Standard Chartered Prediction: Bitcoin (BTC) to Hit a New Record High of $120,000!

Jakarta, Pintu News – Standard Chartered predicts that Bitcoin (BTC) will soon reach a new record high. The bank thinks that the price target of $120,000 in the second quarter is increasingly realistic to achieve.

This forecast is supported by several key factors, such as strong accumulation activity from Bitcoin ETFs and major companies in the sector, as well as growing institutional adoption of Bitcoin in the United States.

What’s Driving the Prediction of Bitcoin Reaching $120,000 in the Second Quarter?

In an interview with the BeInCrypto page, Geoff Kendrick, Head of Digital Asset Research at Standard Chartered, stated that Bitcoin has the potential to reach new highs soon.

He attributes this surge to inflows into ETFs, investment strategies from Strategy (formerly MicroStrategy), as well as institutional involvement.

Read also: 3 Ethereum Crypto Rivals to Watch Out For: SOL, SUI, ADA!

Kendrick emphasized the importance of capital flows in the current bull market trend. Based on data from Glassnode, inflows into ETFs have been strong again over the past two weeks. At the same time, Bitcoin price has risen from $84,000 to $99,000.

“Bitcoin’s current price appreciation is entirely driven by capital flows, and those flows are coming from multiple sources. Spot ETFs in the US have recorded inflows of $5.3 billion in the last three weeks. Based on my price-adjusted calculations, the increase was only $1.2 billion in that period, so the net inflows were actually over $4 billion,” Kendrick explained.

Bitcoin Accumulation by Institutional Investors

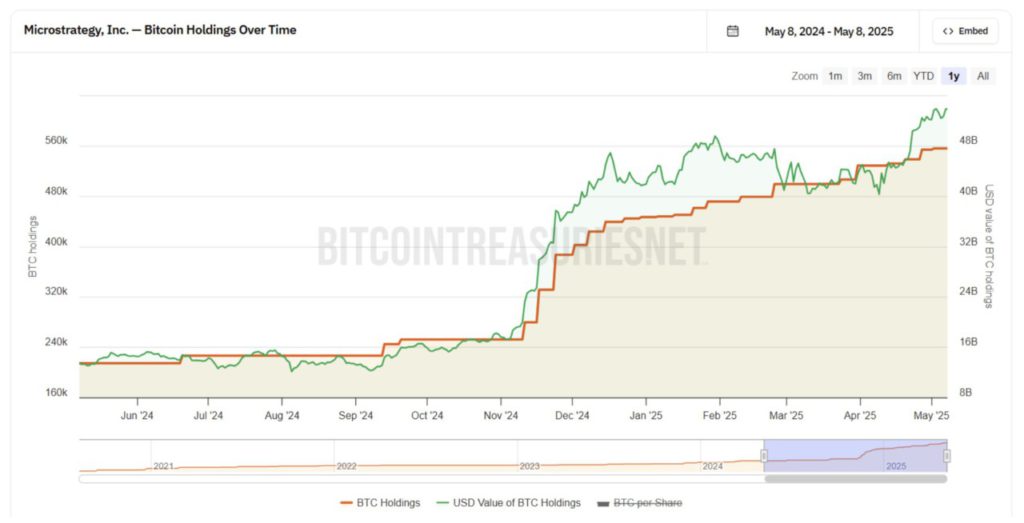

Another important factor highlighted by Kendrick is Strategy’s continued accumulation of Bitcoin. Based on data from BitcoinTreasuries, the company has been consistently adding to its Bitcoin holdings since late 2024.

With the recent price recovery, the total value of Bitcoin Strategy holdings now stands at a record of over $53.8 billion.

Kendrick also stated that the upcoming 13F reports from ETFs and Strategies will provide further insight into their investment activities.

In addition, he highlighted the increasing involvement of large institutions such as Abu Dhabi’s sovereign wealth fund, the Swiss National Bank, and the Norges Pension Fund. This trend reflects the growing acceptance of Bitcoin in traditional investment portfolios.

“At the end of December, Abu Dhabi’s sovereign wealth fund had a position equivalent to 4,700 Bitcoins in IBIT. I expect that number to have increased, and other long-term investors are also starting to jump on the bandwagon. Interestingly, the Swiss National Bank recently started buying MicroStrategy shares, along with the Norges Pension Fund,” he explains.

State Governments Begin to Look at Bitcoin

It’s not just big institutions that are getting involved-local governments in the US are also taking action.

A recent report from BeInCrypto revealed that states such as Arizona, New Hampshire, Texas, and Oregon are making significant progress in legislating Bitcoin strategic reserves.

Read also: MetaPlanet Buys Another 555 Bitcoins, its Share Price Jumps 12%!

“New Hampshire recently became the first state in the US to pass a Bitcoin Strategic Reserve law, and I expect other states to follow suit soon,” Kendrick said.

Taking all these factors into account, Kendrick remains optimistic about Bitcoin’s price prospects. However, he also recognizes that his predictions may still be too conservative.

“I apologize if the $120,000 target for the second quarter is actually too low,” he said.

The combination of strong ETF inflows, aggressive accumulation by Strategy, increased participation of large institutions, as well as local policy support in the US created ideal conditions for Bitcoin.

According to Standard Chartered, a new price record for Bitcoin is not only possible-it could happen in the near future.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Standard Chartered Says Fresh Bitcoin All-Time High Is Imminent. Accessed on May 9, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.