Mysterious ODM Wallet Pulls 2.8 Million Pi Network Tokens — Secret Buyback Strategy Uncovered?

Jakarta, Pintu News – Pi Network is attracting attention because a wallet called “ODM” quickly bought millions of PI tokens.

This sparked a lot of speculation among the community regarding the purpose of the wallet and its potential impact on the network.

Pi Network Activity Increases Amid Massive Accumulation Action

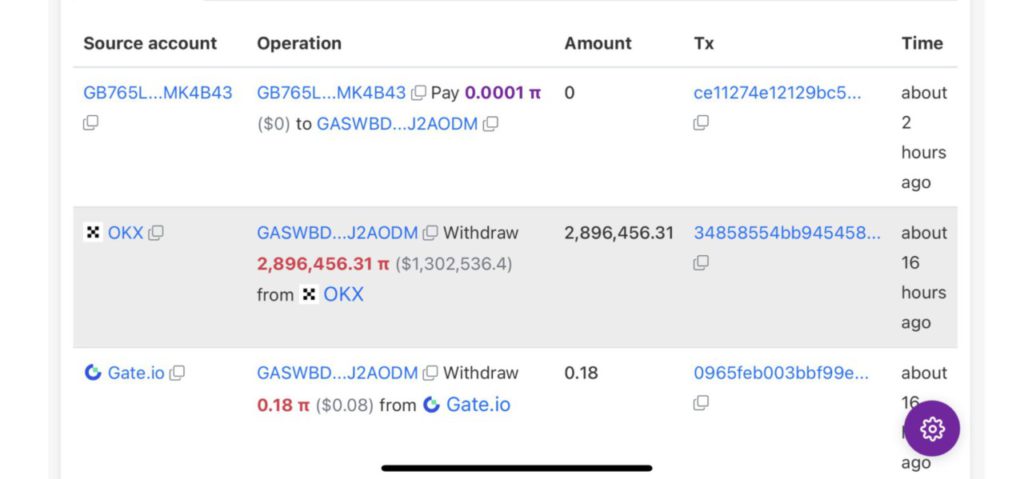

Data from PiScan shows that a mysterious wallet called “ODM” received 2.8 million Pi tokens from the OKX exchange.

Read also: Pi Network Crashes on July 17: 61 Million Tokens on the Move — Is a Drop to $0.26 Inevitable?

Earlier this month, the wallet also withdrew 3.5 million Pi tokens. Currently, the wallet holds around 315 million Pi tokens in total. This amount is large enough to affect the liquidity and distribution of tokens within the Pi Network ecosystem.

This massive buying spree sparked speculation that the wallet may be directly controlled by the Pi Core Team (PCT). Some observers believe that this could be a buyback wallet buying PI tokens in preparation for a possible new listing on an exchange.

Within the Pi Network community, various theories have emerged. Some community members even referred to ODM as the “new Satoshi wallet,” comparing its strategic accumulation pattern to the mysterious holdings of early Bitcoin.

Interestingly, some people believe that big wallets like ODM often appear ahead of important events in the ecosystem. A similar pattern also occurs when blockchain networks announce major upgrades, start new liquidity pools, or form partnerships with institutions.

Is Team Pi Doing Buybacks in the Midst of Unlock Action?

Speculation is growing that this may be a move by the Pi Core Team to stabilize prices or build reserves for future DeFi tool development and ecosystem funding.

Read also: XRP Price Set for a 20% Drop Before Its Next Big Surge, On-Chain Data Warns!

In theory, a few large holders can indeed influence market prices, liquidity events and overall sentiment.

If the ODM wallet is confirmed as a buyback wallet, then its functions can be diverse. These include balancing the number of available tokens, strengthening liquidity pools on decentralized exchanges, as well as funding hackathons and grants for developers.

Changes like this have the potential to increase investor confidence in the token’s growth potential.

This increase in wallet activity comes at a crucial time for Pi Network, as investors begin to worry about its long-term future. Recently, investors voiced concerns regarding the upcoming unlock plan, which could trigger massive selling pressure.

Historically, large token unlocks have often led to sharp declines in other crypto assets, especially when market demand is unable to absorb the newly released supply.

Pi Coin’s own price has remained relatively unchanged due to continued high volatility, despite recent updates such as the launch of Pi Node v0.5.3. However, there are now suggestions that the activity surrounding the mysterious ODM wallet could be a planned attempt by insiders to stabilize the token.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Pi Network Activity Soars as Mystery Wallet Acquires Millions in Pi Tokens. Accessed on July 17, 2025

- Coinpedia. Pi Network Wallet Moves 2.8M Tokens from OKX. Accessed on July 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.