Ethereum Holds Strong at $2,000 — Is a Massive Breakout to $3,000 Just Around the Corner?

Jakarta, Pintu News – Will Ethereum (ETH) price return to the $1,900s before exploding to $3,000 as this crypto analyst says?

Let’s explore Ethereum price predictions and key liquidation levels and see if this retracement will provide a buying opportunity where patient investors can accumulate ETH before it explodes higher.

Before that, let’s explore Ethereum’s price movements today!

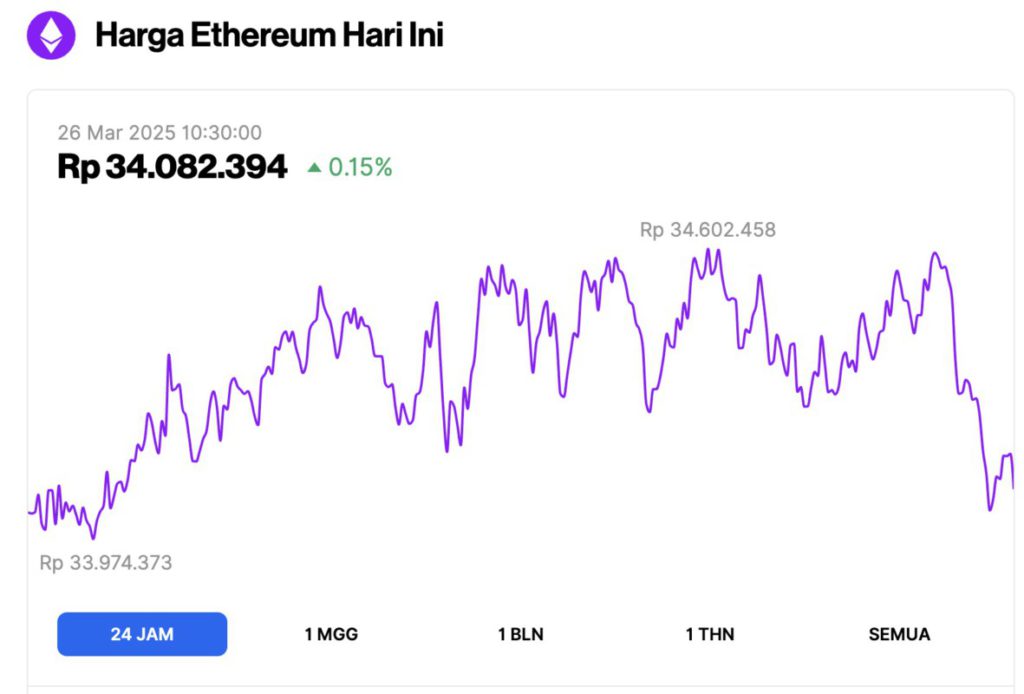

Ethereum Price Up 0.15% in 24 Hours

As of March 26, 2025, Ethereum (ETH) was trading at approximately $2,051, or around IDR 34,082,394, marking a modest 0.15% gain over the past 24 hours. Within that timeframe, ETH dipped to a low of IDR 33,974,373 and climbed to a high of IDR 34,602,458, reflecting slight but steady movement in the market.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $247.45 billion, with daily trading volume falling 19% to $247.45 billion within the last 24 hours.

Read also: Pi Network Plunges 12% Overnight — What’s Behind the Sudden Crash?

Analysts Hint Ethereum Price Correction could be a Buying Opportunity

MAXPAIN, a crypto analyst, explained through its Time Price Opportunity (TPO) chart that Ethereum’s price has the potential to decline about 9% from its recent peak of $2,104 to test key support levels again.

Based on the TPO chart, the observed value area is in the range of $1,874 to $1,924. Just above the upper limit of the range, there is liquidity due to the formation of the same low, and that is what MAXPAIN is targeting.

With these projections in mind, the area around $1,900 is expected to be a good point to buy ETH when the price drops. This means Ethereum’s price is likely to fully erase its recent 6.5% gain.

To date, the value of ETH has dropped 3% from the peak of $2,104 and is currently trading at $2,044 (3/25/25), in line with the analyst’s view. Ethereum’s daily price prediction may appear bearish until it hits the buy zone at $1,900.

However, in the event of a price bounce in the area, it could be a promising opportunity, especially as Bitcoin and the crypto market in general look poised for a major uptrend due to the recent rise in global liquidity indices.

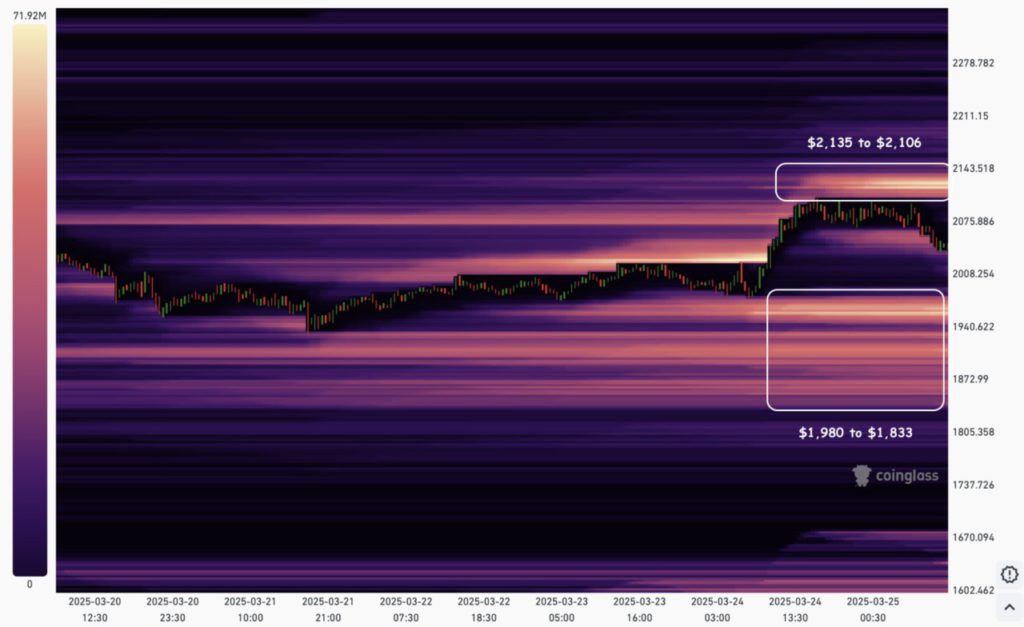

Key Ethereum Levels to Watch Out For

Based on CoinGlass’ Liquidity Heatmap, there are two important zones to watch. For short sellers, the key level is in the range of $2,135 to $2,106, where there is about $450 million of liquidity.

Read also: These 4 Cryptos Are Set to Explode in April 2025!

If the price moves quickly past this level, the short position will be forced to close, which could trigger a price spike.

Conversely, between the $1,980 to $1,833 range, there are over $700 million of long positions that will be forced to close if the price drops below this level.

As such, price movements in either direction can cause great stress in the market. Based on the TPO chart, there is a high probability that long positions will be liquidated first.

However, it is possible that the price of Ethereum may actually rise, especially if the price of Bitcoin (BTC) does not fall further. Regardless of the direction of movement, investors still need to be cautious.

In conclusion, the analyst’s view is that Ethereum’s price is likely to experience a correction of around 9% from its recent peak, providing a buying opportunity in the $1,900 range before potentially heading towards the next psychological level of $3,000.

The liquidation heatmap model also reinforces this short-term downside scenario before ETH resumes its upward movement.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.