Market Analysis Mar 24th, 2025: BTC Finally Breaks Through Crucial Resistance at $84,219

Bitcoin has struggled to break above the $85,000 level for the past three weeks. This prolonged consolidation, marked by significant price fluctuations, reflects the current market uncertainty. Is a bullish resurgence still possible? Check out the full analysis from the Trader Pintu team.

Market Analysis Summary

- 🤩 The resistance at $84,219 remains a key hurdle that BTC must overcome for further upward momentum

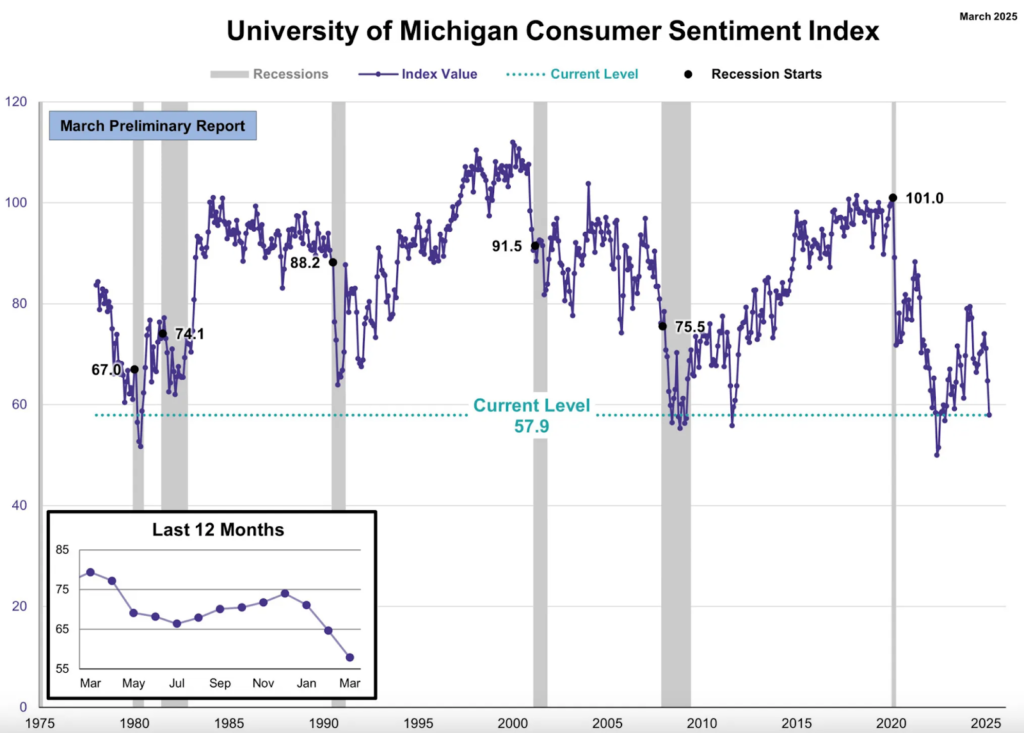

- 📉 The University of Michigan Consumer Sentiment Index for March 2025 dropped to 57.9.

- 📊 The latest retail sales data for February 2025 showed a modest increase of 0.2% from the previous month, falling short of economists’ expectations of a 0.6% rise.

- 🏭 The latest results of the NY Empire State Manufacturing Index indicate a significant downturn in manufacturing activity for March 2025.

- 🏠 In February 2025, U.S. housing starts experienced a notable increase, rising by 11.2% to a seasonally adjusted annual rate of 1.50 million units, up from a revised 1.35 million in January.

Macroeconomic Analysis

Michigan Consumer Sentiment

The University of Michigan Consumer Sentiment Index for March 2025 dropped to 57.9, marking a significant decline from February’s reading of 64.7 and falling well below the forecasted value of 63.1. This represents the lowest level since November 2022 and highlights growing pessimism among consumers regarding the economic outlook. While current economic conditions saw a modest decline (to 53.5 from 65.7), expectations for the future deteriorated sharply (to 54.2 from 64). The sentiment index has now fallen for three consecutive months, reflecting widespread concerns about inflation, labor markets, business conditions, and stock market performance. Many consumers cited policy uncertainty, including erratic tariff policies and inflationary pressures, as key factors impacting their confidence.

The survey revealed heightened inflation expectations among consumers, with the one-year inflation outlook rising to 4.9%, up from 4.3% in February—the highest since November 2022. Similarly, the five-year inflation outlook increased to 3.9% from 3.5%, marking the largest month-over-month jump since February 1993. These inflation concerns are likely tied to recent tariff announcements by the Trump administration, including new tariffs on aluminum and steel and threats of additional tariffs on European goods. Such policies have raised costs for businesses and consumers, exacerbating fears of persistent price pressures in the economy.

The sharp decline in consumer sentiment has significant implications for the economy. Lower confidence typically leads to reduced consumer spending, which is a critical driver of economic growth in the United States. The pessimistic outlook could also dampen business investment and hiring decisions as companies anticipate weaker demand. In financial markets, this sentiment has contributed to increased volatility; equity indices have faced sell-offs as investors reassess growth prospects amid rising inflation expectations. Furthermore, BTC have also been affected, with risk-off sentiment leading to reduced demand for speculative assets as investors shift toward safer options in uncertain times.

Other Economic Indicators

- Retail Sales: The latest retail sales data for February 2025 showed a modest increase of 0.2% from the previous month, falling short of economists’ expectations of a 0.6% rise. This follows a revised 1.2% decline in January, which was worse than initially reported. The total retail sales for February reached $722.7 billion, up 3.1% from February 2024. However, when excluding volatile categories like automobiles and gasoline, sales rose by 0.5%, slightly exceeding the consensus estimate of 0.4%.

- NY Empire State Manufacturing Index: The latest results of the NY Empire State Manufacturing Index indicate a significant downturn in manufacturing activity for March 2025. The index plummeted by nearly 26 points, falling from a positive reading of 5.7 in February to a negative 20.0 in March. This marks the largest decline since May 2023 and is well below market expectations, which had anticipated a much smaller drop to around -0.75.

- Housing Starts & Building Permits: In February 2025, U.S. housing starts experienced a notable increase, rising by 11.2% to a seasonally adjusted annual rate of 1.50 million units, up from a revised 1.35 million in January. This surge was driven primarily by single-family housing starts, which rose 11.4% to 1.11 million, while multi-unit building starts also saw a significant jump of 12.1% to 370,000 units.

BTC Price Analysis

Over the past week, BTC has exhibited significant volatility, with its price fluctuating around key resistance and support levels. Starting from approximately $82,203 on March 12, BTC faced selling pressure after failing to break through the resistance at $84,219. This failure led to a sharp decline, with the price dropping to around $80,789, where it found temporary support. The trading patterns indicated a mix of bullish and bearish signals, characterized by golden and death crosses in technical indicators like the MACD, which contributed to the price fluctuations observed throughout the week.

As of March 19, 2025, BTC’s price has rebounded to around $84,507. This recovery can be attributed to renewed buying interest after the previous week’s lows. The price movement reflects a broader trend where traders are closely monitoring key resistance levels for potential breakout opportunities. The recent uptick in BTC’s value suggests that market sentiment may be shifting positively, driven by factors such as increased institutional interest and positive news surrounding cryptocurrency adoption. However, the ongoing volatility indicates that traders remain cautious and are closely watching for signs of either a sustained uptrend or further retracement.

Key news impacting BTC’s price over the past week includes reports of substantial inflows into Bitcoin exchange-traded funds (ETFs), which have renewed investor confidence in the cryptocurrency market. Additionally, strategic purchases by institutional investors have signaled a strong belief in Bitcoin’s long-term value proposition. However, concerns about regulatory scrutiny and potential market manipulation continue to loom over the cryptocurrency space. These factors contribute to the mixed sentiment among traders, as they navigate both bullish momentum and bearish risks associated with external economic conditions.

The analysis of BTC’s price movements highlights critical technical levels that traders are focusing on. The resistance at $84,219 remains a key hurdle that BTC must overcome for further upward momentum. Conversely, if selling pressure returns and the price falls below support levels around $80,789, it could trigger additional selling and lead to a more significant correction. As such, market participants are advised to remain vigilant and responsive to changes in trading volume and market sentiment.

In summary, BTC’s performance over the past week showcases a dynamic interplay between bullish recoveries and bearish pressures. While recent gains suggest a potential resurgence in buyer activity, traders must remain aware of key resistance levels and external factors that could influence future price movements. The cryptocurrency market remains highly speculative, and as such, careful analysis of both technical indicators and market news will be essential for making informed trading decisions moving forward.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in a anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Real-World Assets Break $10B TVL Milestone as Tokenization Gains Momentum. Real-world assets (RWAs) have surpassed $10.2 billion in total value locked (TVL) across 79 decentralized finance (DeFi) platforms, reflecting growing interest in tokenized traditional assets like treasury bonds, real estate, and gold. The top three protocols—Maker RWA, BlackRock’s BUIDL, and Ethena’s USDtb—account for 36% of this total. Tokenized RWAs are gaining popularity as a hedge against crypto volatility and as a tool for diversification. Major firms like BlackRock and Franklin Templeton are entering the space, with analysts predicting the RWA market could exceed $50 billion by the end of 2025. Ethena’s USDtb notably saw a 1,000% increase in TVL last month alone.

News from the Crypto World in the Past Week

- North Carolina Considers 10% Bitcoin Allocation for Public Funds. North Carolina is reviewing Senate Bill 327, which proposes allocating up to 10% of the state’s public funds into Bitcoin to create a strategic reserve. The bill allows the state treasurer to invest in BTC as a long-term financial strategy, including staking, lending, and other yield-generating activities. Security measures include cold storage with multi-signature authentication and regular audits. The reserve can only be liquidated with legislative approval, except in emergencies or approved investment cases. The bill also supports exploring bitcoin mining operations. If passed, the law would take effect immediately. This aligns with a growing national trend, including a federal initiative to create a Strategic Bitcoin Reserve.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- PancakeSwap +41.25%

- Bonk +24.38%

- Curve DAO Token +18.19%

- EOS (ESO) +13.65%

Cryptocurrencies With the Worst Performance

- JasmyCoin (JASMY) -12.65%

- MANTRA (OM) -7.04%

- Movement (MOVE) -5.20%

- Shiba Inu -4.35%

References

- Kevin Helms, North Carolina Eyes 10% of Public Funds for Bitcoin Reserve Under New Bill, Bitcoin, accessed on 22 March 2025.

- Liz Napolitano, Real-World Asset Protocols Top $10 Billion Amid Tokenization Boom, decrypt, accessed on 22 March 2025.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-