Ethereum Surges to $2,500 — But a Hidden Liquidity Imbalance Could Shake Its Entire Economic Model!

Jakarta, Pintu News – Ethereum (ETH) is currently the backbone of most financial activity in the crypto world.

Currently, there is over $127 billion in stablecoins stored on the network, with Tether (USDT) accounting for over 50% of that amount. This is real on-chain liquidity that is utilized in DeFi, staking, and yield farming.

However, a closer look shows that there is an imbalance.

The stablecoin layer is growing much faster than the market value of ETH itself. If this imbalance continues, could Ethereum fail to maintain the decentralization that was its primary goal in the first place?

Before discussing further, let’s explore Ethereum’s current price movements first!

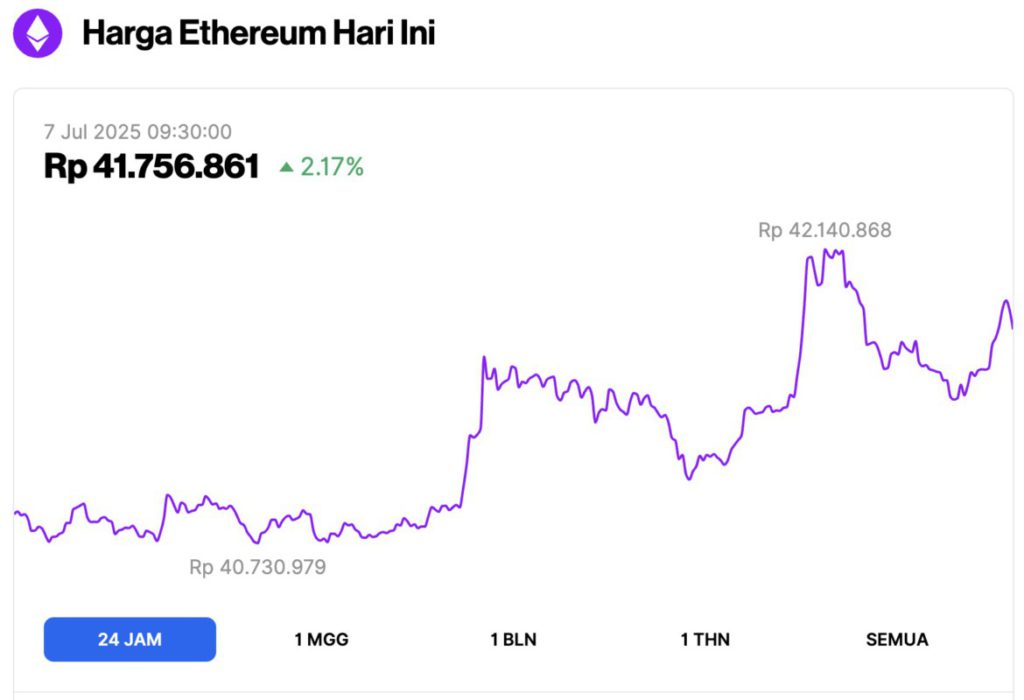

Ethereum Price Up 2.17% in 24 Hours

As of July 7, 2025, Ethereum was trading at approximately $2,580, or around IDR 41,756,861 — marking a 2.17% gain over the past 24 hours. Within this time frame, ETH dipped to a low of IDR 40,730,979 and climbed to a high of IDR 42,140,868.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $310.711 billion, with daily trading volume rising 44% to $13.16 billion within the last 24 hours.

Read also: July 2025 Crypto Picks: Analysts Say Litecoin, Filecoin, and Hedera Are Ready to Soar!

Ethereum’s Economic Model Faces a Scaling Paradox

Ethereum entered 2025 with $110 billion of stablecoins circulating on-chain. Now, heading into the second half of the year, that figure has jumped to $127 billion. That’s a significant increase of $17 billion in just six months.

Interestingly, $64.36 billion of that total supply came from USDT alone, representing 40.36% of Tether’s total market cap of $160 billion. However, that might just be the beginning.

Looking ahead, JPMorgan projects that the stablecoin market could grow to $500 billion by 2028. As that capital grows, Ethereum’s role as the primary settlement layer will likely grow in importance. But this is where structural imbalances start to emerge.

Ethereum started 2025 with a market cap of $400 billion, but that figure has dropped to $304 billion at the time of writing. In contrast, the supply of USDT has increased by about 15.45% over the same period.

This gap raises concerns. If Ethereum’s native assets don’t grow along with the value they guarantee, then the proof-of-stake system could be weakened. This risks making the network increasingly dependent on external, centralized capital.

As Stablecoins Rise, is ETH’s Control Weakening?

Think of the USDC, which already plays a significant role in the DeFi stack on Ethereum.

Protocols like Aave (AAVE) and Compound (COMP) rely on it as core collateral. At the same time, DAOs, traders, and institutions use it to move capital, manage treasuries, and generate yield. All of these activities help support Ethereum’ s proof-of-stake system.

Read also: 3 Altcoins Predicted to Explode in July – Ready for Cuan?

However, the problem is that such liquidity is largely controlled by a centralized issuer. In the case of USDC, that would be Circle.

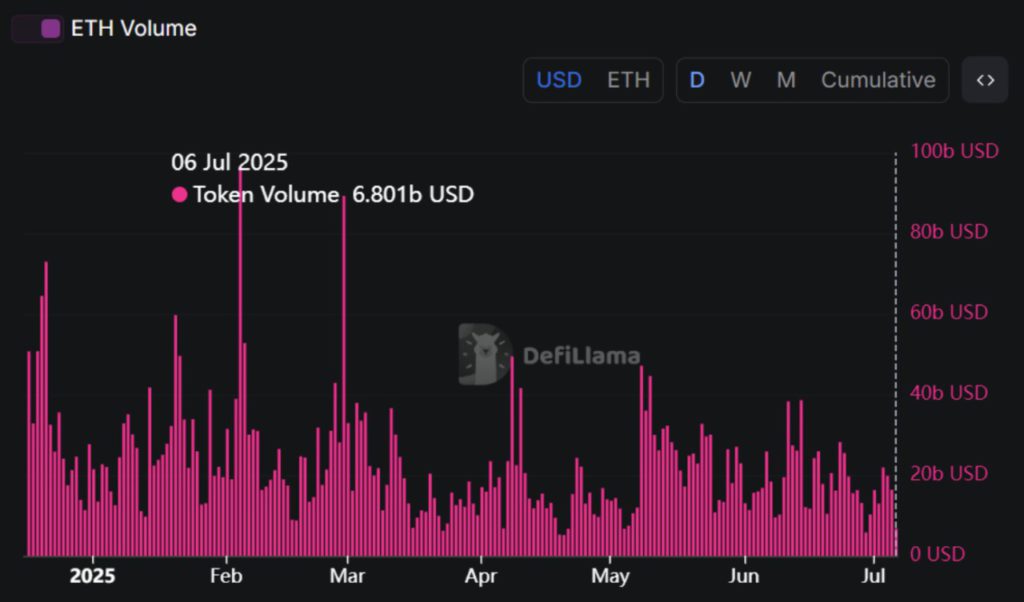

And while the supply of stablecoins continues to rise, the volume of DeFi counted in ETH has fallen to $6.8 billion-a far cry from its peak of $30 billion earlier this year. This highlights a structural imbalance in Ethereum’s economic model.

This difference in direction signals a crucial change: Capital is flowing into stable, externally controlled assets, not into native Ethereum tokens.

More and more users are relying on stablecoins to lend funds, stake, and move capital-withoutusing ETH at all.

As a result, demand for ETH declined, decentralization became harder to maintain, and its market cap began to take a hit.

With capital flows favoring stability over assets that secure the network, Ethereum may be facing the first signs of a deeper structural shift.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Inside Ethereum’s hidden liquidity imbalance that can break its economic model. Accessed on July 7, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.