Bitcoin (BTC) Potential to Break New Record Highs in May

Jakarta, Pintu News – This May, Bitcoin (BTC) is showing strong indications of reaching new highs. Factors ranging from accumulation by whales to an increase in global money supply are all contributing to a potential surge in the price of Bitcoin (BTC).

Hoarding by Whale

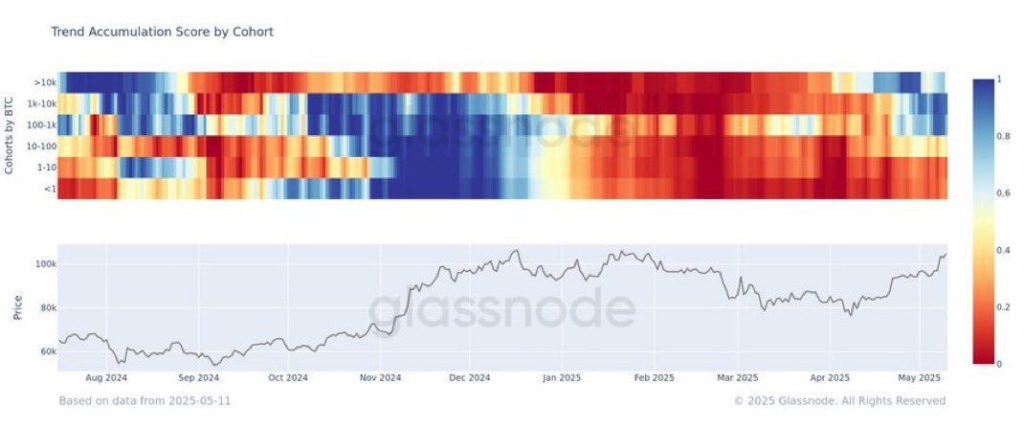

The latest data from Glassnode shows that there has been an increase in Bitcoin (BTC) accumulation by whales, which started in early April. Initially, only large wallets were hoarding, but now smaller wallets are also joining in. Santiment reported that in the last 30 days, whale wallets have added 83,105 BTC to their holdings.

This has turned the Spot Volume Delta positive, providing strong momentum for Bitcoin (BTC) to continue rising. Moreover, predictions from Santiment state that with this aggressive accumulation, it is possible that Bitcoin (BTC) will break the $110,000 price. This is reinforced by the suspended tariff policy between the US and China, which could provide more room for Bitcoin (BTC) to grow.

Also Read: Bitcoin (BTC) Breaks $100K: What are the Hidden Risks Lurking?

Illiquid Supply of Bitcoin (BTC)

The illiquid supply of Bitcoin (BTC) has reached a new record high of 14 million BTC, which is worth more than $1.4 billion. This rise in illiquid supply shows that long-term investors or HODLers are very tight in holding their Bitcoin (BTC) and are not planning to sell anytime soon.

This effectively reduces the amount of Bitcoin (BTC) circulating in the market, and when demand increases, the price of Bitcoin (BTC) can shoot up more easily. This creates an ideal environment for Bitcoin (BTC) to reach higher prices, especially if demand continues to rise amid limited supply.

Small Investor Engagement and Global Liquidity

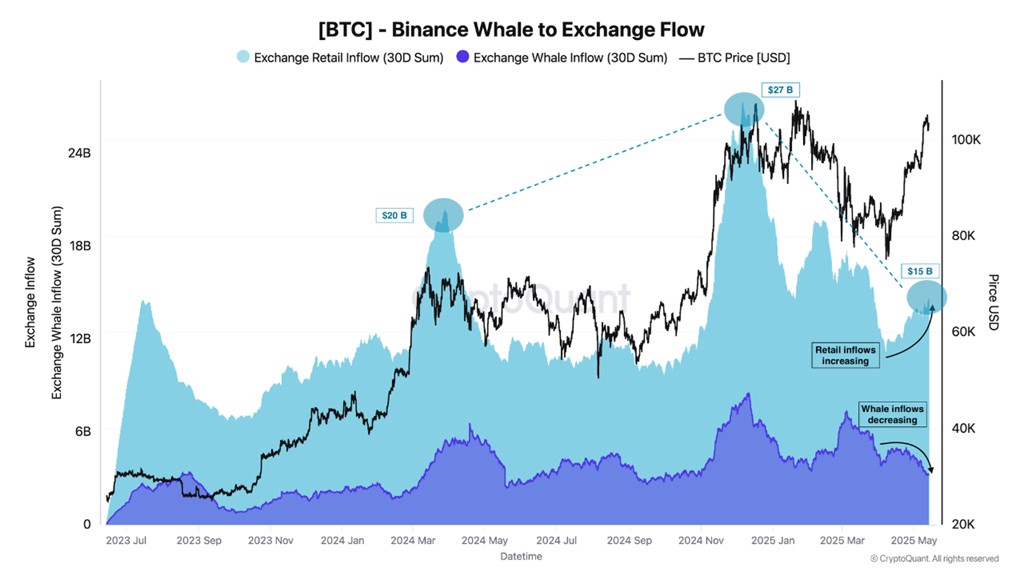

Although retail investors have yet to fully emerge, CryptoQuant noted that retail trading volumes on Binance, the world’s largest crypto exchange, are starting to rebound after experiencing a decline. CryptoQuant analyst Carmelo Alemán observed that although volumes are yet to surge, there are positive signs emerging.

It is expected that in the next few months, retail participation will increase, which will drive growth in active addresses, the number of UTXOs, and other metrics such as New Addresses and Transfer Volume.

Additionally, crypto analyst Colin Talks Crypto points out that there is a correlation between Bitcoin (BTC) price and the global money supply M2. With the current macroeconomic conditions, money supply expansion by central banks such as the Fed, ECB, and BoJ may continue to support Bitcoin (BTC) growth.

Conclusion

With multiple factors in its favor, including accumulation by whales, illiquid supply, and increased retail participation and global liquidity, Bitcoin (BTC) is on track to reach a new price record. The growing optimism among the community, as seen by the increased probability on Polymarket, only adds to the potential for a significant price spike.

Also Read: GD Culture Group Invests $300 Million in Bitcoin and Trump Memecoins

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Reasons Bitcoin Could Hit New ATH in May. Accessed on May 15, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.