Dogecoin Surges 6% Today – Is This the Start of a Massive Long-Term Breakout?

Jakarta, Pintu News – Rekt Capital analysts highlighted that Dogecoin (DOGE) managed to break the resistance level before the halving, with a retest in progress.

If the current support level is able to hold, there is a potential upside of 22.73%.

This week, the Dogecoin price briefly spiked to $0.25 before correcting back to $0.22, in line with the temporary decline in the crypto market in general.

Meanwhile, analysts noted a technical pattern suggesting that DOGE may be transitioning to a more positive market structure, although overall market sentiment remains cautious.

So, how is the Dogecoin price moving today?

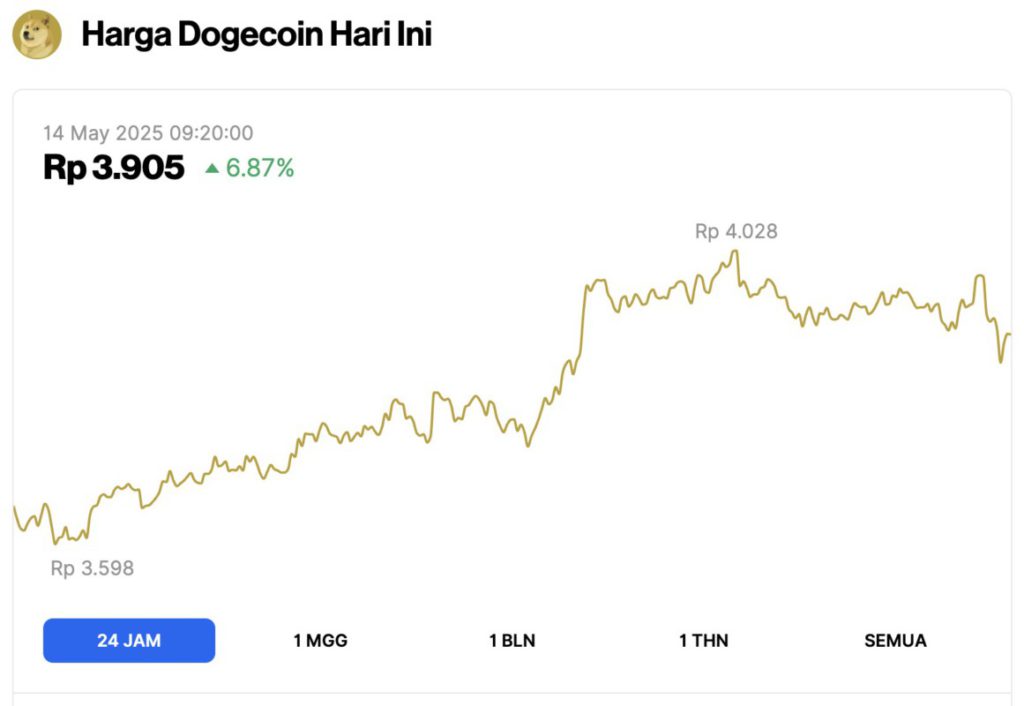

Dogecoin Price Rises 6.87% in 24 Hours

On May 14, 2025, Dogecoin saw a 6.87% jump within 24 hours, trading at $0.2362, or around IDR 3,905. During that period, DOGE hit a low of IDR 3,598 and climbed to a high of IDR 4,028.

At the time of writing, Dogecoin’s market cap stands at around $35.35 billion, with trading volume dropping 39% to $2.69 billion within 24 hours.

Read also: Ethereum Soars to $2,600 — Is a Surge to $4,000 Just Around the Corner?

Dogecoin Shows Crucial Weekly Breakout

Rekt Capital, a widely followed market analyst, identified positive developments on Dogecoin’s weekly chart.

The cryptocurrency just recorded a weekly close above the pre-halving resistance zone-a level that had been limiting price movements for the previous few months.

The horizontal zone marked in green on the chart, which previously served as the upper limit (resistance) before the halving event, now seems to be turning into a support level.

This technical change, known as a shift from resistance to support, is often an important signal in the continuation of an uptrend. The green circle on Rekt Capital’s chart marks both a breakout and a successful retest of the zone.

With DOGE now stabilizing around $0.22, the chart structure shows an increasing dominance from the buyers’ side (bullish). According to the analyst, DOGE is currently undergoing a process of retesting the breakout level.

If this green zone is able to hold, the next target is expected to be in the range of $0.27. This increase would represent a potential gain of 22.73% from the current price level.

Back to Key Resistance Zone

Meanwhile, a separate analysis from market monitor Ali Martinez highlights a historically important area of resistance that sits between $0.24 to $0.27.

Read also: Top 3 Crypto Airdrops You Can’t Afford to Miss This May 2025

Based on the shared chart, this zone has repeatedly acted as both a support and resistance area in recent months. Currently, DOGE is approaching the area again after bouncing back from levels below $0.17.

This zone was an area of support in late December 2024 and early February 2025, before turning into resistance after a sharp drop in mid-February. The price reaction around this zone was significant, as evidenced by the repeated rejection that occurred in late February and March.

The recent rise in DOGE that brought the price back to this area confirms the importance of the zone, given that selling pressure usually increases at these levels.

If Dogecoin manages to break through this resistance zone, then the previous rejection pattern can be declared no longer valid, and there is an opportunity for a more sustainable upward movement.

Javon Marks Highlights Long-Term Breakout Patterns

Another analyst, Javon Marks, highlighted the breakout of the long-term downtrend line that has been forming since Dogecoin peaked at around $0.70.

This breakout ended a long series of price patterns that kept printing lower highs and lower lows, signaling a structural change in DOGE’s price movement.

Since the reversal, Dogecoin has consistently formed higher highs and higher lows, reflecting a continued uptrend. The latest price correction found support around $0.16, creating a new higher low that further reinforces the direction of this uptrend.

Marks projects significant long-term upside potential, with DOGE’s initial target at $0.6533. If key resistance levels are convincingly broken, DOGE is even expected to reach $1.25.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TheCryptoBasic. Dogecoin Breaks Above Pre-Halving Resistance, Targets $0.27 if Support Holds. Accessed on May 14, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.