Dogecoin Tanks 6% in a Day—$20 Million in Long Positions Obliterated!

Jakarta, Pintu News – Dogecoin (DOGE) price is stuck below $0.25 due to profit-taking and Bitcoin (BTC) volatility.

However, the RSI DOGE indicator crossing the boundary on May 7 suggests that buyers may still target the price of $0.30, despite a short-term correction of 5.8% on Sunday, May 11, 2025.

So, how is the Dogecoin price moving today?

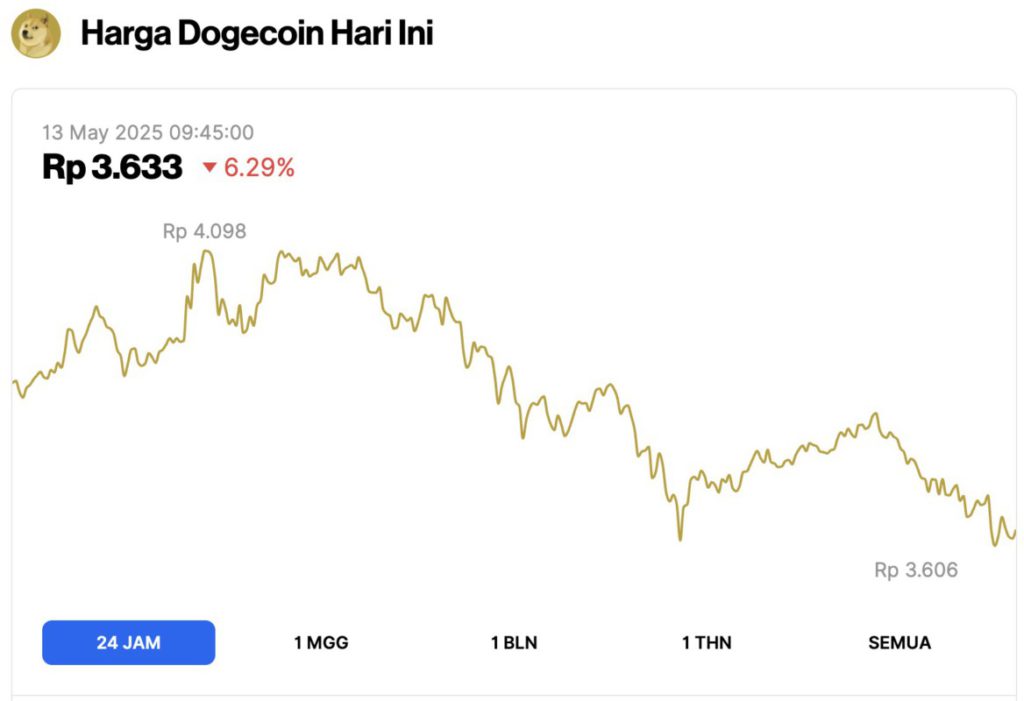

Dogecoin Price Drops 6.29% in 24 Hours

On May 13, 2025, Dogecoin saw a 6.29% drop in value over the past 24 hours, trading at $0.2203, or approximately IDR 3,633. During the day, DOGE reached a high of IDR 4,098 and dipped to a low of IDR 3,606.

At the time of writing, Dogecoin’s market cap stands at around $32.88 billion, with trading volume rising 49% to $4.48 billion within 24 hours.

Read also: Bitcoin Stalls at $102K — But a Bullish Pattern Could Send It Soaring to $150K!

Dogecoin (DOGE) Stuck Below $0.25

In addition to today, Dogecoin’s price decreased by 5.7% on Sunday, May 11, after recording double-digit gains for three consecutive days.

This correction reflects a general market consolidation, where investors are starting to take profits and consider macroeconomic factors. DOGE previously led the market rally this week, but sentiment began to weaken below the $0.25 level as interest in risky assets declined.

Donald Trump’s remarks about successful trade negotiations with China briefly pushed Bitcoin’s price beyond $104,000. However, geopolitical tensions, particularly the escalation of military conflict between India and Pakistan in the last 48 hours, dampened Dogecoin’s momentum.

The situation triggered profit-taking on various assets that are known to be volatile and sensitive to signals of market panic.

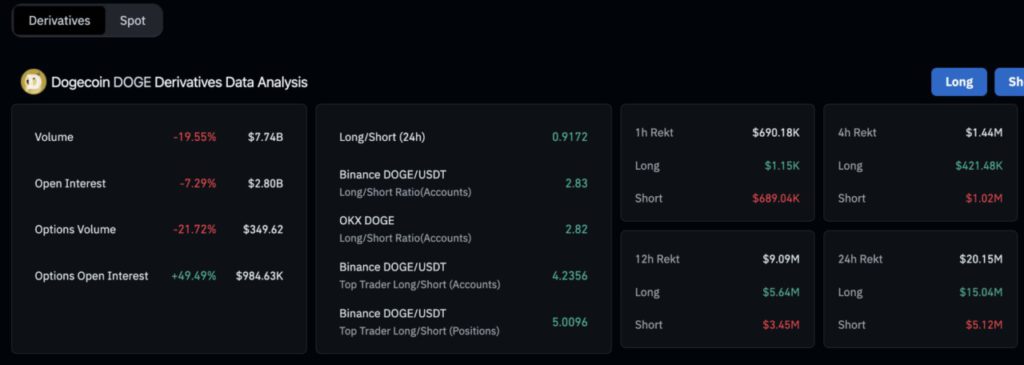

Derivatives: $20 Million Dogecoin Long Positions Liquidated, Open Interest Down 7.3%

The latest price correction in DOGE was also reinforced by significant changes in derivatives market sentiment. Dogecoin’s total open interest fell by 7.29% to $2.80 billion, while daily trading volume shrank by 19.55% to $7.74 billion.

DOGE’s options volume plummeted by 21.72%, although open interest for options surged by 49.49%. This indicates the accumulation of directional bets by market participants, despite the decline in intraday trading activity.

Liquidation data notes that as of May 11, a total of $20.15 million worth of long DOGE positions had been liquidated – with 75% of these being long positions. This indicates that many highly leveraged bullish positions were forced to close when the price dropped below $0.25.

The long/short ratio gives a mixed picture. The account-based long/short ratios on Binance and OKX stand at 2.83 and 2.82 respectively, indicating a dominant tendency towards long positions.

However, the position ratio of top traders surpassed even 5.00, signaling the high conviction of large-volume accounts in DOGE’s potential price rise.

Read also: Dogecoin Set to Skyrocket 500%? Analysts Predict $1 Target by August 2025!

What’s Next for the Dogecoin Price?

Dogecoin’s bullish structure remains intact as long as the support level at $0.225 is not broken. The recent 5-day RSI crossover confirms the upside momentum in the medium term, with a price target of $0.30 remaining realistic if Bitcoin is able to stabilize above $104,000.

Strategic traders will now be watching fund flows from Bitcoin ETFs and US macroeconomic data releases this week. If institutional interest remains strong, then meme coins like DOGE have a chance to continue their uptrend.

However, downside risks still exist if Bitcoin fails to hold above $100,000. If DOGE drops below $0.225, this could trigger further liquidation and temporarily invalidate the existing bullish scenario.

Dogecoin Price Prediction: RSI Crossover Maintains 5-Day Momentum, $0.30 Target Still Valid

Dogecoin price is currently showing signs of stabilization above the $0.23 level, with new momentum starting to build after a temporary rejection around $0.25.

The 5-day RSI crossover was maintained at 70.85, indicating that the bullish momentum still persists despite the price correction.

The higher low (HL) structure formed earlier in this rally, followed by a new local higher high (LH), reinforces the developing bullish movement pattern.

This pattern, which also finds support from the lower level of the SuperTrend indicator at $0.191, suggests that the overall bullish structure is still valid and could potentially continue if the current consolidation phase ends with an upward breakout.

The RSI crossover occurred on May 7, when the purple RSI line (short-term momentum) crossed decisively above the yellow signal line (long-term average). Bullish crossovers like this usually mark a shift in market momentum from neutral or bearish to a new uptrend.

Since that turning point, the purple RSI line has remained above the yellow line, confirming the bullish strength that has persisted over the past five days.

If this momentum continues throughout this week-especially if Bitcoin price rises above $104,000 again as predicted-DOGE could regain strength and target an upper level around $0.30.

Major confirmation will be seen if the daily candle manages to close above $0.25, which was the last level of rejection. This should also be supported by positive delta volume, which today recorded $27.96 million after falling sharply on May 11. This suggests that institutional investors or “smart money” may start buying when the price hits structural support.

However, this bullish scenario will be invalidated if the price drops below the HL at $0.19. A drop below this level will invalidate the higher high/higher low pattern and return DOGE to its previous consolidation zone.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Dogecoin Price Outlook: 5-Day RSI Crossover Confirms $0.30 Breakout Trajectory. Accessed on May 13, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.