Lazarus Cybercrime Network: Managing IDR 15 Trillion Worth of Crypto Funds

Jakarta, Pintu News – The notorious hacking group Lazarus Group, allegedly operating with North Korean support, has amassed cryptocurrency assets worth nearly Rp15.1 trillion ($919 million). The network is known as one of the largest cybercrime organizations in the world, with a hacking footprint across multiple global crypto platforms. From the attack on Bybit to various other platforms, they continue to divert their stolen assets despite being under intense scrutiny.

424,330 ETH Movement by Lazarus Amid Global Scrutiny

On February 21, 2025, the centralized crypto exchange Bybit fell victim to a massive IDR 23.1 trillion ($1.4 billion) hack. Forensic evidence points to the Lazarus Group, also known by various aliases such as Hidden Cobra, Nickel Academy, Diamond Sleet, and Whois Team. Prior to this attack, the group had long been involved in major exploits, including the Ronin Bridge, Coinex, DMM Exchange, and Harmony Horizon Bridge hacks.

Of the total 499,000 Ethereum (ETH) stolen in the Bybit attack, Lazarus has redistributed 424,330 ETH to various wallets. To date, the group still controls around 236,283 ETH worth IDR 9.8 trillion ($592.78 million) from this attack as well as their previous hacks.

Also Read: The Future of Pi Coin (PI) in the Cryptocurrency World: Will PI Capi $5? Here’s the Technical Analysis!

Crypto Assets Controlled by Lazarus Group

In addition to storing large amounts of ETH, Lazarus also has a portfolio of other digital assets, including:

- 3,391 Bitcoin (BTC) worth IDR 5.2 trillion ($319.29 million)

- 3.11 million Binance Coin (BNB)

- IDR 5.5 billion ($337,370) in Baby Doge Coin (BABYDOGE) from the exploitation of 218 trillion coins

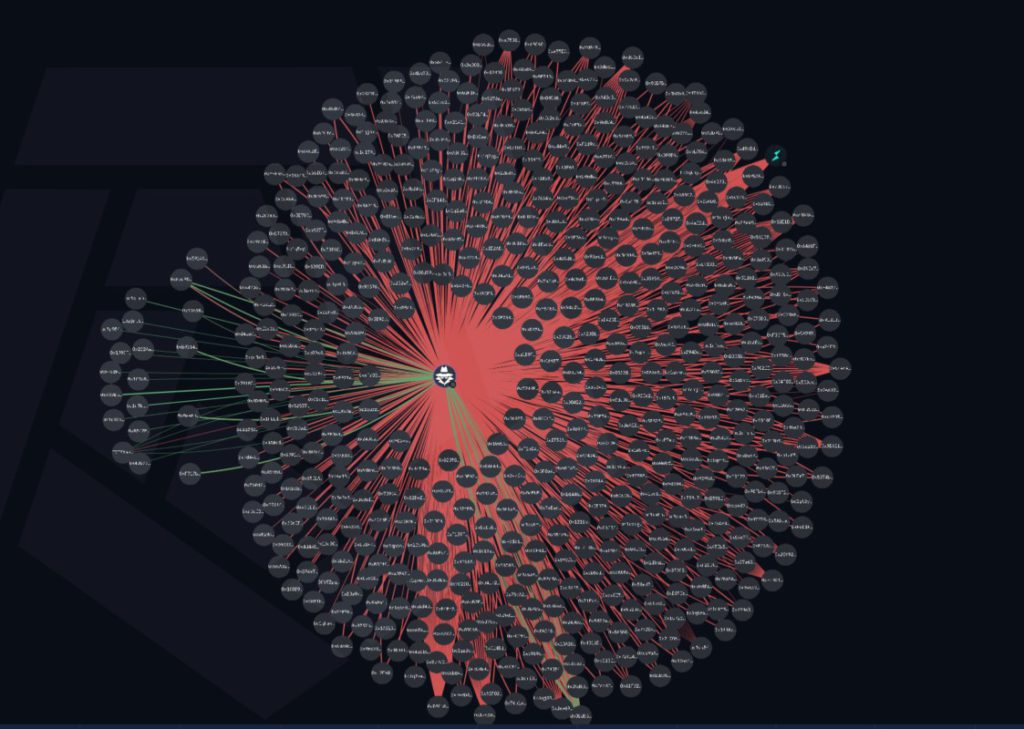

According to data from Arkham Intelligence, Lazarus-related wallets actively interact with various platforms such as Exch.cx, THORChain, MakerDAO (now Sky), Uniswap (UNI), Cow Protocol, Maya Protocol, and Bridgers. After the Bybit hack, these wallets continued to transact aggressively, indicating systematic fund laundering activities.

Challenges in Liquidating IDR 15 Trillion Worth of Crypto Assets

Despite managing to amass a large amount of assets, Lazarus faces major challenges in disbursing their funds. With over 70 wallets that have been flagged as being linked to criminal activity, even the slightest transaction can increase the risk of being detected by authorities.

Commonly used laundering mechanisms such as mixers, decentralized exchanges (DEXs), and cross-chain bridges are now under scrutiny. Global law enforcement is increasingly tightening its monitoring of crypto transactions, which narrows the room for Lazarus to cash out their loot.

Lazarus’ role: Just for Profit or Geopolitical Motives?

Some analysts consider that Lazarus’ operations are not only aimed at financial gain, but also have a geopolitical dimension. There are indications that the group operates on a hybrid model-not fully controlled by the state, but potentially with protection or support from North Korea. This makes attribution and law enforcement against them even more complicated.

With the growing scrutiny on blockchain transactions, the future of Lazarus’ €15 trillion worth of assets remains uncertain. However, if the group manages to find a loophole to cash out their funds, the impact on the global crypto market could be huge.

Also Read: Pi Network Price Plunges 18% After Legal Warning from Vietnam (3/2/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Bitcoin News. Inside the $919M Crypto Labyrinth of the World’s Most Notorious Cyber Cartel. Accessed March 3, 2025.

- Featured Image: Bleeping Computer

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.