Ethereum Price Stuck at $2,700 (12/6/25): Surpassing BTC, Is ETH Poised for a Surge to $10,000?

Jakarta, Pintu News – Ethereum (ETH) has managed to break out of its month-long consolidation phase, and sustainably closed above the important resistance level of $2,700 on June 11, 2025 yesterday.

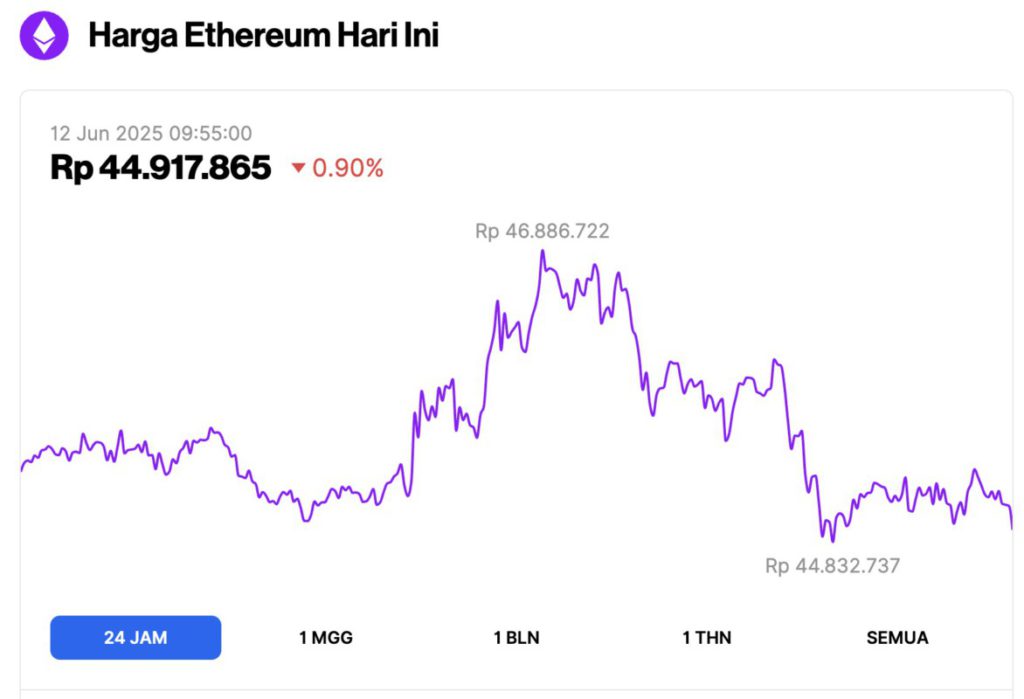

At the time of writing, ETH is trading around $2,759, registering a slight decline of 0.90% in the last 24 hours.

Ethereum Price Drops 0.90% in 24 Hours

As of June 12, 2025, Ethereum (ETH) saw a slight dip to $2,759 (around IDR 44,917,865), marking a 0.90% correction in just 24 hours. During this time, ETH reached a high of IDR 46,886,722 and a low of IDR 44,832,737. Will Ethereum bounce back, or is a deeper plunge ahead?

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $333.13 billion, with daily trading volume falling 18% to $28.49 billion within the last 24 hours.

Read also: Bitcoin Falls to $108,000 on June 12, 2025 as Whale Activity Slows Near All-Time Highs

Ethereum Contract Trading Volume Outperforms Bitcoin

Despite today’s slight correction, ETH’s upward surge yesterday came as Ethereum outperformed Bitcoin (BTC) in terms of contract trading volume.

Data shows that ETH contract volume surpassed $111 billion in the last 24 hours (11/6), beating BTC’s volume of $87.5 billion.

ETH liquidation volume also reached $131 million, more than double the amount recorded on Bitcoin, indicating an increase in leveraged trading activity on Ethereum.

Additionally, the Ethereum network set a new record with 17.4 million unique addresses earlier this month. Growthepie noted a more than 70% increase in ETH addresses interacting between chains since the beginning of the second quarter.

Accumulation from institutions and crypto whales has played a huge role in Ethereum’s price surge. On-chain data revealed that wallet address 0xc097 withdrew 13,037 ETH worth approximately $35.5 million from Binance in the last 24 hours.

In addition, crypto hedge fund Abraxas Capital recently withdrew 44,612 ETH (approximately $123 million) from Binance and Kraken.

ETH Price Projection, Potential to Rise to $10,000!

On the daily chart of ETH shared by the Coinspeaker page (11/6), the price of ETH managed to break the upper limit of the Bollinger Band around $2,782, a bullish signal indicating strong upward momentum.

Read also: Ethereum Today: Crypto Analysts Hint ETH Is Gearing Up for a Spectacular Surge!

The Bollinger Bands are also widening, indicating further upside potential.

The RSI was hovering around 65.25, close to overbought territory, but not yet showing signs of exhaustion. If the bullish trend continues, the immediate resistance lies at $2,835, followed by the psychological level of $3,000.

Meanwhile, the MACD showed a bullish crossover above the signal line, with the histogram turning positive. This signals a favorable trend for the bulls.

However, traders need to watch out for signs of weakening momentum or resistance around overbought levels. If the price declines, immediate support is seen at $2,585, close to the 20-day SMA.

Well-known crypto trader, Merlijn, recently stated on X that ETH is back in “beast mode.”

He predicts that the second-largest cryptocurrency could shoot up to $4,000 or even $10,000 in the long run.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinSpeaker. Ethereum Overtakes Bitcoin in Crypto Derivatives Market with $111B in Contract Volume. Accessed on June 12, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.