Is Bitcoin (BTC) Ready to Surge in April 2025? $31 Billion in Stablecoins Flows to Binance

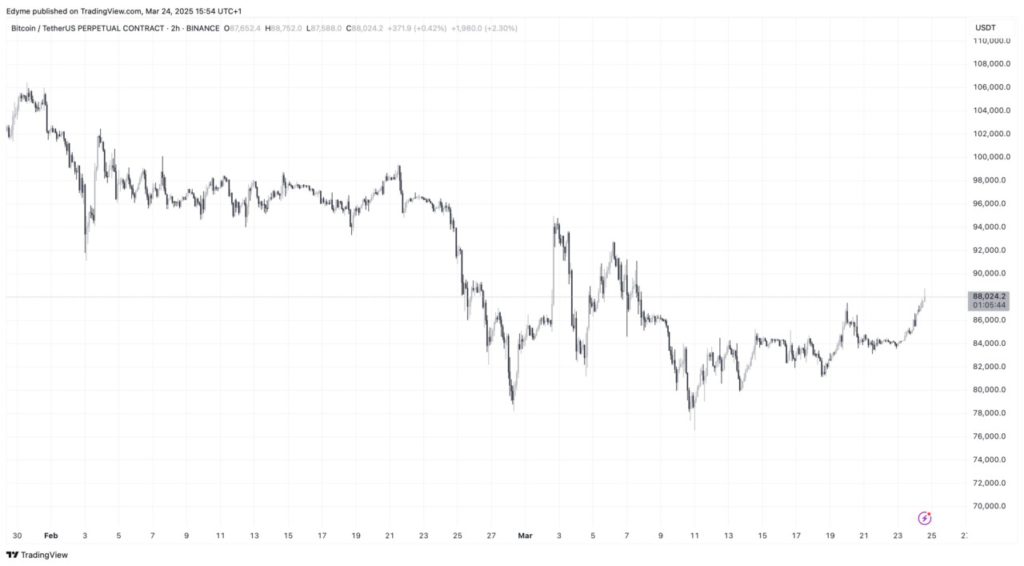

Jakarta, Pintu News – Bitcoin (BTC) seems to be starting to show strong signs of recovery after experiencing recent consolidation. The cryptocurrency has surpassed the $87,000 level, with gains of around 5.2% in the past week and 3.4% in the past 24 hours. This increase marks a stark contrast compared to the steady downward trend observed in recent weeks, giving traders renewed momentum and sparking discussions about broader market sentiment.

Stablecoin Buildup and Investor Sentiment

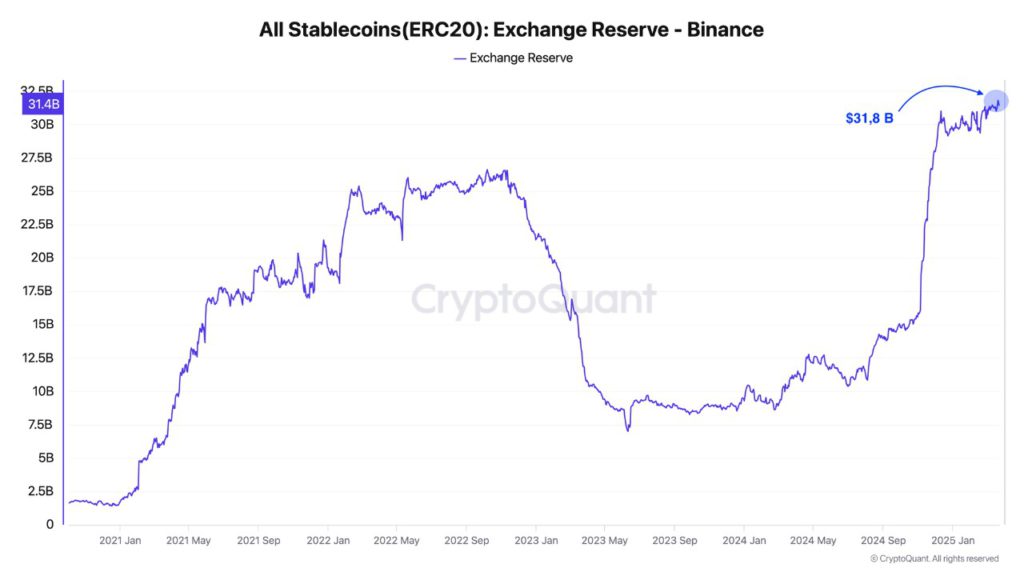

Analysis from Darkfost on CryptoQuant’s QuickTake platform shows that the amount of ERC-20 stablecoins held on Binance has reached a new record high, now surpassing $31 billion. Binance continues to lead the way in trading volume among centralized exchanges, making this metric particularly important for analyzing short-term price action. The increase in stablecoin reserves indicates increased trust among Binance users.

These funds may represent capital positioned to re-enter the crypto market, potentially signaling a wave of buying pressure. Additionally, Binance may be accumulating stablecoins to manage liquidity for ongoing investor demand or hedging strategies.

Stablecoin balances on exchanges are often used as indicators of future market participation. When reserves increase, it usually reflects investors’ readiness to deploy capital into assets like Bitcoin (BTC) and Ethereum (ETH). While this trend doesn’t guarantee direct upward price movement, it generally goes hand in hand with improved sentiment and increased demand.

Also Read: Why is Bitcoin (BTC) Following the 2024 Summer Trend? Check out the Next Prediction!

Bitcoin (BTC) Short-Term Cost Basis Levels to Watch Out For

In another report, CryptoQuant analyst Burak Kesmeci outlined important cost levels for Bitcoin (BTC) investors based on duration of ownership. This “cost basis” rate represents the average entry price for a segmented group of investors based on how long they have held their Bitcoin (BTC).

Monitoring this range helps assess which price levels might act as support or resistance in the market. Kesmeci identified four key price bands: $85,000 for holders between 1 to 4 weeks, $89,000 for holders of 3 to 6 months, $98,000 for holders of 1 to 3 months, and $63,000 for those holding between 6 to 12 months.

This zone is important because short-term investors often react to this level-either taking profits or exiting when prices approach their average entry cost. A move above $89,000, for example, could turn this zone into support and potentially pave the way towards a retest of higher levels near $98,000.

Conclusion

With the increase in stablecoin reserves on Binance and the identification of a critical cost floor, the Bitcoin (BTC) market may be gearing up for its next phase of growth. Investors and traders should pay attention to these indicators as signals for their trading strategies, given the potential for significant price movements in the near future.

Also Read: Lighter Tariff Hike Triggers Altcoin Surge: Solana, DOGE, and ADA Shine

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. $31B in Stablecoins Piled Into Binance, Is Bitcoin’s Next Leg Up Loading?. Accessed on March 26, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.