Ethereum Price Surges 6% to $3,900 Today (August 8) as Tom Lee Predicts a Rally Toward $16K!

Jakarta, Pintu News – Ethereum (ETH) price is expected to reach $16,000 according to Tom Lee, head of research at Fundstrat.

He believes that Ethereum’s current position is similar to that of Bitcoin (BTC) in 2017, when financial institutions began to show initial interest in the asset.

Then, how is Ethereum’s current price movement?

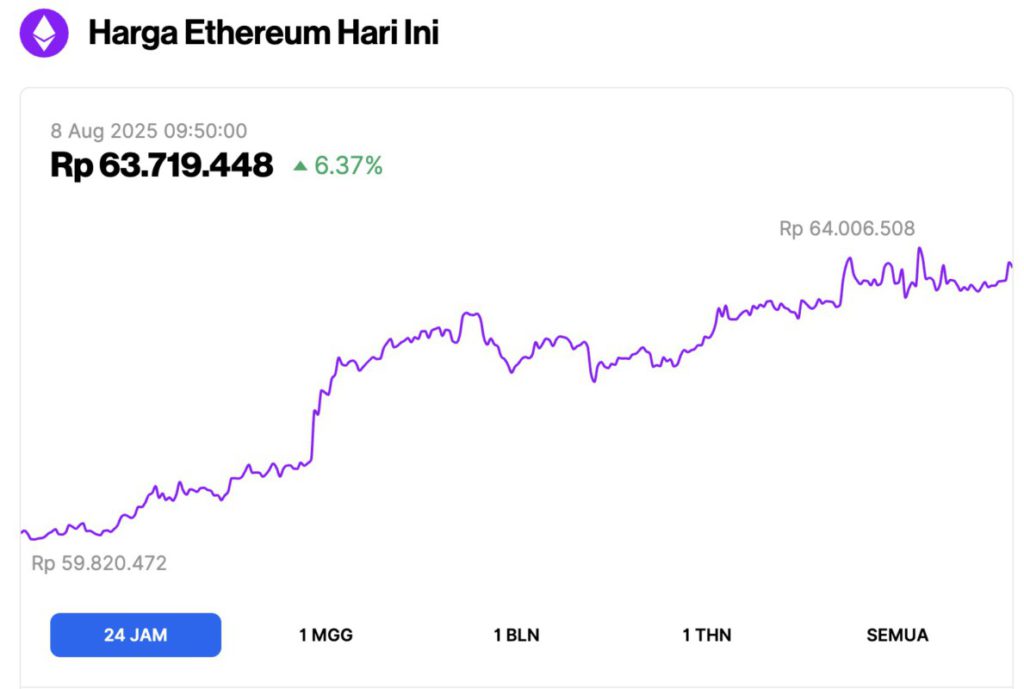

Ethereum Price Up 6.37% in 24 Hours

On August 8, 2025, Ethereum was trading at around $3,901 — roughly IDR 63,719,448 — marking a 6.37% gain over the past 24 hours. During the day, ETH dipped to as low as IDR 59,820,472 before climbing to a peak of IDR 64,006,508.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $470.93 billion, with daily trading volume rising 55% to $41.03 billion within the last 24 hours.

Read also: Bitcoin Hits $116K, Holds Firm Despite Trump’s Counter-Tariffs

Tom Lee Predicts Ethereum Price to Break $16,000

Despite a slow start to August, Wall Street analyst Tom Lee remains optimistic about Ethereum’s prospects. In a recent interview with CNBC, Lee stated that he still sees potential for ETH to reach a price of $16,000.

This prediction is based on the BTC/ETH ratio in 2021. According to him, if Ethereum follows a similar pattern, there is still huge room for growth. He said:

“The Ethereum to Bitcoin ratio could return to the highs of 2021, which is around 0.14. If that happens, then Ethereum’s current value could reach around $16,000.”

Lee also mentioned that Ethereum is experiencing a moment like Bitcoin did in 2017. At that time, Wall Street began to accept the narrative that BTC was digital gold.

Now, with more friendly US regulations, Wall Street is starting to look at ETH. This means that the growth Bitcoin has experienced in the last eight years since 2017 could be repeated on Ethereum.

Tom Lee is now one of the biggest supporters of ETH. He is currently the chairman of Bitmine, a company that is slowly evolving into “Ethereum’s MicroStrategy.”

According to a report by CoinGape, Bitmine is one of the companies that are increasing their Ethereum holdings in their treasury portfolio.

ETH Confirms Wedge Pattern Breakout, 79% Rally Possible

Analyst Gert van Lagen also shares the optimistic view that the Ethereum price will go higher.

Read also: XRP Rebounds from Key Support — Is a Move to $3.40 Coming Next?

He identified a falling wedge pattern hidden behind the price rejection at the $4,000 resistance level. This pattern suggests that ETH may be preparing for a bounce or rally in the near future.

The distance between the highest and lowest points of the wedge pattern is a 79% decrease. This means that the ETH price has the potential to make a similar movement, but this time in the form of a 79% increase.

If calculated from the $4,000 resistance, this potential upside could take the Ethereum price to around $9,000.

According to Lagen, there is a 67% chance that this pattern will be realized. Therefore, the $16,000 target predicted by Tom Lee is also not impossible.

These projections show that sentiment towards ETH is still generally very positive. However, looking further ahead, Ethereum’s long-term outlook appears more balanced, with opportunities for both bullish and bearish parties.

In conclusion, Ethereum’s price movements in August could be part of the usual seasonal pattern. It is not new for ETH to move sideways during this period.

But with more institutions coming in, Tom Lee’s $16,000 target remains wide open.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. ETH Price to $16K? Wall Street Analyst Tom Lee Says Ethereum is Having its Bitcoin 2017 Moment. Accessed on August 8, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.