Why Solana (SOL) Could Return to the $180 Peak? Check out the reason (10/3/25)

Jakarta, Pintu News – The crypto market continues to fluctuate, but cryptocurrencies like Solana (SOL) show significant recovery potential. Here are some factors that could push the Solana (SOL) price back to $180.

1. Solana On-Chain Activity Recovery

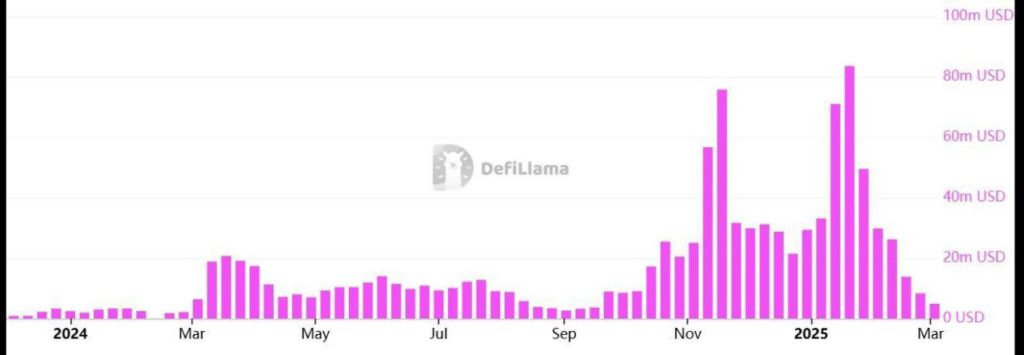

Solana (SOL) has seen a decrease in activity in several key categories such as liquid staking, decentralized exchanges, and NFT marketplaces. Network fees have dropped by 73% in the last month, signaling a decrease in user activity. Active addresses on Jito, Solana’s largest liquid staking platform, dropped by 56% in the last 30 days, while Magic Eden, one of the most popular NFT markets, saw a 38% decline.

Save (formerly Solend), a lending protocol, also lost 42% of its active users. If Solana can turn this around and bring back new activity, this could be a catalyst for price recovery. This increase in activity is crucial to rebuilding trust and interest in the network. With increased transactions and platform usage, Solana can again attract investors and users, which in turn will push the SOL price up.

Also Read: El Salvador’s President Closes Bitcoin Animal Hospital: Controversy and Impact

2. Increased Leverage Demand for SOL Tokens

Market sentiment is often reflected through the demand for leverage, particularly through perpetuity futures contracts. In the past three days, the SOL funding rate has been negative, indicating that short sellers are paying to maintain their positions. A move to a long position can trigger a price spike, especially if there is surprising news that catches short sellers off guard.

This scenario could accelerate the rise in SOL prices to higher levels. When leverage demand increases, it indicates optimism in the market which could trigger more purchases and investments in SOLs. This is an important indicator that investors often watch to assess market momentum.

3. Decrease in MEV Bot Activity

A small number of users have had a major impact on transaction fees on the Solana network. It is reported that 95% of the network fees are generated by only 1.3% of users, most of which come from market-making companies such as Wintermute and MEV bots. If the Solana network manages to make improvements that reduce the dominance by MEV bots, it could create a better environment to encourage long-term participation.

These improvements will not only reduce costs, but also increase fairness and transparency in transactions. This is crucial to attracting more users and investors who may have previously been deterred by bot dominance.

4. Potential Institutional Investment Boosts Solana Price

A large institutional investor, World Liberty Financial, has bought several cryptocurrencies but has not shown any interest in Solana (SOL). If World Liberty Financial decides to invest in SOL, it could indicate that the investor is optimistic about the future of the network, pushing the price higher.

If on-chain activity, leverage demand, MEV bot behavior, and institutional investments improve, Solana’s price could gain momentum and recover to the $180 level. Investments from large institutions such as World Liberty Financial are often considered a validation of the asset and could trigger another wave of investments from large and small investors.

Conclusion

With multiple factors favoring a potential Solana (SOL) price recovery, investors and market watchers should pay attention to these indicators. Increased on-chain activity, leveraged demand, decreased MEV bot activity, and institutional investment are the keys that could reopen Solana’s high value in the crypto market.

Also Read: Cardano and Check Point Collaborate for AI-Based Blockchain Security!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. 4 Key Reasons Solana (SOL) Could Rebound to $180. Accessed on March 10, 2025

- Featured Image: Euronews

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.