To Buy BTC Again, MicroStrategy Prepares a Fantastic Fund Worth $21 Billion!

Jakarta, Pintu News – MicroStrategy, a company known for its massive investments in Bitcoin (BTC), recently announced an ambitious plan to raise $21 billion in funding.

The funds are planned for further Bitcoin (BTC) purchases, demonstrating the company’s strong commitment to this cryptocurrency. Nonetheless, the stock market did not welcome the announcement positively, with MSTR shares falling.

Check out the full news below!

Strategic Announcement and Fundraising Plan

MicroStrategy revealed through a press release that it will issue and sell series A preferred shares with a par value of $0.001 per share, totaling up to $21 billion. The sale of these shares will be gradual and measured through an At-the-Market (ATM) program.

The company plans to use the net proceeds from this sale for general corporate purposes, including Bitcoin (BTC) acquisitions and working capital. This approach demonstrates MicroStrategy’s confidence in the long-term value of Bitcoin (BTC), even though the stock market has yet to show a positive response.

MSTR shares are currently trading at $271, down more than 5% in pre-market trading, and have fallen more than 14% in the past month.

Also read: 1 Pi Network (PI) to Dollar Price Today (11/3/25)

Market Reaction to Announcements

Despite MicroStrategy’s stock decline, the price of Bitcoin (BTC) briefly jumped to $84,000 after the announcement. This surge shows that the crypto market is still very responsive to major actions from major players like MicroStrategy.

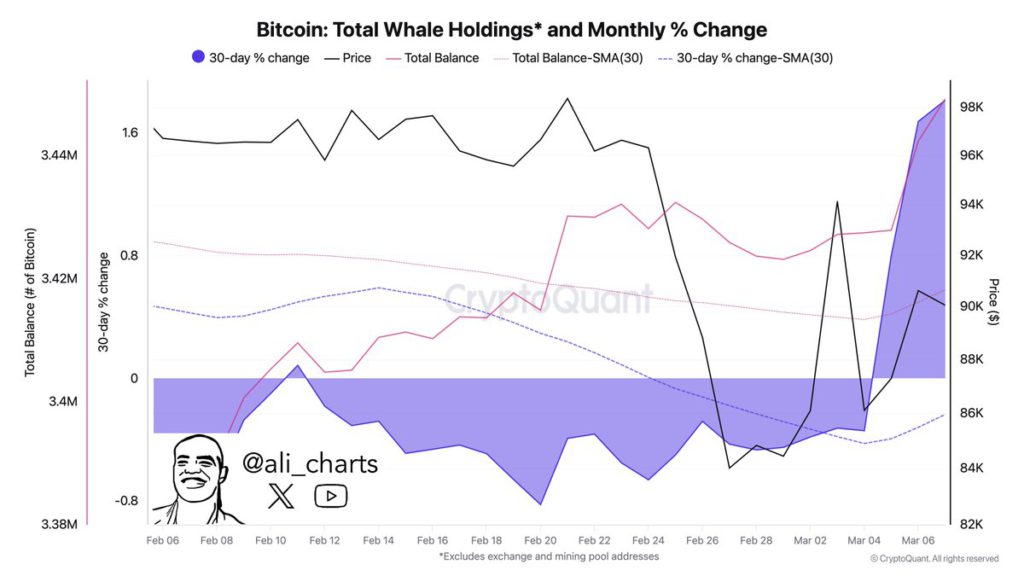

However, since the company buys Bitcoin (BTC) through over-the-counter transactions, the direct impact on market prices may be limited. Crypto analyst Ali Martinez notes that crypto whales are also using this opportunity to increase their holdings of Bitcoin (BTC).

In the past 72 hours, they have bought more than 22,000 BTC, indicating a strong belief in Bitcoin’s (BTC) potential future price rise.

Read also: BBVA Spain Launches Bitcoin and Ethereum Trading Service!

Long-term Strategy MicroStrategy

MicroStrategy’s investment in Bitcoin (BTC) is nothing new. The company has long been recognized as one of the largest institutional investors in Bitcoin (BTC). With this latest strategy, MicroStrategy further strengthens its position in the crypto market, showing that they see Bitcoin (BTC) as an important asset in their investment portfolio.

This move also shows confidence that Bitcoin’s (BTC) value will continue to increase. Despite significant price fluctuations, MicroStrategy seems to be focused on long-term potential and is not distracted by short-term volatility. This could be a signal for other investors to consider Bitcoin (BTC) a viable long-term investment.

Conclusion

Despite the uncertainty in the stock market, MicroStrategy’s bold move to raise large funds for further investment in Bitcoin (BTC) shows their long-term vision. This may be a pivotal moment that will determine the company’s future direction and possibly the crypto market as a whole.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. MicroStrategy to Raise $1.2 Billion to Buy More Bitcoin. Accessed on March 11, 2025

- Featured Image: Medium

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.