Dogecoin Just Dipped — But Is $0.22 Within Reach Next?

Jakarta, Pintu News – As reported by Coin Republic, the price of Dogecoin (DOGE) has decreased in line with the general weak market conditions, but technical analysts point to a golden cross on the weekly chart.

This pattern, combined with bullish derivative data and Fibonacci-based projections, indicates that DOGE prices may soon try to break the resistance level at $0.22.

If successful, price targets in the range between $0.4355 to $1.179 could potentially emerge in the next bullish cycle.

Dogecoin Price Drops 0.71% within 24 Hours

On June 23, 2025, Dogecoin saw a slight pullback, dipping by 0.71% over the past 24 hours to trade at $0.1528 (approximately IDR 2,511). During the day, DOGE reached a high of IDR 2,586 and a low of IDR 2,356.

At the time of writing, Dogecoin’s market cap stands at around $22.9 billion, with trading volume rising 74% to $1.74 billion within 24 hours.

Read also: Ethereum Crashes to $2,200 — Is a Fall Below $2,000 Next?

Dogecoin Price Forms Weekly Golden Cross

The latest technical formation puts the Dogecoin price in a potentially explosive position.

According to analyst Kamran Asghar, DOGE prices are approaching the formation of a golden cross on the weekly chart, where the 10-week simple moving average(SMA) is almost crossing above the 20-week SMA.

In the past, this pattern has resulted in huge spikes in Dogecoin’s price of 232% and 313% respectively.

As of June 22, DOGE was trading at $0.16, the Dogecoin price is consolidating slightly below the $0.22 level. Analysts agree that this zone is a key barrier.

If it is able to break this level, it will confirm the continuation of the bullish trend and open up opportunities to reach higher price targets.

Waleed Ahmed highlighted the $0.22 figure in the chart as the last obstacle before heading towards all-time highs.

Golden cross patterns are rare on long-term timeframes and are usually a sign of good potential in the long term.

A series of higher lows on the weekly chart also supported this formation, suggesting that momentum is slowly starting to favor the bulls.

Read also: Bitcoin Dips to $101K — But Holders Stay Strong as Peak Warning Signs Flash!

Fibonacci-based Price Targets at $0.4355 and $1.179

Analyst Surf shared a monthly chart of Dogecoin that highlights key Fibonacci extension levels. In his analysis, he revealed that the 1,618 extension aligns with a price target of $0.4355, while the 2,618 level is expected to take the price up to $1.179.

These levels depend on the impulse wave and retracement structure of the previous cycle.

However, the Dogecoin price must first break the resistance at $0.22 before these targets can be considered realistic. Meanwhile, the monthly candlestick shows a strengthening market structure in the form of consistent higher lows.

If this top meme coin manages to cross the $0.22 level and confirms a breakout with strong volume, then the Fibonacci path can be used as a fundamental reference for potential long-term gains.

Historically, the price action supports this. The last time Dogecoin broke through its local resistance in 2021, the price jumped over 800% in just a few weeks.

While a rise of that magnitude cannot be guaranteed to happen again, there are indications that similar patterns in terms of structure are being re-established at the moment.

Derivative Metrics Support Continuation of Bullish Trend

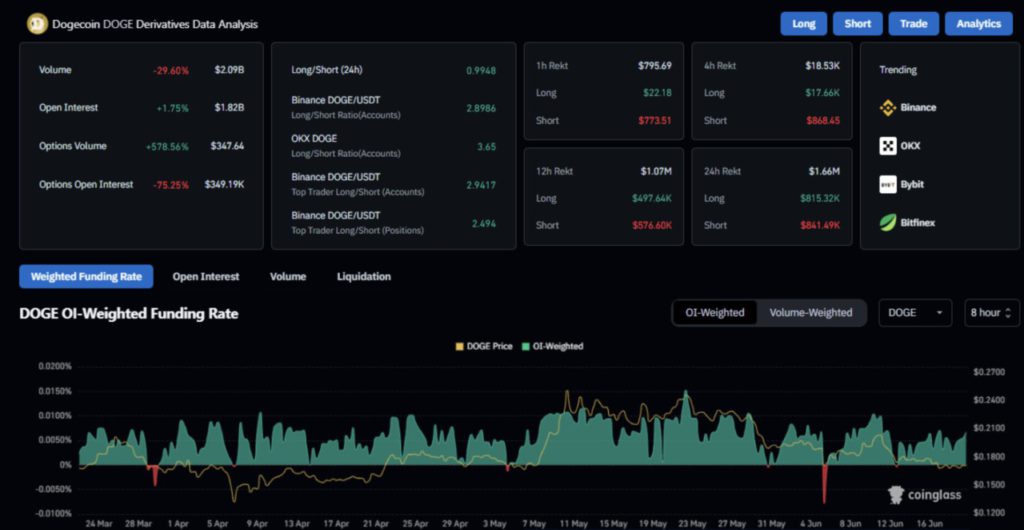

Derivatives and on-chain data show increased interest in long positions. Based on data from Coinglass, Dogecoin’s open interest increased by 1.75% to $1.82 billion.

This indicates that capital is flowing back into DOGE contracts on exchanges such as Binance and OKX.

The long/short ratio also looks very skewed towards longs. On Binance, the DOGE/USDT ratio is recorded at 2.89. While on OKX, the figure is even higher at 3.65.

These figures show that most traders are speculating on upward price movements, not downward risks.

Read also: Top 7 Potential Memecoins that Many Buy for the Long Term

Additionally, options volume increased by 578%, signaling a surge in speculative demand. Although open interest on options fell by 75%, this may indicate that traders are starting to implement more targeted trading strategies that involve less hedging.

Overall, these data provide a strong argument that market sentiment is in line with a bullish technical outlook.

Funding levels are also fairly neutral, meaning that leverage levels are not too excessive. This creates healthier conditions for a potential long-term rally as there is less chance of forced liquidation in a short period of time.

Dogecoin Price Needs to Break $0.22 to Confirm Bullish Momentum

For the current bullish scenario to be realized, the Dogecoin price needs to remain above the $0.16 support level. This level has served as a demand zone for the past few weeks.

If there is a drop below this level, then various bullish formations such as the golden cross and wedge pattern will fail to form.

However, if DOGE manages to break the resistance at $0.22 on the weekly or monthly timeframe, analysts expect the price to move quickly towards the next target of $0.35 and then towards the all-time high of $0.73.

After that, attention will turn to the Fibonacci targets at $0.4355 and $1.179, especially if the overall market sentiment also strengthens.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinRepublic. Will This Push Dogecoin Price Past $0.22? Accessed on June 23, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.