Bitcoin Stalls at $114K — Is a Crash to $70K Next?

Jakarta, Pintu News – As reported by TronWeekly, Bitcoin (BTC) is showing significant signs of weakness after reaching a peak of nearly $130,000 last month.

Now, the leading cryptocurrency continues to decline, recently hitting a three-week low below $112,000. Traders fear this could be the start of a broader decline.

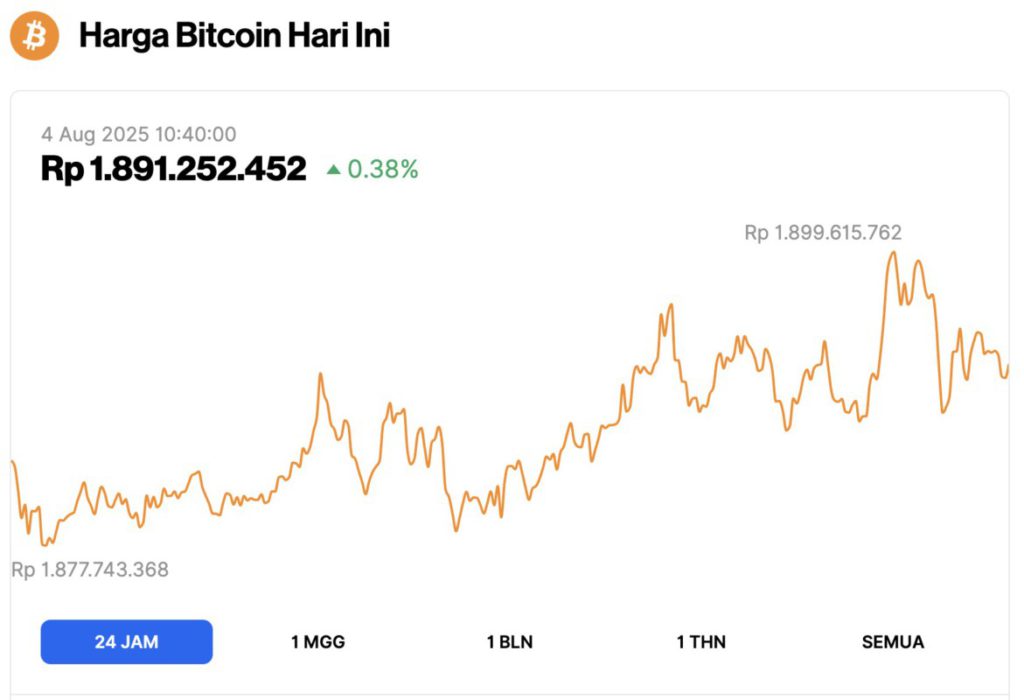

Bitcoin Price Up 0.38% in 24 Hours

On August 4, 2025, Bitcoin was trading at around $114,669, or roughly IDR 1.89 billion, posting a modest 0.38% gain over the past 24 hours. During the same period, BTC dipped to a low of about IDR 1.88 billion and climbed as high as IDR 1.90 billion.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.28 trillion, with trading volume in the last 24 hours falling 16% to $47.97 billion.

Read also: Ethereum Surges 3% Today — But Is a Drop Below $3,000 Looming?

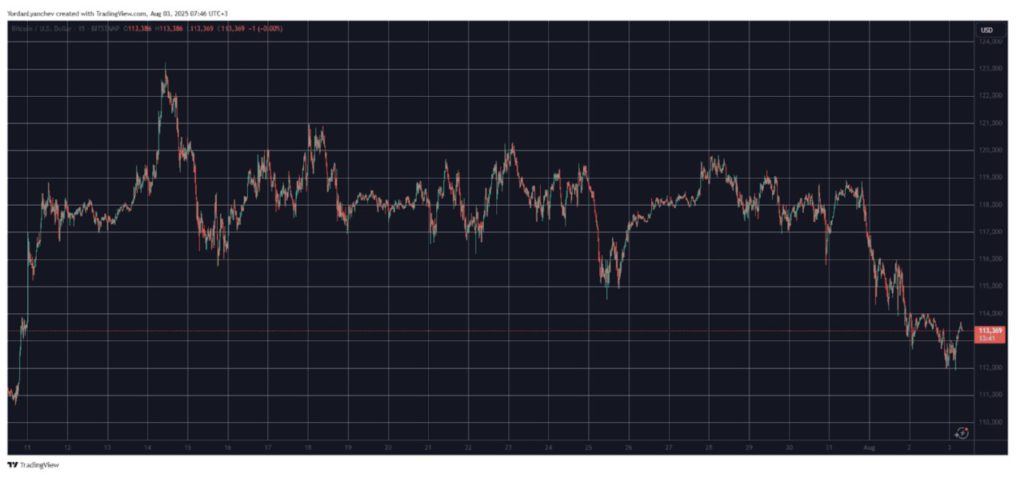

Possible Double Top Formation

A chart shared by crypto analyst @sayinshallah sparked such concerns. In his latest post on X, he warned that Bitcoin may be forming a macro double top pattern, similar to the one that appeared before the brutal market crash in 2021. The similarities are obvious.

He highlighted that Bitcoin previously peaked at $65,000, failed to break upwards, and then plummeted. Now, the price is showing a similar pattern around $130,000.

The market looks overheated, with influencers predicting a $500,000 target and politicians joining the flow of pro-Bitcoin support.

BTC’s potential drop to $70,000

According to @sayinshallah, if history repeats itself, Bitcoin (BTC) could fall to the $70,000 level, which was previously a strong resistance point. The level was previously a strong resistance area and coincided with one of the key volume nodes.

A drop of this magnitude would represent a correction of about 45%-something that has happened frequently in Bitcoin’s history, though still painful for traders.

Bitcoin’s dominance also stalled at around 62%, failing to break 63%. This pattern mirrors the performance in July, when altcoins started to rally. Traders are now watching closely, as this could signal the start of a new altseason, similar to the one in 2021.

Read also: Top 3 Crypto Coins to Hunt for August 2025!

In terms of price, Bitcoin briefly touched a peak of around $123,000 in mid-July, but failed to maintain that momentum. For several days, the price moved in a narrow range between $117,000 and $120,000.

The fake breakout attempt on July 25 failed, followed by strong rejection at $119,000.

Sideways Range Breached, Prices Plummet

The rejection became a turning point in the price movement. BTC fell sharply and hit a low of around $112,000 on August 1.

This level marked new lows in the past three weeks and confirmed the loss of control from the bullish side. Since then, the market has been under constant pressure.

This fall erased almost $1 billion from over-leveraged positions. Crypto analyst Ali Martinez mentioned that the next area of support is in the range of $105,000 to $107,000.

He emphasized that $107.100 is an important accumulation point that is likely to serve as a crucial line of defense for the bulls.

Overall, with the current situation, investors and traders in the crypto market should be vigilant and prepare for the worst-case scenario. Monitoring patterns and key levels will be crucial in the coming weeks to anticipate the next movement of Bitcoin (BTC) price.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Tron Weekly. Bitcoin Faces Critical Double Top, Could Drop To…. Accessed on August 4, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.