Aave Breaks $150 Resistance, What’s Next?

Jakarta, Pintu News – Aave [AAVE] showed slow but steady growth in Total Value Locked (TVL) the past few days, signaling increased investor confidence and more capital being deposited in Aave’s smart contracts.

The Aave team has allocated $50 million annually to buy back AAVE from the market, a move that may also boost investor confidence. Thanks to this news and the market rally that took place last week, the altcoin managed to break the $150 short-term resistance zone.

Aave’s strengthening is still not safe

Since bottoming out at $125 on April 9, AAVE has gained 26.2% in two weeks. In comparison, Bitcoin (BTC) is up 22% in the same period. Despite this, the altcoin market generally follows the trend of Bitcoin (BTC). AAVE itself has not shown remarkable strength.

The On-Balance Volume (OBV) did not reach a new local peak, which means that buying pressure is still low. Therefore, investors and traders hoping for a sustained rally should expect buying volumes to increase in the near future.

Also Read: 7 Ways to Save Dollars (USD) for Maximum and Effective Use

Technical Indicators Show Momentum

The Relative Strength Index (RSI) has risen above 50 indicating a momentum shift in a bullish direction on the chosen time frame. However, with no signs of accumulation, this momentum shift means little, as it could simply be the result of Bitcoin (BTC) moving.

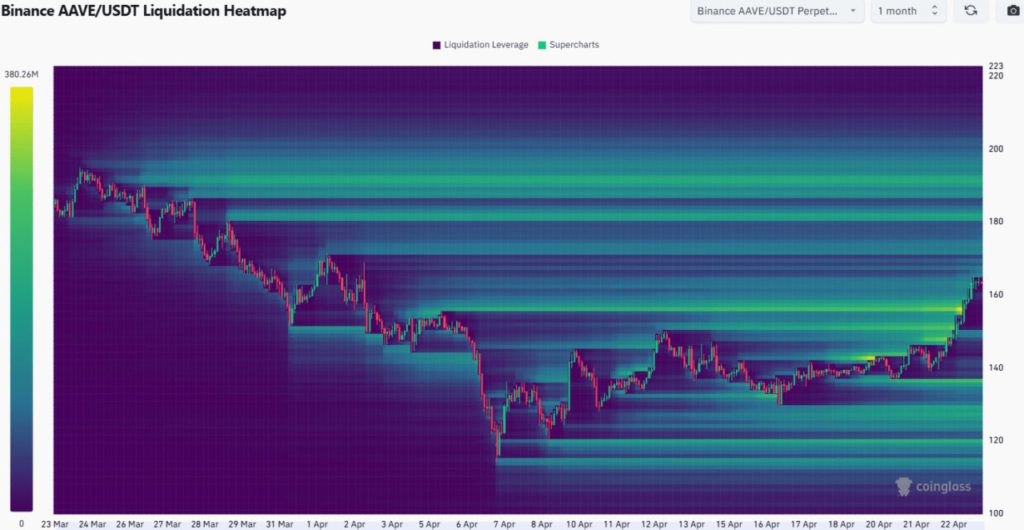

The $190 level is the lowest peak of the downtrend that occurred in 2025, making it the target of this rally. The one-month liquidation heatmap shows that the $182 and $191 levels are the strongest magnetic zones above the market price, making them attractive targets for AAVE.

Short-term Price Projections

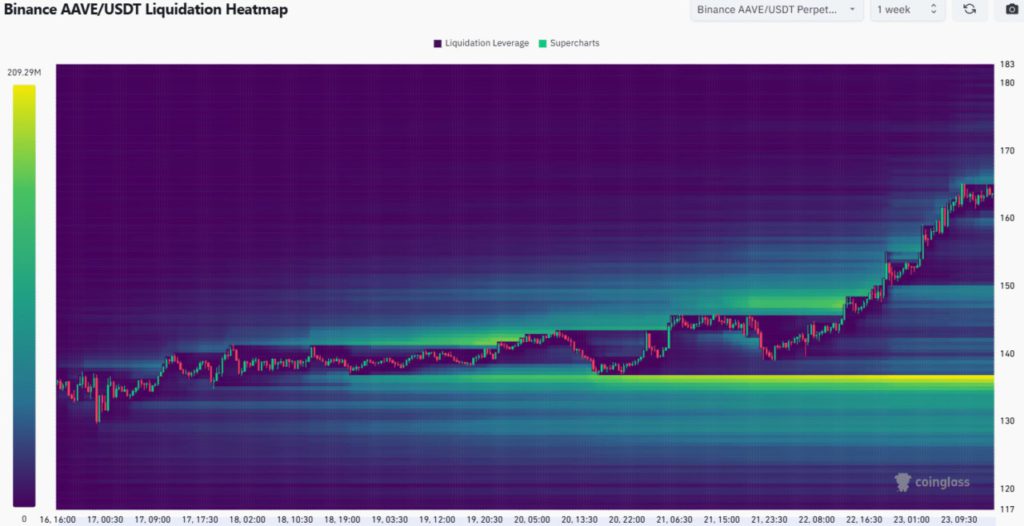

Observing the one-week liquidation heat map, the levels of $166, $159, and $149 appear as short-term price targets that may experience a price reversal. Incorporating the clues from the liquidation heatmap, Aave is likely to climb higher towards $190. This level coincides with the lowest peak on the daily chart.

On the way there, the $170 region could hamper the upside. In fact, it could trigger a retracement as far as $159 or $149. A price drop like this would likely be a buying opportunity.

Market Conclusions and Expectations

Traders have evidence to be bullish in the short term, but a break beyond $190 requires sustained demand, which AAVE currently lacks. Despite some positive indicators, the market should still be cautious given that AAVE is yet to show signs of strong accumulation.

Also Read: 7 Ways to Get Passive Income from Crypto 2025, Simple!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Aave breaks $150 resistance as bulls gain confidence, what’s next?. Accessed on April 24, 2025

- Featured Image: Beamstart

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.