Surge in XRP Trader Activity Promises Price Increase!

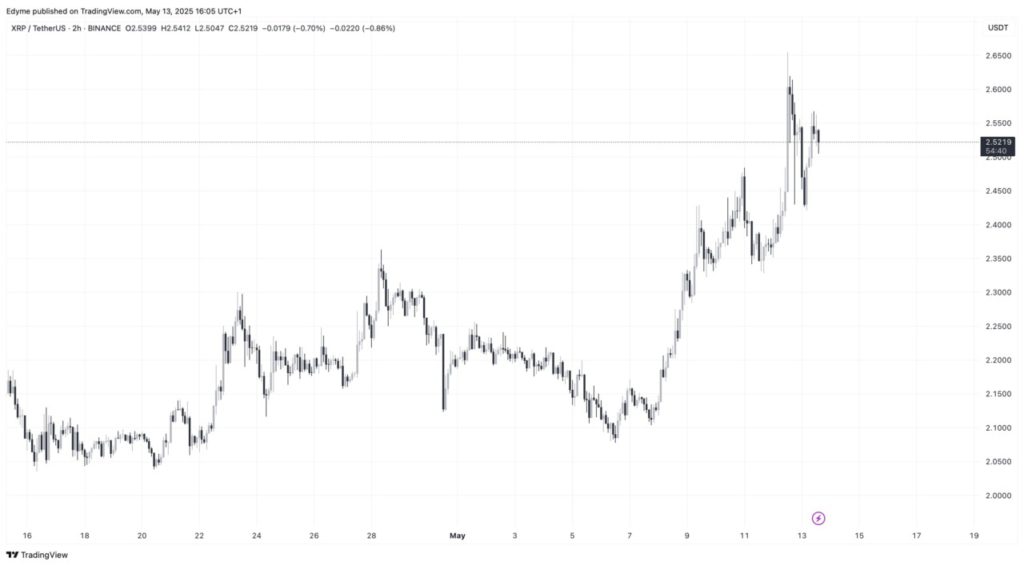

Jakarta, Pintu News – Ripple (XRP) followed the general positive trend of the crypto market by registering significant gains during last week. Despite the slight decline, Ripple (XRP) is still well above its recent low, indicating increased interest from traders. Currently, Ripple (XRP) is trading at $2.54, down 2% in the last 24 hours.

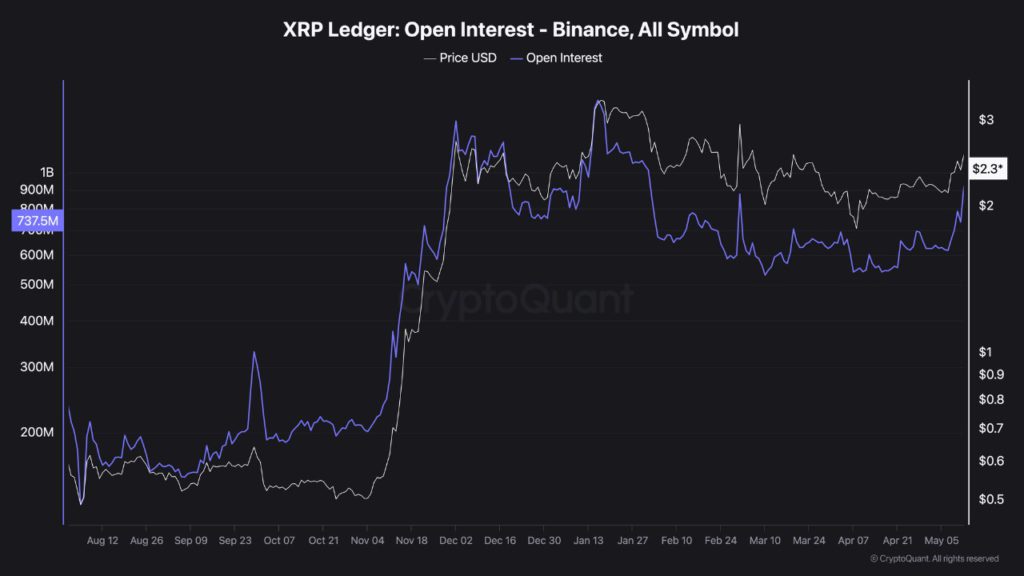

XRP Open Interest Increases

Open interest, which is the total number of unsettled futures contracts, indicates the level of market engagement. When open interest increases alongside price, it often signals an increase in speculative participation. Recent data shows that open interest for Ripple (XRP) has recovered from a low of $530 million to a higher range, signaling a recovery in market confidence after a significant drop from its peak of $1.5 billion.

The funding rate on Binance, which reflects the cost of maintaining a long or short position in futures contracts, went negative during Ripple’s (XRP) last correction. This indicates an increase in short positions, which could trigger a short squeeze. Currently, the funding rate is neutral, indicating a balance between bullish and bearish positions.

Also Read: Bitcoin (BTC) Breaks $100K: What are the Hidden Risks Lurking?

Sell Taker Pressure Meets Stable Prices

One of the metrics analyzed is the Buy/Sell Taker Ratio, which compares the volume of aggressive buy orders to sell orders. A ratio below 1 indicates seller dominance. For Ripple (XRP), this ratio stands at 0.91, which means selling pressure is dominant. However, the absence of a significant price drop despite the pressure suggests a possible absorption by big players, which could be a prelude to a bullish price movement.

The combination of increased open interest, neutral funding levels, and stable price levels despite selling pressure suggests that there may be tacit accumulation taking place. Although the market is still undecided, this pattern is often seen in the early stages of a trend reversal or breakout.

Markets Prepare for the Next Phase

As speculative activity increases, it will be crucial to continue monitoring this signal for further confirmation. Whether this will lead to a continuation of the Ripple (XRP) rally or not, current data suggests that the market is actively adjusting and may be preparing for the next phase in price action. Market participants and investors should take note of these dynamics to make informed investment decisions.

Conclusion

With various indicators showing accumulation potential and a balance between buyers and sellers, Ripple (XRP) is in an interesting position to follow. The rise in open interest and stable prices despite selling pressure are signals that should not be ignored by investors looking for opportunities in the crypto market.

Also Read: GD Culture Group Invests $300 Million in Bitcoin and Trump Memecoins

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. XRP Sees Renewed Trader Activity as Market Absorbs Selling Pressure. Accessed on May 14, 2025

- Featured Image: FXL Leaders

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.