Is BNB Ready to Surge? Two Reasons Why Price is Showing Strength

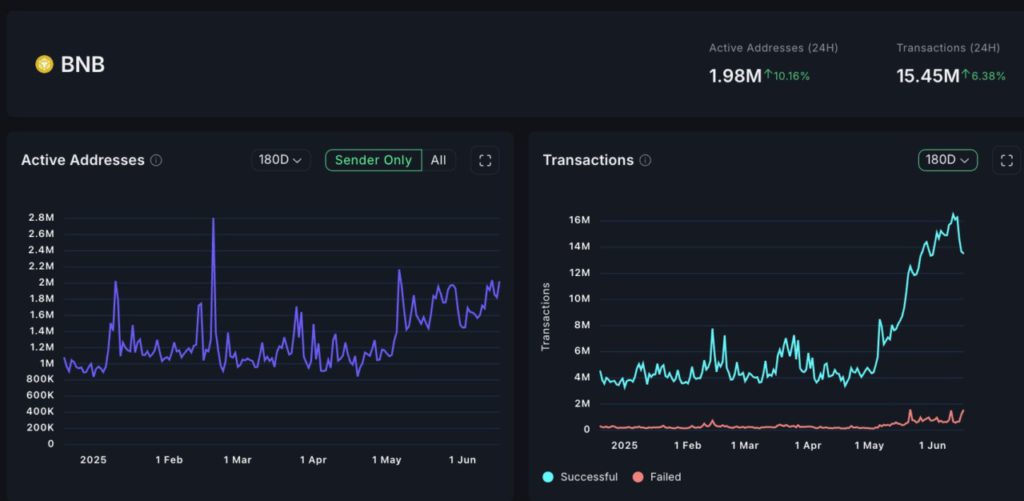

Jakarta, Pintu News – BNB Chain usage has increased sharply, but price action is still stuck below key resistance.

Traders’ Confidence Begins to Waver

BNB’s Long/Short ratio on Binance was recorded at 1.70, with 63.02% of accounts holding long positions. This shows that most traders are still optimistic about BNB’s prospects. However, there are concerns raised as this ratio shows a decline from the previous period, which could be an indication of hesitation among traders.

Nonetheless, strong support at $625 has been successfully defended by buyers. If this continues, there is potential that BNB will try to break through the important resistance at $700. However, if buyers are unable to maintain this momentum, BNB may continue to move within the current price range.

Also Read: Ethereum (ETH) Prepares for a Surge: Bullish Signs Strengthen

Options Frenzy Explodes

Derivatives data showed increased trader participation, with volumes increasing by 63.83% to $630.92 million. Options volume also jumped dramatically by 102.71% to $2.37 million. This indicates that there is a significant increase in interest in BNB derivatives, which could be a positive indicator for future prices.

This increase in volume suggests that traders are not only active in spot trading but are also increasingly interested in options as a way to take positions in BNB. This could be a signal that traders are anticipating significant price movements in the near future, be it upwards or downwards.

Will $700 be a Booster or a Barrier?

Currently, BNB is still trading above an important uptrend line, with the next big resistance being $700. Buyers have managed to defend the support at $625 successfully. If they can take control and push the price past $700, BNB could resume its uptrend.

However, if BNB fails to generate upward momentum, prices may remain confined within the current range. Key support at $625 will be crucial to maintain to avoid further declines that could negatively affect market sentiment.

Conclusion

Increased BNB network activity, strong trend support, and booming derivatives participation reflect growing market interest. Despite the decline in long/short conviction, the current bullish structure still provides hope for buyers. Going forward, the ability to break $700 will largely determine the price direction of BNB.

Read More: Will Selling Pressure Shake Chainlink’s Bullish Dominance?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Is BNB ready for a bullish breakout? 2 reasons why price shows strength. Accessed on June 19, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.