Ethereum Hits $2,269 Today (March 6, 2025) – Massive Whale Dumping 40,000 ETH!

Jakarta, Pintu News – On March 6, 2025, Ethereum (ETH) continued its upward momentum, reaching $2,269 after a 3% gain in the past 24 hours. This surge comes despite a major sell-off by large-scale ETH holders (whales), who reportedly dumped 40,000 tokens into the market.

Ethereum Price Up 3.28% in 24 Hours

On March 6, 2025, Ethereum (ETH) was trading at approximately $2,269 or 37,049,279 IDR, reflecting a 3.28% increase in the past 24 hours. During this period, ETH hit a low of 35,373,766 IDR before rebounding sharply, nearing its daily high of 37,787,782 IDR.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $275.44 billion, with daily trading volume falling 23% to $21.64 billion in the last 24 hours.

Read also: Bitcoin Surges to $91,000 Today (March 6, 2025) – Are BTC Buyers Taking Full Control?

Major Ethereum Whale Dumps 40,000 ETH as Economic Uncertainty Looms

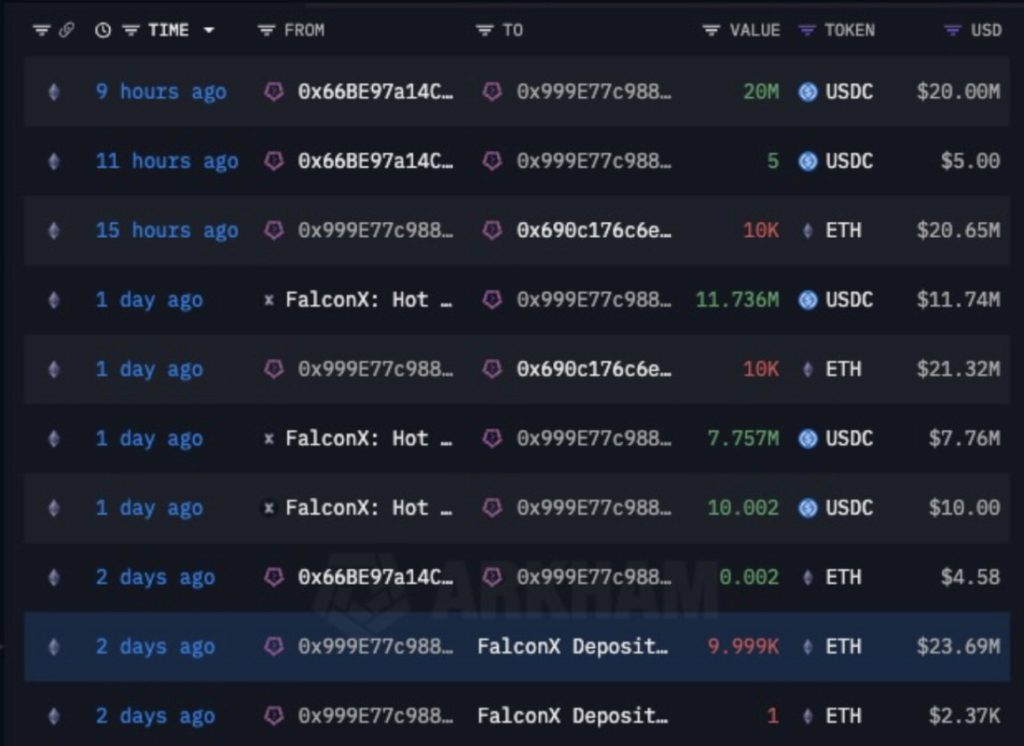

Despite the rise since March 5 until today, citing a Coingape report (5/3), a large Ethereum holder, known for earning huge compensation during the liquidation of Genesis Trading in August 2024, has reportedly sold 40,000 Ethereum (ETH) worth $89.9 million through over-the-counter (OTC) transactions in recent days.

This heavy selling comes amid growing economic uncertainty, which is creating anxiety among investors and market analysts.

Furthermore, this transaction is one of the largest made by an individual in the Ethereum (ETH) market in recent times, suggesting that even large investors are starting to doubt Ethereum’s long-term prospects, which could be a negative indicator for Ethereum’s future value.

Unrealized Gains Plunge to Bear Market Lows

According to data from CryptoQuant, the ratio of unrealized gains by large Ethereum holders has dropped to its lowest level since the last bear market. This suggests that many large holders are now at a disadvantage, which could trigger further selling in the market.

Read also: Top 3 Crypto Whales Are Accumulating as the Market Crashes!

This decline was also followed by a drop in the Ethereum (ETH) to Bitcoin (BTC) exchange rate, indicating that Ethereum (ETH) is losing value relative to Bitcoin (BTC).

This adds to the uncertainty in the market, with many investors possibly considering switching to assets that are considered more stable such as Bitcoin (BTC).

Ethereum (ETH) Price Behavior Reminiscent of 2019

Leading crypto analyst, Benjamin Cowen, has found similarities between Ethereum’s (ETH) current price behavior and its performance during the Federal Reserve’s monetary tightening cycle in 2019.

According to Cowen, Ethereum (ETH) seems to be repeating the same pattern during the period of quantitative tightening (QT) by the Fed. This suggests that Ethereum (ETH) may still face further selling pressure if global economic conditions continue to provide challenges.

This analysis is important for investors trying to understand the direction of the Ethereum (ETH) market in the next few months.

Overall, with heavy selling by large holders and market indicators pointing to a potential further decline, the future of Ethereum (ETH) seems to be full of uncertainty.

Investors and market watchers should remain alert to changing market dynamics and prepare for the possibility of higher volatility.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Whales Dump 40k Coins, More ETH Price Pain Ahead. Accessed on March 6, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.