Bitcoin price predicted by analysts to weaken to $92,000, when will the accumulation phase start?

Jakarta, Pintu News – After reaching a new record high above $111,000 in May, Bitcoin (BTC) price is now showing a bearish trend. This decline comes after a period of significant gains, which allowed Bitcoin (BTC) holders to make huge profits.

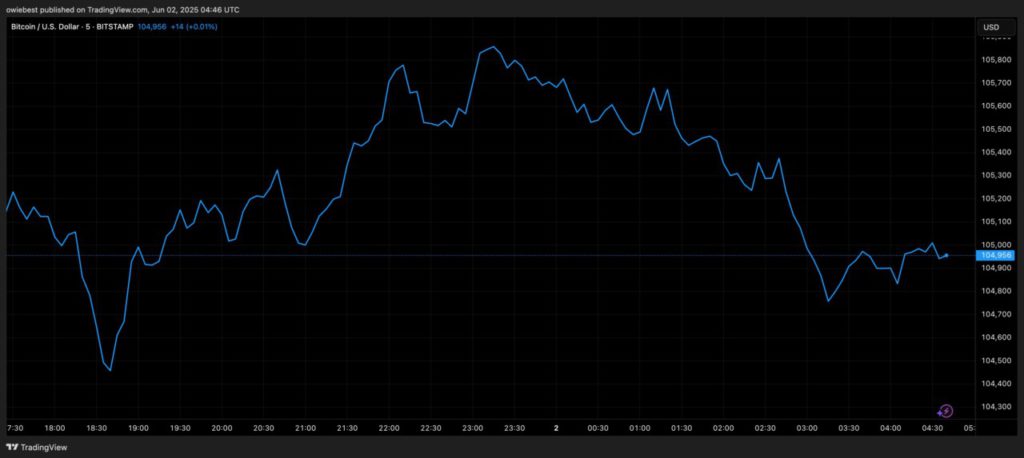

Currently, the price of Bitcoin (BTC) has dropped 6% from its peak and is at $104,000. However, market analysis suggests that this decline may not be over yet and the price could drop below $100,000 again.

Analysis of Bitcoin’s New High

An analyst who goes by the pseudonym Youriverse on the TradingView website has outlined Bitcoin’s (BTC) price movements of the past few weeks. According to him, Bitcoin (BTC) has been experiencing what is called textbook accumulation since the uptrend began in the second week of May. This accumulation phase is one of the reasons why the cryptocurrency has been able to reach new highs.

During this period, Bitcoin (BTC) price showed more compression by hitting higher lows while resistance remained relatively flat. The selling pressure that previously affected Bitcoin (BTC) price due to Donald Trump’s tariff war has also subsided, giving price control to buyers. As a result, there is the so-called ‘Power of 3’, which includes Accumulation, Manipulation, and Distribution.

Also Read: Pi Network (PI) Token is Ready to Flood! What Happens If the Price Falls Below IDR6,500?

Potential Decline to $92,000

According to Youriverse’s analysis, a ‘Power of 3’ may be underway, which could cause the price to drop further as large investors sell their assets to less informed retail investors. Additionally, the longer the Bitcoin (BTC) price stays below the $106,000 support, the more likely it is that the price will continue to fall.

“The rejection above ATH and subsequent collapse below $106,000 has introduced significant oversupply, which could act as resistance in the short-term,” the analyst said.

As such, it is expected that Bitcoin (BTC) price could return to $100,000 and even reach the mid-$90,000s. However, this drop not only signals a bearish trend, but could also be an opportunity to buy, as this area could attract more liquidity and be a jumping-off point for another rally.

Opportunity In Decline

These potential dips shouldn’t just be seen as a sign of weakness. In many bull cycles, corrections and bumps like this serve to take out over-leveraged positions and reset sentiment, ultimately preparing the ground for renewed upward momentum. This shows that any price drop, in the right context, can be an opportunity for investors who understand market dynamics.

Conclusion

By understanding the current market dynamics and potential future price movements of Bitcoin (BTC), investors can be better prepared to make informed decisions. Capitalizing on any dips as buying opportunities may be a profitable strategy in the long run.

Also Read: XRP is in Freefall! Is This a Sign of a Big Storm in the Crypto World?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Price Break Down. Accessed on June 3, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.