Will Bitcoin (BTC) Reach $75,500? Analysts Reveal Historical Magnet Levels (6/3/25)

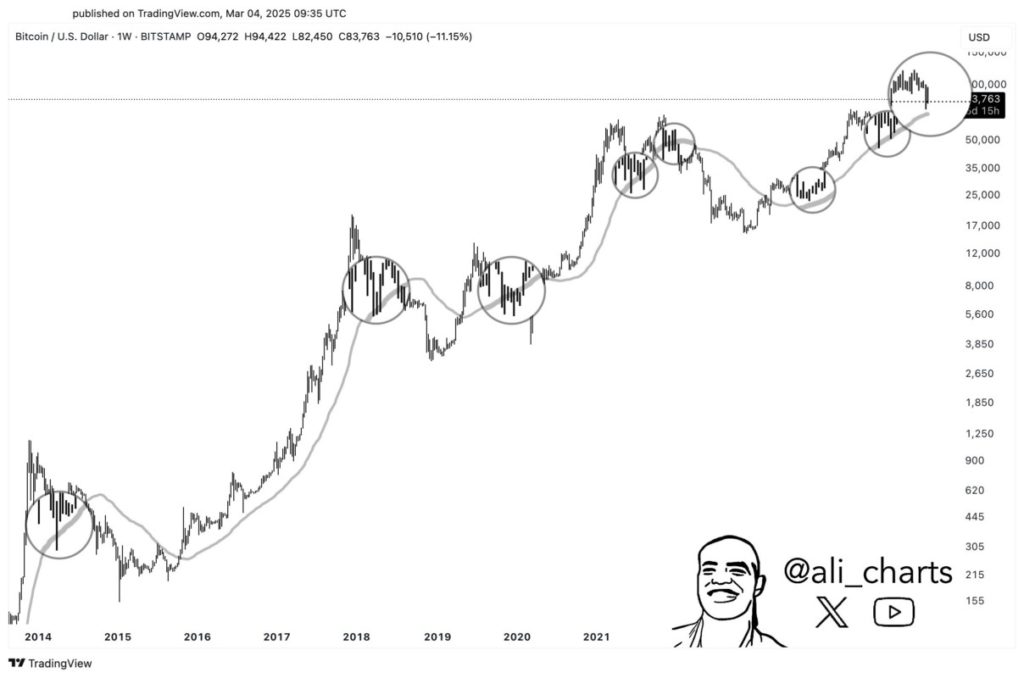

Jakarta, Pintu News – In the world of cryptocurrency investment, Bitcoin (BTC) has always been a topic of interest. Recently, an analyst named Ali Martinez highlighted the movement of the 50-week weekly average (MA) of Bitcoin (BTC), which indicates possible future price trends. According to Martinez, this MA often serves as a magnet that draws the price of Bitcoin (BTC) closer to it.

Bitcoin (BTC) 50-Week Moving Average

The 50-week moving average (MA) is a technical analysis indicator that calculates the average value of an asset’s price over a given period of time. For Bitcoin (BTC), this MA is currently at $75,500. This suggests that there is potential for Bitcoin (BTC) price to decline from its current position, which is around $85,700.

According to analysis conducted by Ali Martinez, this MA has repeatedly been a turning point for Bitcoin (BTC) price movements in the past. When the price approaches this MA, there is often a change in trend, be it a significant increase or decrease.

Also Read: Arbitrum (ARB) Surges After Robinhood Entry: What Will Happen Next?

Current Bitcoin (BTC) Price Movement

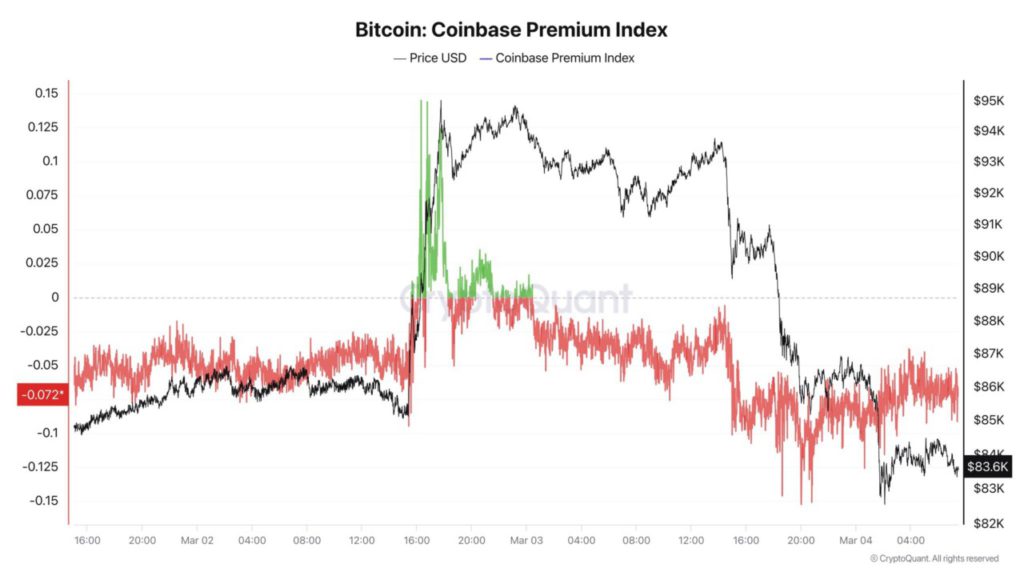

Currently, the price of Bitcoin (BTC) has decreased by more than 4% in the last 24 hours, with the value floating around $85,700. This decline has led to speculation among investors and analysts about a possible deeper price correction towards the 50-week moving average. The drop also marks the continued volatility in the cryptocurrency market, which is often affected by various external factors such as government regulations, changes in global financial markets, and investor sentiment.

Potential Impact on Investors

If Bitcoin (BTC) price continues to approach the 50-week MA, this could be an opportunity for investors to assess their positions. Some may see this as an opportunity to buy at lower prices, while others may consider selling and securing their profits.

It is important for investors to monitor indicators such as the 50-week moving average and understand how they can affect their investment strategy. Technical analysis, while not always perfect, provides insights that can be invaluable in decision-making in an uncertain market.

Cover

Observing the 50-week MA as a historical magnet for Bitcoin (BTC) price provides a new perspective in cryptocurrency investment strategies. Although the market is full of uncertainties, using analytical tools such as the MA can help in formulating a more informed and potentially profitable approach.

Also Read: Binance Attracts Investors After Bybit Hack, Funds Flow Increases Sharply!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin’s $75,500 Analyst Historical Magnet Level. Accessed on March 6, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.