Pi Network (PI) July 2025 Price Prediction: Major Support at $0.45, What if it Fails to Hold?

Jakarta, Pintu News – Pi Coin (PI) entered July 2025 with significant downward pressure, after experiencing sharp declines in May and June. Various factors, including a large token unlock, are expected to add to the selling pressure, which could send the cryptocurrency further down.

Check out the full analysis here!

Causes of Pi Coin Selling Pressure

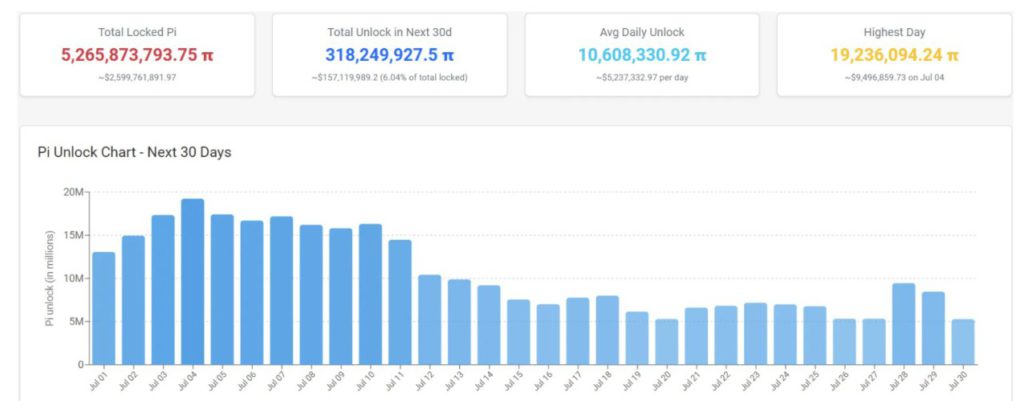

Pi Coin (PI) faced major pressure in July due to token unlocking events. Analysis from Pi Scan Unlock shows that more than 318 million Pi (PI), worth nearly $160 million, will be unlocked gradually during the month. This additional supply could pressure prices further.

The combination of the token unlock and lack of strong demand could push Pi Coin (PI) into deeper bearish territory. Investors may try to sell their holdings before new tokens flood the market, adding downward pressure on the price.

With more tokens in circulation, the existing supply and demand imbalance could make it difficult for Pi Coin (PI) to recover in the near future.

Read also: 4 Most Talked-about Cryptos in Q3 2025

Pi Coin’s Macro Dynamics and Momentum

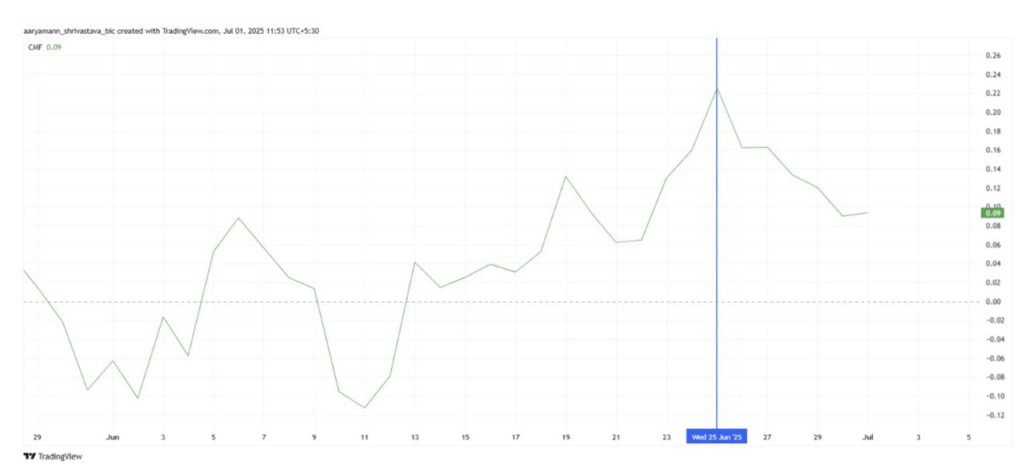

According to BeInCrypto, Pi Coin’s (PI) macro momentum was also affected by the decline in the Chaikin Money Flow (CMF) indicator over the past week. The CMF indicator, which tracks asset accumulation and distribution, showed a downward trend, signaling increased selling pressure.

Although the earlier inflows gave hope for a trend reversal, the outflows that followed showed a decline in investor confidence in Pi Coin (PI). The increased outflows reflect investors’ growing concerns after the underperformance, with more holders exiting their positions in anticipation of further price drops.

Current trends suggest that Pi Coin (PI) may struggle to regain its bullish momentum, especially with the upcoming token unlock and continued bearish market sentiment.

Also read: Will Bitcoin (BTC) Surge in Q3 2025?

Pi Coin Price Recovery Prospects

The price of Pi Coin (PI) has dropped 21.8% over the last week, holding at $0.49. This support level has helped prevent a sharper decline, but it remains vulnerable to further falls. If Pi Coin (PI) fails to hold this level, the next major support at $0.45 could be threatened.

Given the factors at play, Pi Coin (PI) is likely to experience a correction in July. The all-time low (ATL) of $0.40 is 19% away from the current price. Heavy selling could push the price towards this level. If the price fails to hold above $0.45, Pi Coin (PI) could experience further declines.

Conclusion

To thwart the bearish outlook, Pi Coin (PI) needs a strong change in momentum. A bounce off $0.49 and a break above $0.51 would mark a shift towards a more bullish trend. Additionally, turning $0.57 into support would be a key factor in reversing the current downward trend. This could potentially push the price higher.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. What to Expect from Pi Coin Price in July 2025. Accessed on July 3, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.