Pi Network Price Prediction: Massive Sell-Off by Core Team Sparks Sharp Drop in Social Sentiment!

Jakarta, Pintu News – Pi Network (PI) experienced a decline of almost 2% on Friday (4/7), after forming a Doji candle pattern the day before.

As Pi Network moved in a flat pattern below $0.50, conversations on social media increased as interest from investors grew. However, the net outflow from the Pi Foundation’s wallet indicates that confidence is starting to decline.

Pi Foundation Outflows Surpass Investor Interest

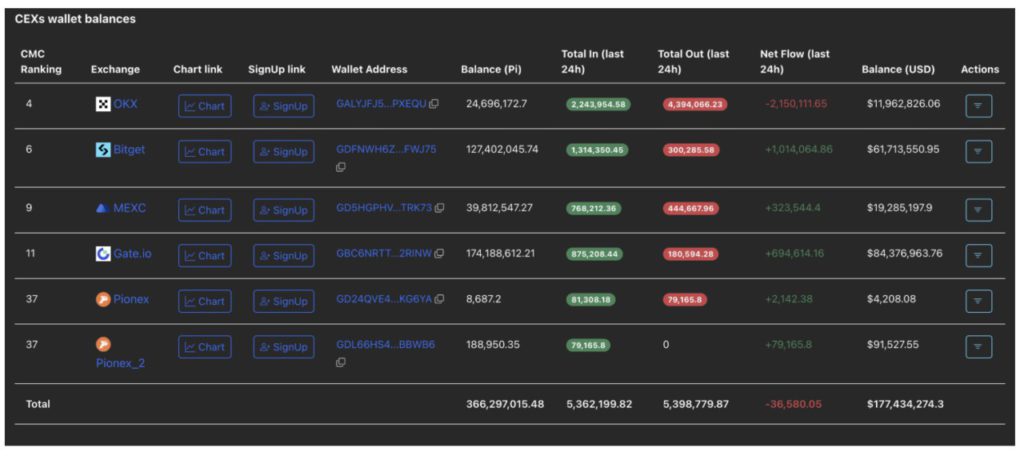

Data from PiScan shows a sharp net outflow of 2.15 million PI tokens from OKX exchanges in the last 24 hours (7/4).

Read also: Pi Network Price Prediction if Listing on Binance and Coinbase: How High Can Pi Coin Go?

This net outflow from OKX surpassed the net inflow from all otherexchanges, bringing the total net outflow fromcentralized exchanges ( CEXs) to 36,580 PI tokens.

Typically, a decrease in wallet balances on the CEX indicates an increase in demand from investors, especially as the general market begins to recover.

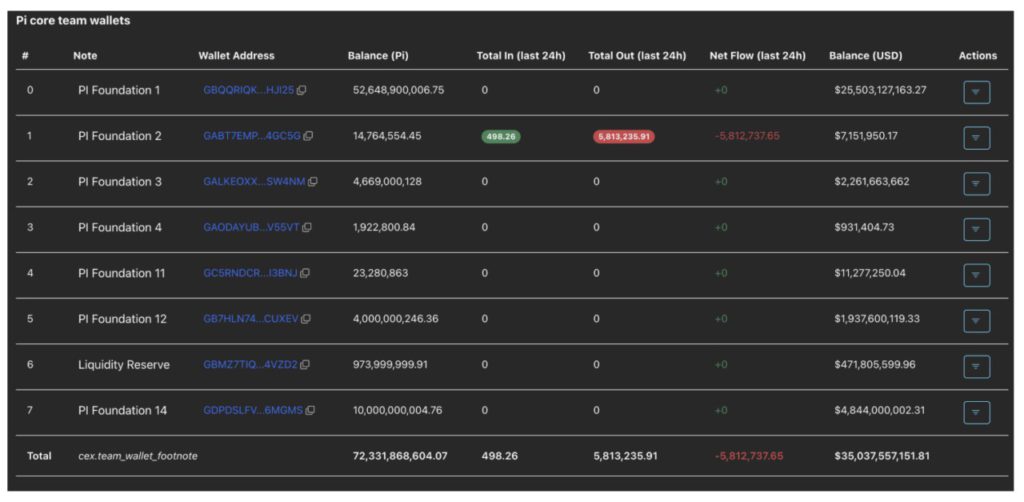

However, the Pi Foundation 2 wallet recorded a net flow of -5.81 million PI tokens, which far exceeds the total net outflow from the wallet balance on CEX. Investors need to remain cautious so as not to become exit liquidity for the outflows made by the Pi Foundation team.

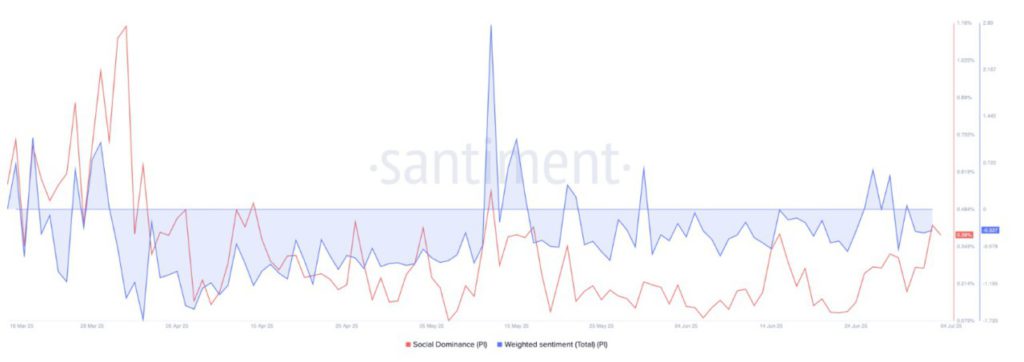

Pi Network’s social dominance continues to rise

The social dominance score measures how often an asset is mentioned in social conversations. Data from Santiment shows Pi Network’ s social dominance at 0.39% this Friday, up from 0.18% on Monday.

Amidst heightened social conversations throughout the week, the total weighted sentiment recorded at -0.327 reflected the bearish tendency of the market.

Pi Network at Risk of Losing Crucial Support Levels

On Friday (July 4), Pi Network fell about 2% and traded between the psychological level of $0.5000 and the June 22 low of $0.4711.

Also read: Dogecoin Price Prediction July 2025 – DOGE Preparing to Break $0.25, Time to Invest?

If the price closes daily below $0.4711, the decline could continue towards $0.4000 – a level last tested on June 13.

Technical indicators showed bearish pressure on the direction of the trend. The Moving Average Convergence/Divergence (MACD) indicator triggered a sell signal, with the MACD line cutting below the signal line on the daily chart.

Meanwhile, the Relative Strength Index (RSI) stands at 36, close to the oversold boundary zone, signaling that the bearish momentum is still ongoing.

To confirm theuptrend, Pi Network needs to close above the $0.5031 level – which parallels the June 22 close. If successful, the uptrend could target the $0.6600 level last touched on June 25.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Pi Network Price Forecast: Social chatter tilts bearish as core team offloads 5.81 million PI tokens. Accessed on July 7, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.