Aptos Surges to Top 3 in Global RWA — But Is a $50M Token Unlock About to Crash the Party?

Jakarta, Pintu News – Aptos has successfully established itself as the third largest blockchain for Real-World Assets (RWA), with Total Value Locked (TVL) reaching $538 million.

However, a challenge arose with the planned $50 million token opening that could affect market dynamics.

Aptos’ Strategic Position in the RWA World

According to CoinSpeaker, Aptos (APT) has cemented its position as the third-largest blockchain for real-world assets (RWA), despite an imminent $50 million token release.

Read also: Sei Network Breaks Records as TVL Soars Past $626 Million—What’s Fueling the Surge?

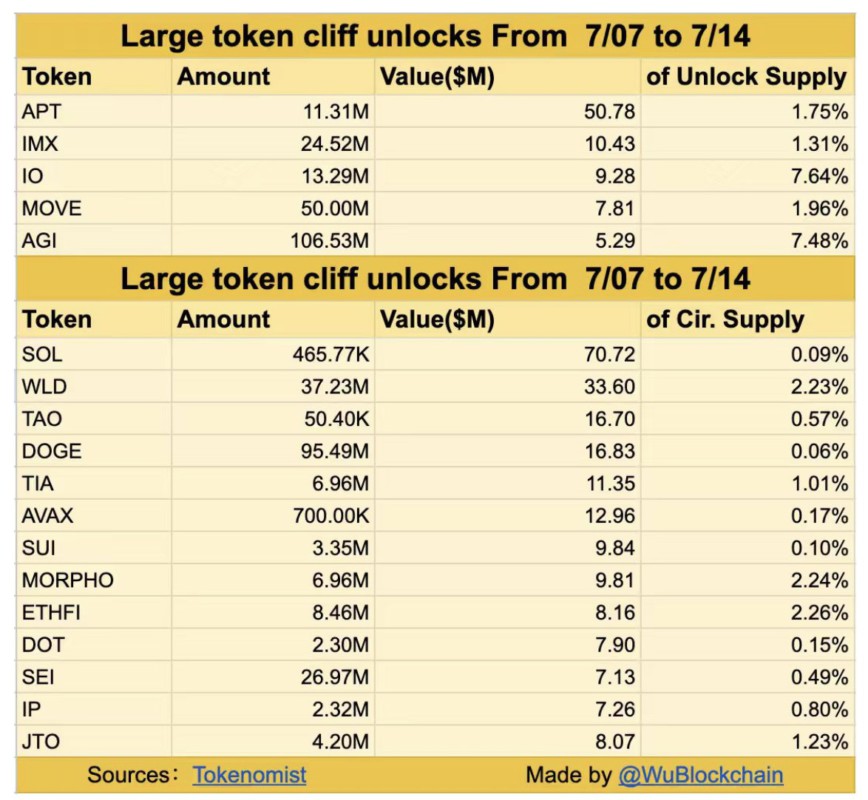

A total of 11.31 million APT tokens will be released on July 12, which equates to about 1.75% of the total circulating supply. Investors and ecosystem players are now closely watching the token ‘s price movements.

Unlocking Growth or Pressure?

This token release worth approximately $50 million has triggered caution in the market. Historically, token releases tend to put short-term price pressure due to increased supply.

However, Aptos allocates most of those tokens to the community and in exchange for staking. This move may help reduce selling pressure while increasing engagement.

This week has been filled with token releases. Solana is scheduled to release $69.49 million worth of tokens in Solana (SOL), while Immutable X (IMX) will unlock over $10 million in IMX on July 11, according to data from Tokenomist (formerly TokenUnlocks).

RWA Milestones: $538 Million and Growing

Aptos‘ Total Value Locked (TVL) in real-world assets jumped 56.28% in the last 30 days, now reaching $538 million. Aptos is behind only Ethereum and zkSync Era in this fast-growing sector.

Of the total TVL, nearly $420 million was related to the private credit market, $86.93 million inUS Treasuries, and $30.72 million in institutional alternatives.

Major institutional players such as BlackRock (through its BUIDL product), Franklin Templeton (BENJI), and Berkeley Square of the PACT Consortium were the main drivers of this growth.

Read also: Crypto Analyst Says PEPE Coin Could Skyrocket 20x — Is the Next Big Meme Rally Here?

Wyoming Eyes Aptos for State Stablecoins

It’s also worth noting that Aptos was recently ranked the highest among more than 10 blockchain candidates for Wyoming’s official state stablecoin, WYST.

Although there is no final implementation yet, the Aptos blockchain obtained the highest technical score from the Wyoming Stable Token Commission, outperforming competitors such as Sei (SEI) in various categories such as throughput, security, finality, and vendor support.

APT Price Analysis: Breakout Signal in Sight?

As of July 8, APT was trading around $4.38 after months of forming a falling wedgepattern – acommon bullish reversal signal. Prices are now nearing the top of this pattern, with the $4.2-$4.3 level being a key support area.

The RSI is around 49.27, neutral territory, which suggests a potential breakout in either direction. However, the recent formation of higher lows hints at bullish momentum taking shape.

Read also: Meet EVA: The Human-Like AI Agent from Virtuals Protocol That’s Shaking Up the Digital World!

Meanwhile, the MACD indicator shows convergence just below the zero line, signaling bearish pressure is easing and an upward crossover is likely in the near future.

Fibonacci retracement levels suggest the next resistance zones are at $5.2 (0.236) and $6.30 (0.382), while $4.00 is a crucial level for the bulls to defend.

If Aptos manages to break out of the falling wedge pattern on high volume-especially after the tokenrelease-this could trigger a short-term rally towards $5.5-$6, with intermediate targets at $7.8 and $9.2 based on Fibonacci projections.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Aptos Claims Third Spot in RWA, $50M APT Unlock Looms. Accessed on July 8, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.