4 Things About Bitcoin Season

Jakarta, Pintu News – The cryptocurrency market is famous for its cyclical pattern, where Bitcoin (BTC) and altcoins take turns leading the market performance. Cryptocurrencies are digital currencies that operate using decentralized blockchain technology.

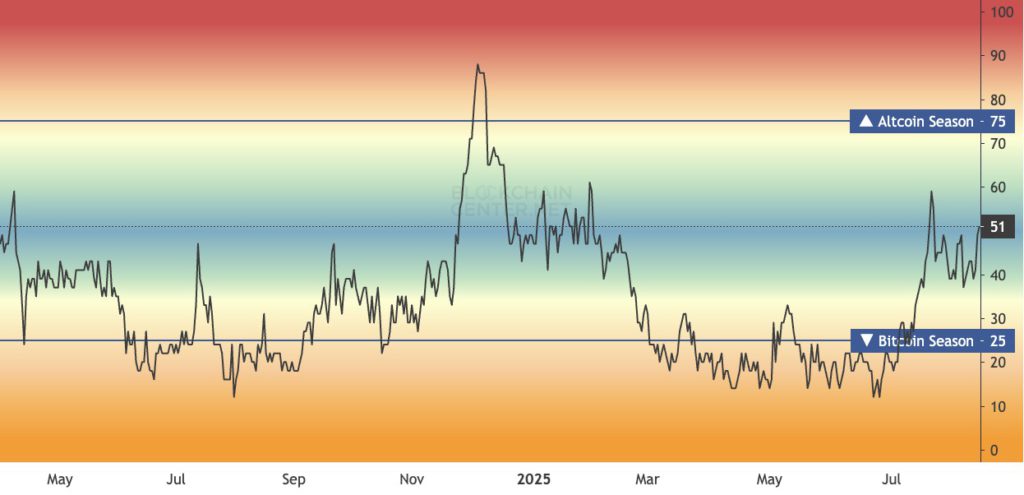

One important indicator in identifying the right time to invest in crypto is the Bitcoin Season Index. This index helps traders understand when Bitcoin dominates the market and how it can affect altcoins and their trading strategies.

Here are 4 things about Bitcoin Season according to Token Metrics.

What is the Bitcoin Season Index?

The Bitcoin Season Index is a specialized metric that measures Bitcoin’s (BTC) market dominance relative to other cryptocurrencies over a period of time. The index calculates Bitcoin’s market share in the total cryptocurrency market capitalization.

When more than 25% of altcoins outperform Bitcoin, the market is said to be in Bitcoin Season. This index gives an idea of Bitcoin’s more dominant strength, attracting most of the capital flows in the crypto ecosystem.

The index is calculated by dividing Bitcoin’s market capitalization by the total cryptocurrency market capitalization and multiplying it by 100 to get the percentage.

In general, if Bitcoin dominance is above 60-65%, it indicates that the market is in a Bitcoin Season phase, which often signals a good time for traders to increase their exposure to Bitcoin (BTC).

Read also: 5 Phases of Altcoin Season

Bitcoin’s Dominance as a Market Indicator

Bitcoin dominance (BTC.D) is becoming one of the most reliable indicators to assess market sentiment and capital allocation in the cryptocurrency ecosystem. When Bitcoin price rises faster than the overall cryptocurrency market, Bitcoin dominance increases.

Conversely, when altcoins collectively outperform Bitcoin, Bitcoin’s dominance decreases. This pattern creates a predictable dynamic that traders often use to adjust their strategies, either to enter or exit the market.

During the Bitcoin Season, several key dynamics usually emerge. Institutional investors tend to favor Bitcoin due to its more guaranteed stability, regulatory acceptance, and its status as the first cryptocurrency. Retail traders also tend to favor Bitcoin during volatile market conditions, as it is considered safer than more volatile altcoins.

Bitcoin Performance in 2025

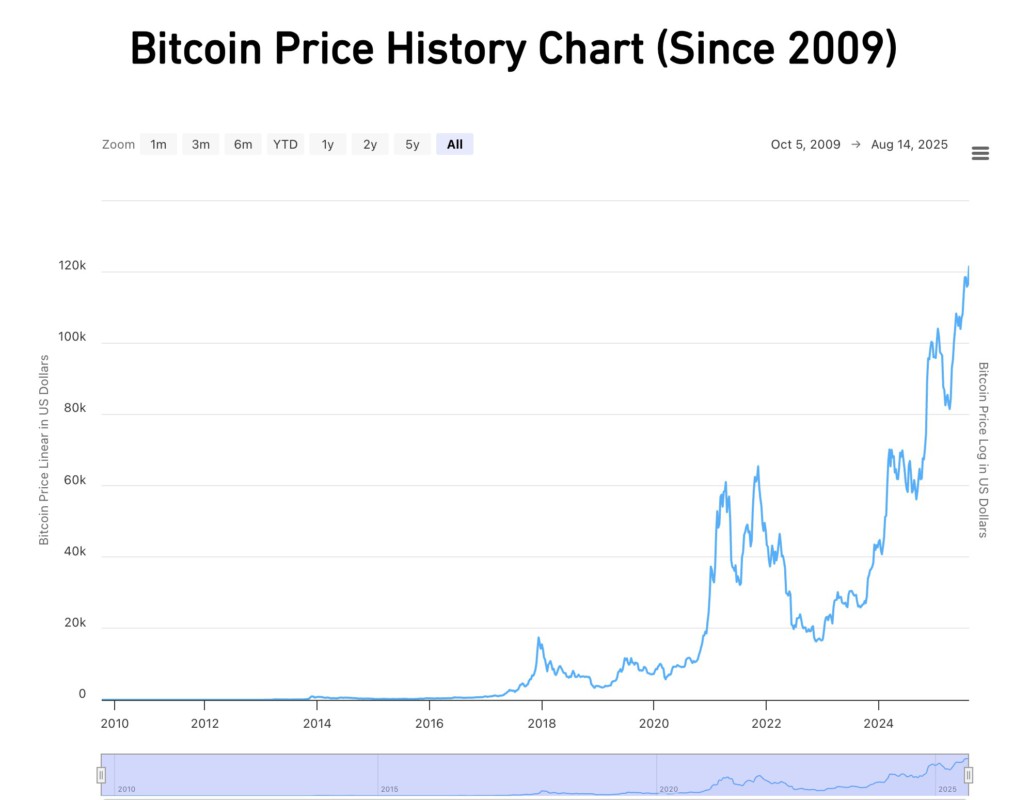

Until mid-2025, Bitcoin (BTC) showed outstanding performance and proved that the market was entering the Bitcoin Season.

Since the beginning of the year, Bitcoin has seen a rise of about 10%, outperforming almost all major altcoins except Ripple (XRP) which recorded a rise of more than 12%. Meanwhile, other major altcoins such as Ethereum (ETH) have seen a decline of up to 30%.

Bitcoin’s (BTC.D) dominance currently stands at around 64%, which is a high number that usually signifies Bitcoin-dominated market conditions.

A drop in dominance below 60% often marks the beginning of the Altcoin Season, where capital flows switch from Bitcoin to altcoins. Bitcoin’s high dominance in 2025 signifies that the cryptocurrency is still leading the market despite some fluctuations in altcoins.

Also read: 5 Resilient Altcoins that Made ‘Chart of The Week’ August 2025

Historical Patterns and Market Movements

Understanding the historical patterns of Bitcoin Season provides invaluable context in interpreting current market conditions and forecasting upcoming trends. Bitcoin’s dominance has shown clear cyclical patterns throughout the history of the cryptocurrency market, with periods of expansion and contraction in line with broader market trends and investor sentiment.

For example, in the 2017-2018 cycle, Bitcoin’s dominance dropped from over 80% to under 40% when the ICO (Initial Coin Offering) boom drove huge capital flows to altcoins.

However, during the subsequent bear market, Bitcoin’s dominance increased again as investors sought stability in more established cryptocurrencies. A similar pattern occurred during the 2020-2021 bull market, where Bitcoin initially led before altcoins took over in the latter stages.

Conclusion

By understanding the dynamics of the Bitcoin Season Index, traders can be better equipped to recognize when the time is right to invest more in Bitcoin or allocate funds to altcoins.

Following Bitcoin’s dominance as a leading indicator can increase the chances of success in the notoriously volatile crypto market. Utilizing indicators like this provides better insights and allows traders to navigate the market with more confidence.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Token Metrics. Crypto Trading: Understanding Bitcoin Season Index and BTC Market Dominance with Token Metrics AI. Accessed August 14, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.