3 US Crypto Stocks that Soared Post-Passage of the GENIUS Act

Jakarta, Pintu News – The passage of the GENIUS Act by the US Senate has opened a new chapter in stablecoin regulation at the federal level, triggering price spikes in several leading crypto stocks. Here are three stocks that investors should watch out for after this momentous event!

Coinbase Global (COIN)

Following the passage of the GENIUS Act, Coinbase Global (COIN) shares saw an increase of over 15%. The addition of Coinbase Payments, a new stablecoin transaction network that enables payments using USD Coin (USDC) on major platforms such as Shopify and eBay, further strengthens COIN’s position in the market.

This rise in share price reflects increased investor confidence, with COIN shares up 16% in the past 24 hours. The Chaikin Money Flow (CMF) indicator jumping above the zero line to 0.04 indicates the dominance of buying pressure in the market. If this trend continues, COIN stock price could potentially break $305.42. However, if the buying pressure eases, the share price could drop to $270.61.

Also read: MicroStrategy Profit Predicted to Skyrocket in Q3, Supported by Bitcoin Price Increase!

Circle Internet Group (CRCL)

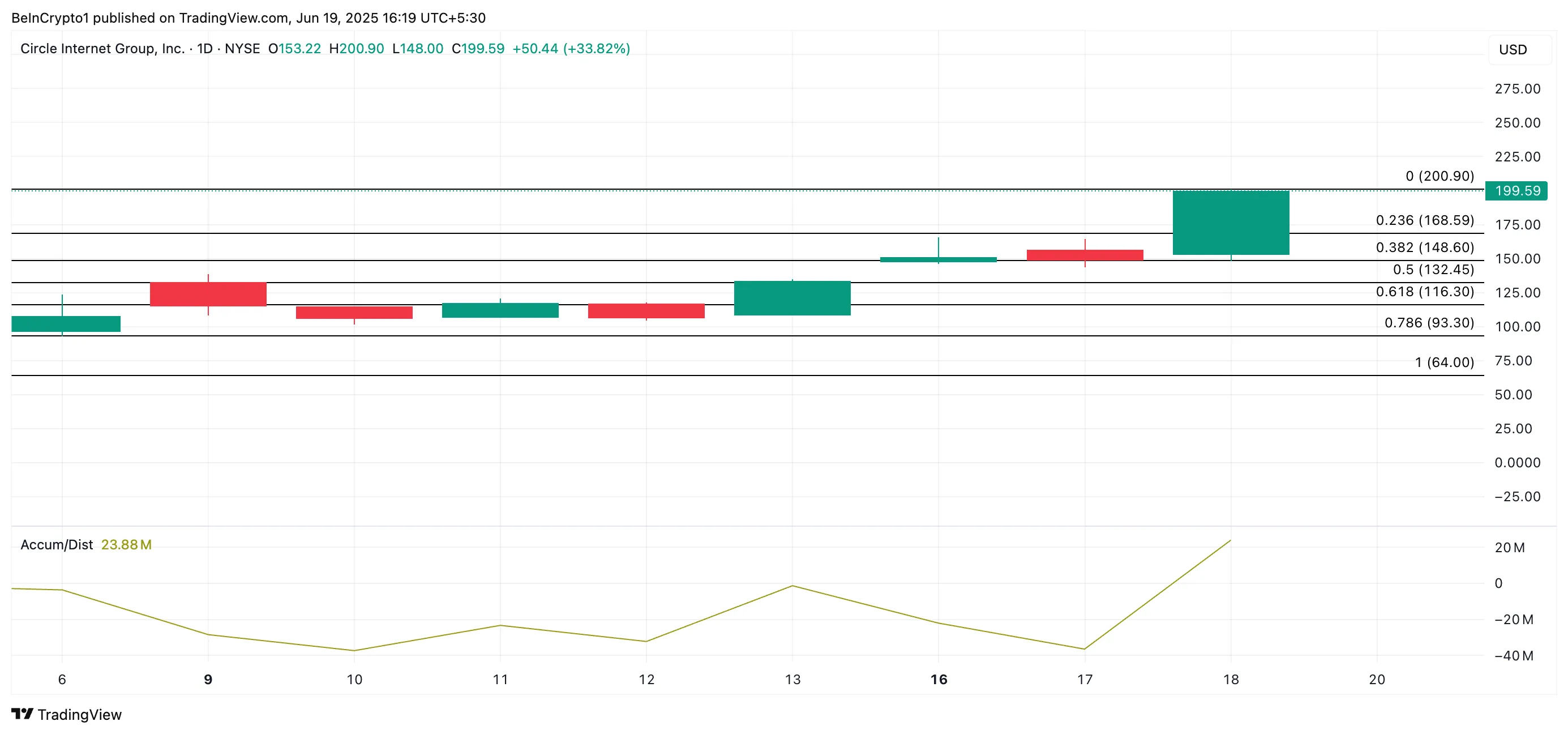

Since its initial public offering (IPO) on June 5, Circle Internet Group (CRCL) shares have surged significantly. The positive response to the passage of the GENIUS Act drove CRCL’s share price up by 33% on Tuesday, with the current share price standing at $199.59, a more than five-fold increase from the IPO price of $31.

On the daily chart, the Accumulation/Distribution Line (A/D Line) shows an increase of over 250% in a day, reaching 24 million. This increase indicates that buying pressure is greater than selling pressure, which could push CRCL’s share price past its previous record high of $200.90. However, if the buying pressure diminishes, the share price could drop to $168.59.

Read also: Cardano vs. Solana: Which has the Greater Growth Potential by 2026?

Galaxy Digital (GLXY)

Galaxy Digital (GLXY) recently announced a partnership with Polymesh to provide secure custodian and staking services for Polymath (POLYX) through Impenetrable Vault.

The move increases institutional access to regulated digital assets, especially in South Korea, where POLYX is experiencing rapid growth and adoption. This provided a positive boost to the performance of GLXY shares, which recorded a 4% price increase on the day. The rising Relative Strength Index (RSI) indicator indicates increased demand for GLXY shares.

With the current RSI value of 48.53 and rising, it indicates that buying momentum is developing. If the bullish sentiment continues to strengthen, the share price could break the resistance at $19.57 and rise towards $21.30. However, if demand declines, the share price could drop to $17.40.

Conclusion

This significant rise in crypto stocks indicates a very positive market response to the passage of the GENIUS Act. Investors who pay attention to market indicators and current news may find profitable investment opportunities in these fluctuations.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Key US Crypto Stocks to Watch After Genius Act. Accessed on June 21, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.