What Is COTI?

The traditional financial system grapples with persistent challenges, such as high costs and non-instantaneous transaction processes. To address these issues, the emergence of blockchain technology is expected to solve the problems faced by the financial system. One such solution is COTI, which has emerged as a blockchain platform that can act as a bridge between the conventional financial system and a blockchain-based financial system. Read the full article on what COTI is below.

Market Analysis Summary

- 🚀 COTI is a decentralized payment protocol that uses Layer 1 Proof of Trust (PoT) and Directed Acyclic Graph (DAG) technology to improve speed, scalability, and cost efficiency.

- 🏦 COTI features the Coti Treasury, a depository for COTI tokens where users can deposit $COTI to earn rewards. The Coti Treasury saw an all-time high in COTI token deposits in 2022, reaching 500 billion COTI.

- 🤝 COTI is currently working with Cardano to create the Djed stablecoin, which is designed to support the Cardano ecosystem. COTI has established over 40 partnerships in the development of Djed.

- ✅ The utility of the COTI token plays a critical role in the functioning of the COTI network, including network fees, node operator rewards, arbitrator fees, and staking rewards.

What Is COTI?

COTI, or “Currency of the Internet,” is a decentralized payment protocol that supports instantaneous peer-to-peer transactions without intermediaries or third-party involvement. COTI uses a unique consensus algorithm, known as Trustchain, designed to provide security, scalability, and efficiency.

The protocol used by COTI is an enterprise-grade Layer 1 Proof of Trust (PoT) blockchain protocol with a Directed Acyclic Graph (DAG) structure that can achieve instant transaction consensus due to its speed, which can handle hundreds of thousands of transactions per second (TPS). The COTI network provides a level of security, scalability, and low transaction costs that addresses many of the concerns that exist in the global payments industry.

How Does the COTI Protocol Work?

COTI is based on a combination of the Proof of Trust (PoT) consensus algorithm and the Directed Acyclic Graph (DAG) data structure. This combination ensures that the COTI network remains secure, scalable, and user-centric.

Proof of Trust (PoT)

Unlike traditional Proof of Work (PoW) or Proof of Stake (PoS) algorithms, COTI’s PoT algorithm prioritizes the trustworthiness of transactions. As a result, transaction validation relies as much on the behavior of network participants as it does on the transaction data itself. At the heart of PoT is the Trust Scoring Mechanism. In this system, each participant in the COTI network is assigned a trust score derived from their historical behavior and actions within the network.

Those with high trust scores benefit from faster transaction processing and reduced fees. Conversely, actions that involve dishonesty can lower a participant’s score, resulting in higher fees and slower processing times. This mechanism is implemented to encourage honest participation and positively impact the COTI network.

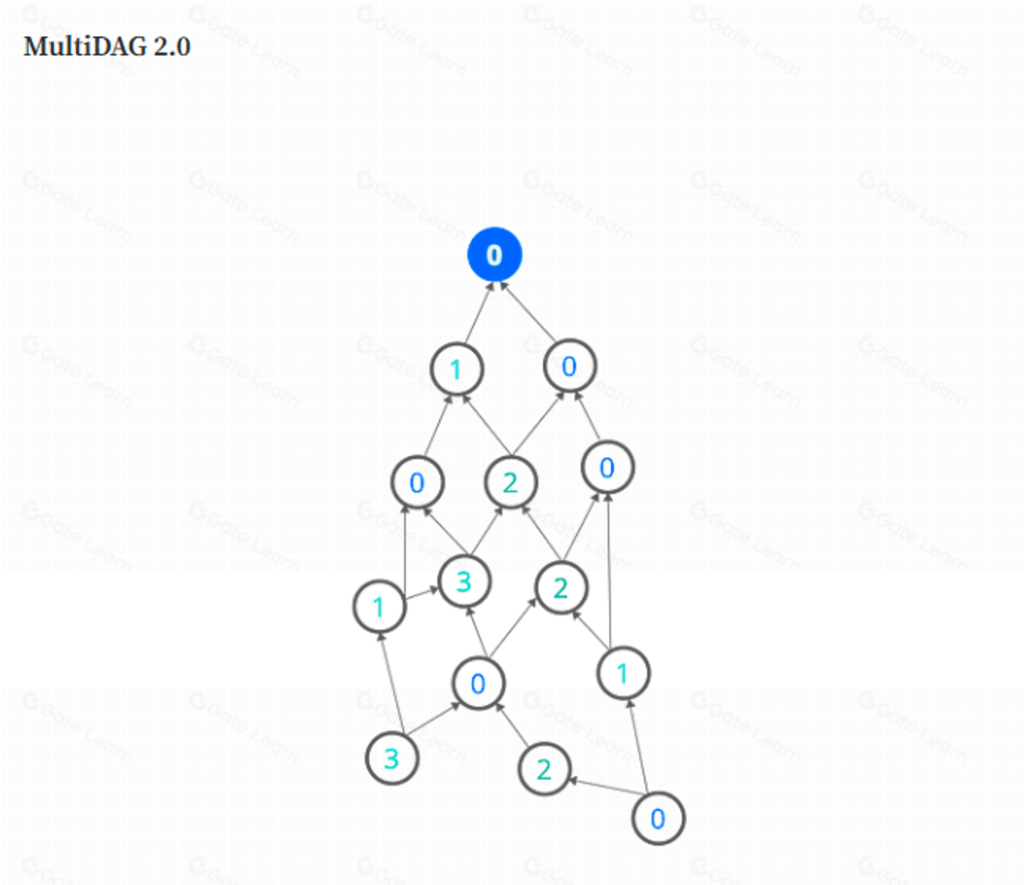

Directed Acyclic Graph (DAG)

The second architecture that forms the backbone of the COTI protocol is the Directed Acyclic Graph (DAG), which highlights a new approach to decentralized financial systems.

The Directed Acyclic Graph (DAG) is a non-linear data structure. Instead of stacking blocks in a chain like traditional blockchains, the DAG connects transactions directly to each other. This design allows for parallel transaction confirmations, resulting in faster throughput and increased scalability.

Within this DAG structure is another layer, known as the MultiDAG layer, which consists of a collection of interconnected DAGs representing specific tokens or a complete transaction history. The MultiDAG layer ensures that data is organized into multiple DAGs, each of which can be updated and queried independently.

Interestingly, the MultiDAG structure allows each transaction to have a unique path through the DAG, eliminating the need for blocks and enabling extremely fast transactions. This also allows the network to process an unlimited number of transactions per second.

Next, COTI introduces MultiDAG 2.0, which represents several revolutions from the previous version. MultiDAG 2.0 promises to empower developers, merchants and enterprises with the ability to mint tokens that fully leverage the power of the trustchain. From scalability, high throughput, and low cost to intuitive payment tools like COTI Pay Business, the offerings are extensive.

Fundamentally, both MultiDAG 1.0 and MultiDAG 2.0 possess the inherent adaptability of the MultiDAG system to pave the way for the formulation of various stablecoins, whether they are backed by fiat, crypto assets, or even unbacked. COTI, as the primary issuer of the Cardano stablecoin, Djed, and the ADA Pay payment mechanism, exemplifies the vast potential and broad capabilities of this platform.

COTI Use Cases

COTI offers a variety of tailored solutions to meet the needs of the modern digital economy. Here are some examples of COTI use cases:

- Payment Infrastructure: COTI provides large-scale payment solutions that enable a business to create its own payment system and digitize any currency.

- Consumer Wallets: COTI provides easy-to-use digital wallets that allow consumers to manage, spend and store funds with ease.

- Merchant Processing: Merchants using COTI can process digital and fiat transactions, benefiting from low fees and instant transactions.

- Money Transfers: The COTI system enables fast, low-cost money transfer services.

- Loyalty Networks: Businesses can build loyalty networks on COTI, streamlining reward distribution and increasing user engagement.

- Micro-Payments: COTI is ideal for micro-transactions, making it suitable for content creators, online services and other micro-transactions that require low-fee services.

With the various use cases outlined above, COTI represents a versatile application capable of transforming the way businesses and consumers approach transactions and digital assets.

COTI Ecosystems

COTI has a broad ecosystem focused on leveraging technology to streamline payment processes by reducing costs and increasing efficiency. This technology can also help facilitate cross-border payments, which are currently slow and expensive.

In addition, the COTI blockchain can be used for fast and easy peer-to-peer (P2P) payments and to simplify complex and slow business-to-business (B2B) payments. Even in-game purchases and other gaming-related payments can be facilitated by COTI. Here are a few examples.

Coti Treasury

The Coti Treasury is a repository where users can deposit $COTI to earn rewards. Users can choose their risk and Annual Percentage Yield (APY) by adjusting the deposit amount, multiplier, and lock-up period. Significantly, all fees collected by the COTI ecosystem are directed to the Treasury and distributed as rewards to its users.

Since its launch in 2022, the COTI Treasury has seen a record 500 billion COTI deposited. However, at the time of this writing, the amount deposited in the Coti Treasury has decreased to 340,023,851 COTI.

Djed Stablecoin

The Djed Stablecoin is a project developed by COTI in cooperation with Cardano. Djed is a secured stablecoin powered by COTI. The stablecoin comes with the support of ADA tokens and SHEN, which serve as reserve coins. Djed was developed to support the Cardano ecosystem. Since the introduction of Djed in 2021, COTI has worked closely with the Cardano IOG team to develop Djed and has established over 40 partnerships to facilitate the proper use of Djed.

Through collaboration and the introduction of Djed, the entire COTI ecosystem is expected to benefit greatly, not only through increased recognition of COTI, but also through the distribution of operating fees from Djed reserves to the COTI Treasury Reserve Fund.

The COTI blockchain offers numerous benefits for merchants to enhance the competitiveness of their businesses, such as improved security, minimized costs, global reach, fast and flexible payment processes, and easy integration. These benefits create value for merchants, making COTI an ideal choice for businesses of all sizes.

Native Token COTI

The COTI token is the digital currency of the COTI platform, which enables decentralized financial transactions. Its maximum supply is capped at 2 billion tokens, with a circulating supply of 1,262,013,246 tokens or (63.10%) already in the market (as of November 2023).

The COTI token is a versatile digital currency at the core of the COTI ecosystem. Unlike systems based on Proof of Work, COTI operates on three mainnets: Trustchain (its original mainnet), Ethereum (as an ERC-20 token), and BNB Chain (in BEP-2 and BEP-20 versions).

This native currency not only simplifies transactions between users, merchants, consumers, and intermediaries, but also supports node validation, mediation staking, merchant reserves, and fee payments. The currency is more incentivized than others due to its low transaction fees. In essence, the COTI coin is the lubricant that ensures the smooth and efficient operation of the entire COTI ecosystem.

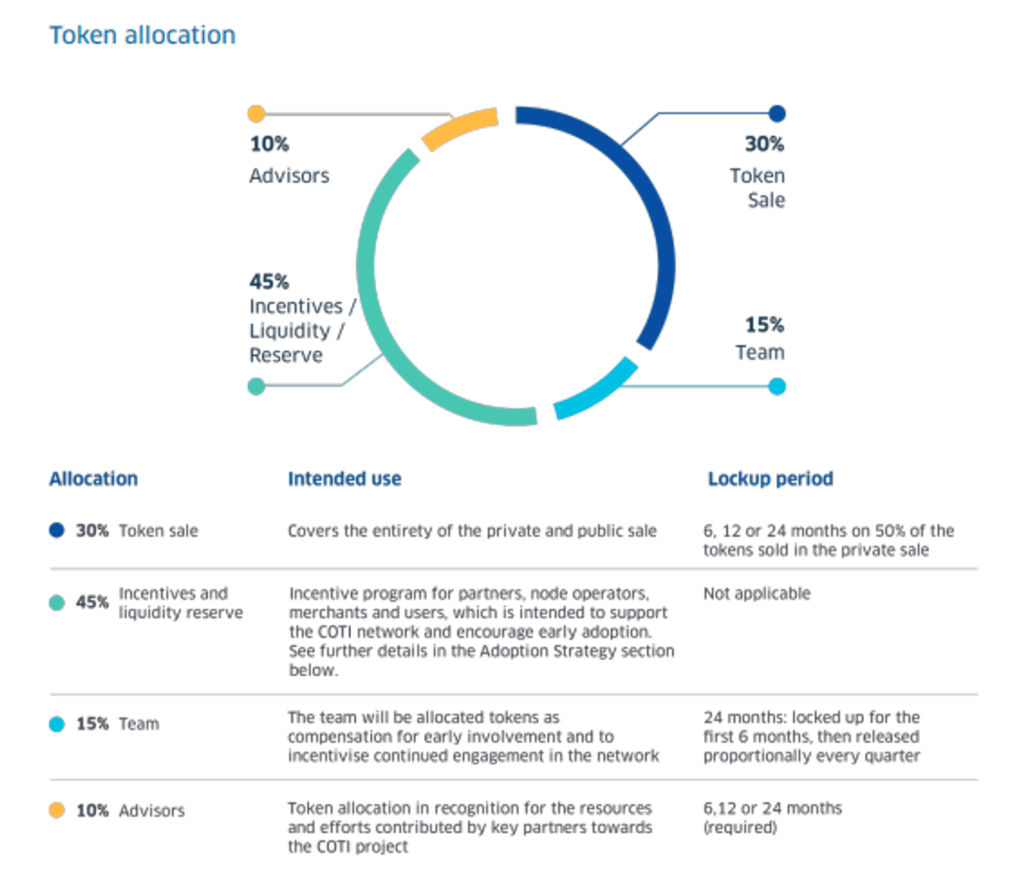

The distribution of COTI tokens includes 30% that were sold in a private token sale during the pre-launch phase and subsequent public sale. Following the launch, the tokens began trading in May 2019. In addition, 10% were allocated to COTI advisors, while another 15% of the tokens were distributed to team members for their early involvement in the project. Finally, the remaining 45% of the tokens will be reserved for liquidity reserves and incentives.

Uses of the COTI Token

The COTI token plays a critical role in the operation of the COTI network. In addition to facilitating interactions between merchants, consumers, and intermediaries, COTI is used as a reward currency for participants who contribute to the functioning of the network. The following are some of the uses of the COTI token:

1. Network fees

COTI is used to pay fees for all transactions within the network. This token is also used to compensate arbitrators and node operators who run the COTI protocol.

2. Node Operator Rewards

Each Node Operator must stake COTI coins to validate transactions in the network. All incentives for these operators are given in the form of COTI, but the type of node and the minimum amount of COTI required to stake will affect the incentive differences.

3. Arbitrator fees

Arbitrators must hold COTI to arbitrate and resolve disputes between buyers and sellers in order to earn COTI fees.

4. Stake Rewards

Users can store COTI tokens in the COTI Treasury to earn additional COTI. The Treasury adjusts its annual reward percentage every 60 seconds based on the Treasury balance. Rewards are automatically compounded with a one-time multiplier, and users can still adjust the risk/reward level up to a maximum of eight times. Although tokens stored in the Coti treasury can be withdrawn at any time, users should be aware that an early withdrawal fee of up to 2% of the deposit may apply. To avoid paying a withdrawal fee, users can change the locked period to unlocked, but the downside is that they will not be able to withdraw COTI for at least 24 hours.

Conclusion

Despite the market disruptions of 2022, COTI remained steadfast by maintaining high standards and undertaking several key initiatives to realize its vision and mission. As a Layer 1 company, COTI entered 2023 with optimism, launching various feature enhancements such as Treasury 2.0, introducing $gCOTI, and driving adoption growth of the Djed stablecoin to increase Djed’s growth and dominance in the Cardano ecosystem. In addition, COTI also revamped the COTI V2 protocol, which will extend the Layer 1 reach for developers to create dApps.

How to Buy COTI in PINTU

You can start investing in COTI by buying the COTI token on the Pintu app. Here is how to buy COTI on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for COTI.

- Click buy and fill in the amount you want.

- Now you are a COTI investor!

Looking to invest in other crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

References

- COTI, An All-Time High Record For the COTI Treasury: half a Billion $COTI Has Been Deposited!, Medium, accessed on 9 November 2023.

- Gaurav Roy, Investing in Coti (COTI) – Everything you Need to Know, Securities.io, accessed on 9 November 2023.

- Mauro, What Is Coti? All You Need to Know About COTI, gate.io, accessed on 9 November 2023.

- Kevin Moore, What Is The COTI Blockchain?, e-cryptonews, accessed on 9 November 2023.

- COTI, COTI: Our Plans for 2023 and Beyond, Medium, accessed on 9 November 2023.

Share

Related Article

See Assets in This Article

ADA Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-