Metaplanet Buys Another 1,271 Bitcoins! Will BTC Price Explode This Week?

Jakarta, Pintu News – On Monday (12/5/25), Metaplanet announced the purchase of an additional 1,271 Bitcoin (BTC) with an investment value of $126.7 million, at a Bitcoin price of $102,111 per coin.

This announcement comes just days after the company announced the issuance of a $25 million bond at 0% interest to support their Bitcoin acquisition plans.

With this latest purchase, the Japanese company now owns more Bitcoin than El Salvador.

Metaplanet gets closer to 10,000 BTC target

Known as “Japan’s MicroStrategy”, Metaplanet has once again strengthened its Bitcoin holdings with the latest purchase of 1,241 BTC worth approximately $126.7 million. This move confirms the company’s belief in Bitcoin’s long-term potential.

Read also: Bitcoin Stalls at $102K — But a Bullish Pattern Could Send It Soaring to $150K!

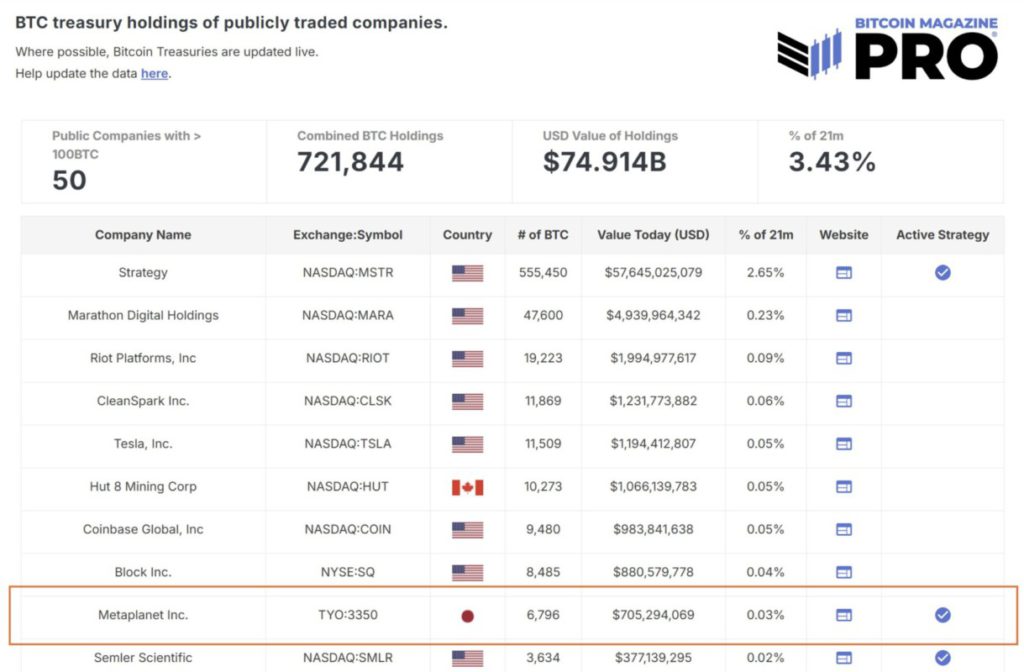

As of May 12, 2025, the company’s total Bitcoin reserves stood at 6,796 BTC, which was acquired with a total investment of approximately $608.2 million, at an average price of $89,492 per BTC. Metaplanet’s CEO, Simon Gerovich, also noted that their Bitcoin acquisition strategy over the past year has resulted in a BTC yield of 170%.

Some veteran market participants such as Adam Back even argue that BTC Metaplanet’s acquisition strategy is better than MicroStrategy.

After surpassing El Salvador in Bitcoin holdings, the Japanese company is now aiming to rival giants like Coinbase and Block Inc. by steadily increasing the amount of BTC held.

This latest development comes a week after Metaplanet announced plans to issue its 13th Series Ordinary Bonds, with a fundraising target of $25 million for additional Bitcoin purchases.

The company has consistently utilized EVO FUND to issue bonds as part of its ongoing strategy of expanding Bitcoin reserves. Metaplanet is now rapidly approaching its target of having 10,000 BTC in the company’s coffers before the end of 2026.

Along with this announcement, Metaplanet shares jumped 3% and surpassed 550 yen. Since adopting the Bitcoin strategy in mid-2024, the company’s shares have skyrocketed by 1700%, and are up more than 51% since the beginning of 2025.

Bitcoin’s Rally Continues This Week?

With a weekly gain of 10.63%, Bitcoin price surged to $105,000 today, on the back of positive developments in trade talks between the US and China.

Market analysts are starting to get optimistic that a new record high could be reached in the near future, perhaps even this week.

Financial analyst Joe Consorti notes a strong correlation between Bitcoin price movements and the global M2 money supply, with a time lag of about 70 days. While he admits that M2 is not an ideal measure of money supply, the trend is still interesting to observe.

Read also: Standard Chartered Prediction: Bitcoin (BTC) to Hit a New Record High of $120,000!

In addition to Metaplanet’s buying spree, “whales” or large Bitcoin investors also continued to make large purchases. Blockchain analytics platform LookonChain reported significant activity from one major whale.

The investor had just purchased an additional 821 BTC worth approximately $85.42 million, having also made a similar purchase the day before.

In total, the whale has accumulated 1,721 BTC worth approximately $179 million in just the last two days.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Metaplanet Bitcoin Strategy Outpaces El Salvador. Accessed on May 13, 2025

- Coingape. Metaplanet Acquires 1,271 More Bitcoins, Will BTC Rally This Week. Accessed on May 13, 2025

- Coinpedia. Metaplanet Boosts Bitcoin Holdings to 6,796 BTC, Solidifying Position as Asia’s Largest Corporate Holder. Accessed on May 13, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.