Bitcoin Struggles at $84,000 Today (Feb 28, 2025) – Is a Drop to $73K Coming, or Will BTC Bounce Back?

Jakarta, Pintu News – Bitcoin (BTC) is still moving at around $84,000 on February 28, 2025, after experiencing selling pressure in recent days. The price of BTC had plummeted from its highest level of $100,000, sparking investor concerns of a potential deeper correction.

Currently, the crypto market is waiting to see if Bitcoin will continue to drop to test the support level at $73,000, or if it will reverse direction and head back towards $95,000 to $100,000.

Bitcoin Price Drops 0.44% in 24 Hours

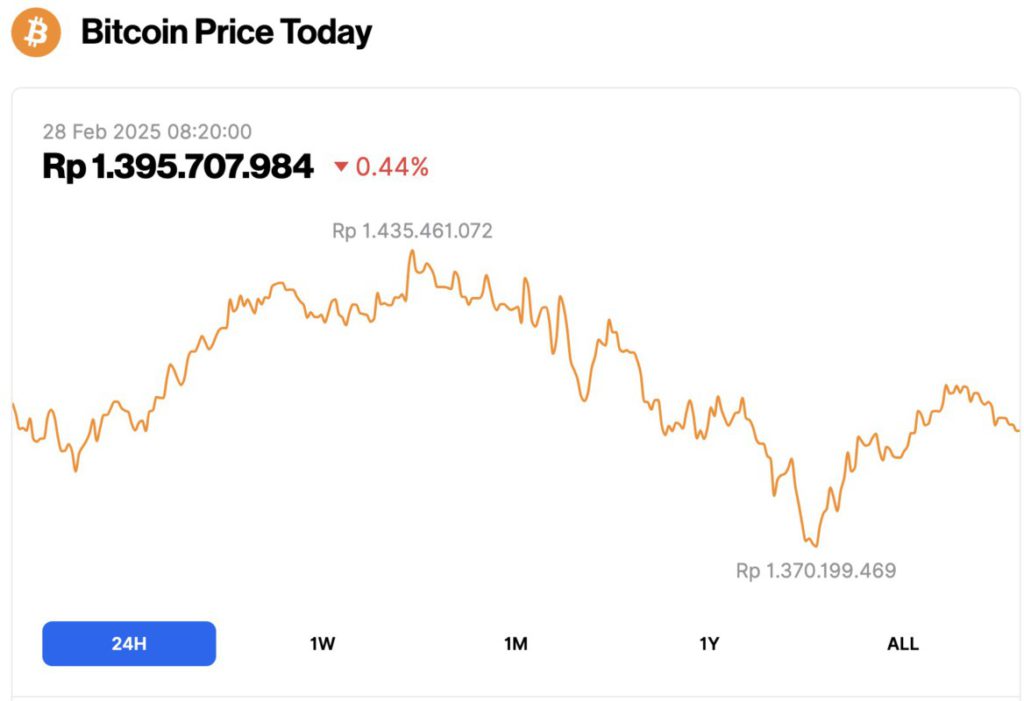

On February 28, 2025, Bitcoin (BTC) was trading at $84,103, equivalent to 1,395,707,984 IDR, reflecting a slight 0.44% decline over the past 24 hours.

Read also: Pi Network Breaks Records! Check Today’s Price in Rupiah (Feb 28, 2025)

During this period, BTC briefly surged to a high of 1,435,461,072 IDR before undergoing a correction, dipping close to its lowest point at 1,370,199,469 IDR. Despite these fluctuations, Bitcoin continues to exhibit a dynamic price movement, keeping investors on edge.

According to CoinMarketCap, Bitcoin’s market capitalization has now fallen to $1.66 trillion, with trading volume in the last 24 hours also falling 22% to $49.36 billion.

Bitcoin drops below $85,000 on Trump’s 25% tariff threat to EU

The day before today, Bitcoin price had experienced a 5% drop, reaching a low of $82,256. This weakness was triggered by recent statements from US President Donald Trump regarding his tariff policy.

Trump reiterated plans to impose 25% tariffs on Canada and Mexico, which had previously been postponed until April 2, 2025. In addition, he also announced that the European Union (EU) would be included in the list of countries affected by this policy.

Trump confirmed that 25% tariffs will be imposed on the automotive sector and other products from Europe, with further details to be announced in the near future.

According to Joshua Gibson, analyst at FXStreet (2/27/25), although Trump continues to emphasize his import tax policy to cover the US budget deficit, he again postponed the implementation of tariffs for Canada and Mexico for the fourth time, which are now scheduled to take effect from next April.

Institutional Investors Offload BTC Holdings, Selling Pressure Increases

Bitcoin price experienced three consecutive days of decline this week, falling from a high of $96,500 on Monday to a low of $82,256 on Wednesday (27/2). This price correction was driven by decreased demand from institutional investors as well as increased selling pressure.

Read also: 3 Cryptos that Whales Are Hunting While the Market Plummets!

Based on data from Coinglass, net outflows from Bitcoin spot Exchange Traded Funds (ETFs) reached $2.2 billion in the last three days, continuing a selling trend that has been ongoing in recent weeks.

If this outflow of funds continues and gets bigger, the price of Bitcoin is at risk of a further correction.

Stagflation concerns intensify, Bitcoin and risk assets are under pressure – QCP Capital Report

A recent report from QCP Capital on Wednesday (27/2) highlighted that the risk-off global market sentiment has led to declines in stocks, gold, and Bitcoin. One of the main factors behind this pressure is the growing fear of stagflation among market participants.

The report also noted that US-imposed import tariffs are starting to impact consumer confidence, as reflected in the lower-than-expected Consumer Confidence Index data (98 vs. 103 expected). Meanwhile, the consumer survey showed that short-term inflation expectations remain high.

An analyst from QCP Capital stated that while it is too early to ascertain whether the economy has actually entered a stagflationary phase, the market’s reaction to the latest developments shows growing concern.

Furthermore, the analyst explained that the US tariffs have further weakened market sentiment, especially with expectations of tougher measures against China. Investors have also started to reduce risk exposure, potentially accelerating further declines in riskier assets due to liquidation of large positions.

Read also: Changpeng Zhao (CZ) Confident in Bitcoin’s $1M Surge—Even as the Crypto Market Crashes!

“Bitcoin continues to move in tandem with other risk assets, and the outflows from ETFs indicate a lack of investor conviction. In volatile market conditions, crypto becomes the first asset to be liquidated as traders seek to reduce risk exposure,” said an analyst from QCP Capital.

Bitcoin Price Prediction: BTC Corrects to $73,000 or Recovers?

According to FX Street (27/2), Bitcoin finally broke out of its long consolidation phase, breaking support at $94,000 and closing at $91,552 after a 4.89% decline on Monday.

This correction continued over the next two days, with BTC falling 8.22% to bottom out at $82,256 on Wednesday. However, on Thursday, BTC started to show signs of recovery and is currently trading in the $86,300 range.

If the correction continues, BTC has the potential to drop further to test the next support at $73,000 (IDR1,209,880,000).

From a technical perspective, the daily Relative Strength Index (RSI) indicator is currently at 30, which signals an oversold condition. Although the RSI is starting to point upwards-indicating significant selling pressure-the potential for a price reversal or bounce remains open.

However, traders need to be cautious as the RSI could remain in the oversold zone and the correction could continue.

Conversely, if BTC manages to recover, the price could extend its rally and eye the $100,000 psychological level as the next target.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Bitcoin Price Forecast: BTC recovers above $85,000 while institutional investors offload their holdings. Accessed on February 28, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.