits a highly erratic price movement, with BTC tracing out a substantial descending channel pattern since March. Although the cryptocurrency has recently bounced off the lower boundary of this pattern, it appears to be retracing towards it again.

Within this timeframe, the RSI indicates values below 50%, indicating a bearish momentum over the 4-hour period. Traditionally, a bullish upturn often succeeds a descending channel pattern. However, its breakdown typically leads to a severe downturn, often accompanied by a notable sell-off.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days was lower than the average. They have a motive to hold their coins. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Avail to Boost Layer 2 Projects with Data Availability Integrations Before Mainnet Launch. Avail, a modular blockchain solution, is set to enhance its data availability (DA) capabilities through upcoming integrations with five leading Layer 2 projects: Arbitrum, Optimism, Polygon, StarkWare, and zkSync. This move, ahead of Avail’s mainnet launch expected in the next few weeks, follows the recent launch of Turing, their final pre-mainnet testing environment, and the airdrop of 600 million AVAIL tokens. By leveraging Avail DA, these platforms aim to achieve greater scalability, reduced costs, and enhanced composability for their chains. The integration will provide developers with robust tools for building more efficient and interconnected blockchain systems, addressing major challenges such as data bottlenecks and fragmented user experiences across different platforms.

News from the Crypto World in the Past Week

- SEC Rejection Looms for Ether ETFs, Delaying US Entry. Recent interactions with the Securities and Exchange Commission (SEC) suggest they are poised to reject applications for exchange-traded funds (ETFs) tied to the price of ether by U.S. issuers, including VanEck and ARK Investment Management. This comes unlike prior approvals for bitcoin spot ETFs and ether futures-based ETFs. The SEC’s meetings with issuers have been notably non-communicative, lacking substantive discussions that marked earlier negotiations. This shift has led industry analysts to anticipate delays in approval, possibly extending into 2024 or beyond. The expected denial, reflecting broader regulatory concerns about the cryptocurrency market’s depth and maturity, has already impacted ether’s market performance, with its price gains lagging behind bitcoin’s.

- US Prosecutors Ask Binance Founder Changpeng Zhao for 3 Years in Prison for Money Laundering Offenses. United States prosecutors are advocating for a three-year prison sentence for Changpeng Zhao, founder and former CEO of Binance, the world’s largest cryptocurrency exchange, following his guilty plea to violating anti-money laundering laws. In a court filing in Seattle, prosecutors argued Zhao’s sentence should be double the maximum 18-month sentence recommended under federal guidelines, to reflect the seriousness of the willful violation and the importance of legal compliance. Zhao’s lawyers had requested probation and highlighted acceptance of responsibility, financial penalties including a criminal penalty of $4.32 billion for Binance. Sentencing by US District Judge Richard Jones is scheduled for tomorrow, Tuesday, April 30. Zhao, who had stepped down from Binance last November, has also agreed not to appeal any sentence in accordance with the guidelines and is free on $175 million bail.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Bonk (BONK) +58,7%

- Pepe (PEPE) +36,89%

- Hedera +33,32%

- Near Protocol +22,74%

Cryptocurrencies With the Worst Performance

- Ethena (ENA) -19,04%

- Toncoin (TON) -15,38%

- Celestia +15,02%

- Sui -14,45%

References

- Hannah Lang, US SEC expected to deny spot ether ETFs next month, industry sources say, Reuters, accessed on 27 April 2024.

- James Hunt, Arbitrum, Optimism, Polygon, StarkWare and zkSync to integrate with Avail for data availability, Theblock, accessed on 27 April 2024.

- Chris Prentice, US seeks 3 years prison for Binance founder Zhao, Reuters, accessed on 27 April 2024.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-