Could Asia, Not Wall Street, Spark the Next Crypto Rally? Here’s What’s Driving It

Jakarta, Pintu News – Asia is on a fast track. From liquidity flows in Beijing to stablecoin approvals in Tokyo, the region is starting to set the pace.

While at first glance it may seem like a simple regulatory move, the reality is that this could be the starting point of a global rally.

Are Altcoins getting a boost when Beijing moves?

As China’s economic indicators start to show signs of fatigue, the People’s Bank of China is preparing its next move. The stimulus may come as soon as September, and for altcoins, this could be a signal to start a rally.

History shows that liquidity injections, especially from big players like China, often push risky assets higher. Crypto is no exception.

Also read: 3 US Economic Events that Crypto Traders Must Watch This Week!

The price of Bitcoin (BTC) even shows a closer correlation with global liquidity than the S&P 500 or gold. If Beijing opens the liquidity spigot, the market could respond with increased interest in altcoins.

Although China’s official stance on crypto is still limited, its influence on the global market clearly cannot be ignored.

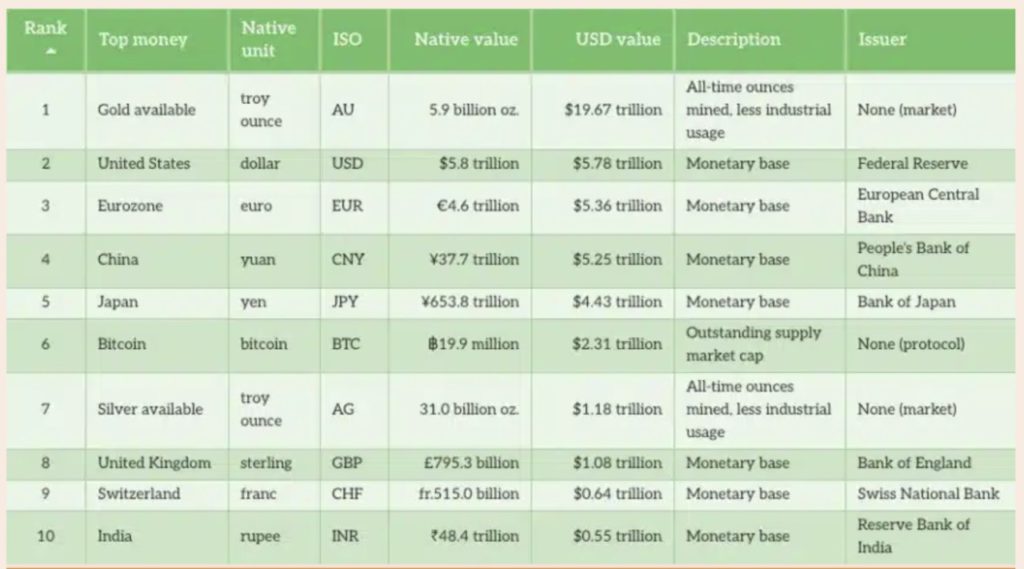

With a monetary base of $5.2 trillion – behind only the US and the Eurozone – China carries enormous weight. Moreover, it contributes nearly 20% of global GDP, making its central bank one of the most influential players in global capital flows.

While the world’s attention is often focused on the Fed, China’s Central Bank has just as much potential to move markets.

South Korea Steps Up in Crypto Market

South Korea’s financial authorities unveiled a four-stage plan that includes a spot Bitcoin ETF proposal, a trial of a stablecoin pegged to KRW, as well as a roadmap to lift the corporation’s trading ban in place since 2017.

In the first half of 2025, non-profit organizations and public institutions are allowed to offload existing crypto holdings. In the second half, listed companies and verified investors will begin trading on a trial basis.

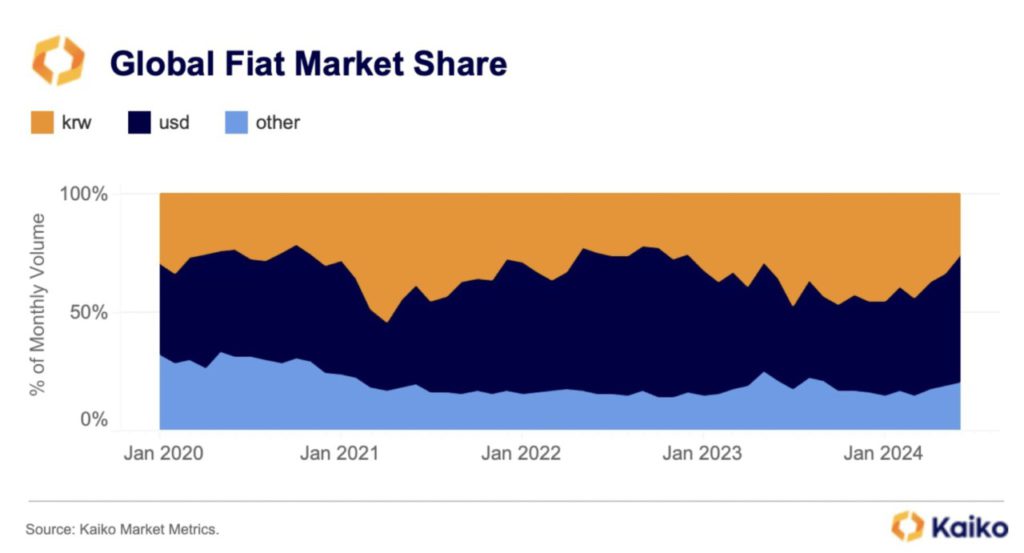

At the market level, the Korean won is the second most traded fiat currency in the crypto world, with a volume of $663 billion since the beginning of the year, or about 30% of total global fiat-to-crypto flows, according to Kaiko.

Nearly one in three Korean adults now owns crypto, double the rate of the United States.

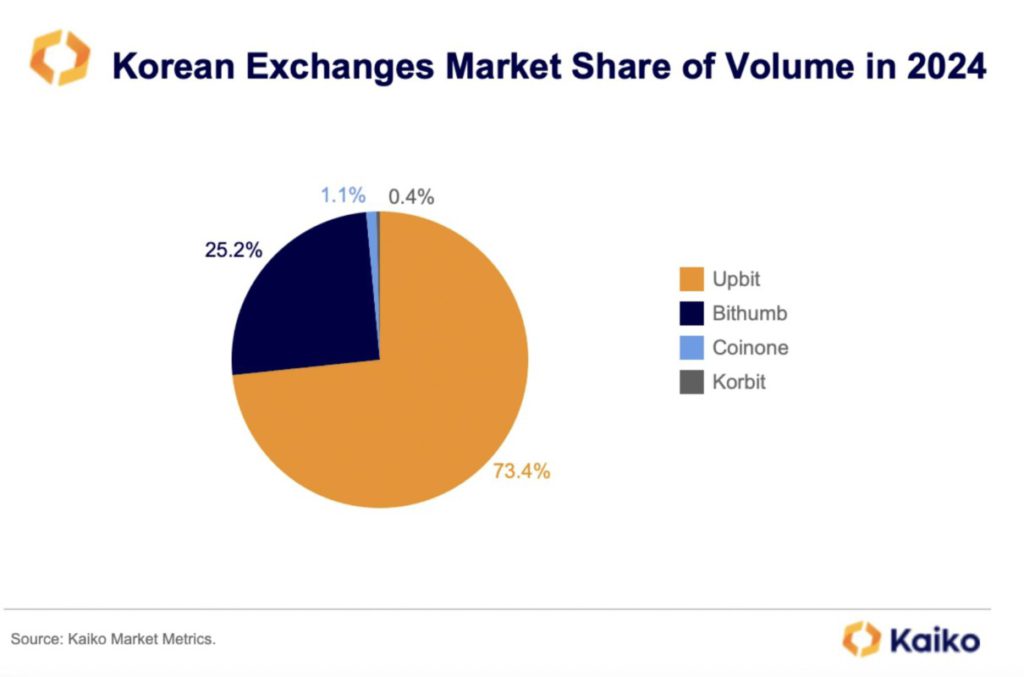

Meanwhile, major exchanges in Korea are expanding their operations. Upbit commands 69% of the domestic market share, while Bithumb bounced back to 25%, with its private shares surging 131% since the beginning of the year ahead of a listing on KOSDAQ.

The development of stablecoins is being led by banks, with major Korean financial institutions such as KB Kookmin, Shinhan, Hana, and Woori preparing to issue tokens pegged to KRW.

Japan becomes a new player in stablecoins

In addition, Japan is venturing into the stablecoin market with its first digital token pegged to the yen. Japan’s Financial Services Agency is set to approve JPYC, a stablecoin issued by Tokyo-based fintech JPYC Inc, for launch later this year.

The token is backed by bank deposits and government bonds, so it is designed to keep a fixed value of 1:1 against the yen.

What’s interesting about this launch is the investor support: Circle, the issuer of USDC, participated in a ¥500 million JPYC Series A round, signaling that Japan’s domestic stablecoin market could soon become international.

JPYC CEO, Norikata Okabe, mentioned that JPYC has received direct investment or through Corporate Venture Capital (CVC) from listed companies such as Circle, Asteria, Densan System, Persol, Aiful, and others.

Also read: XRP Price Potentially Plummets to $2, Read Analysis from Ali Martinez!

In addition, JPYC entrusted Simplex to develop its trading system.

JPYC will operate under Japan’s Payment Services Act, providing a clear legal basis and strict oversight. The token will be available on Ethereum (ETH), Polygon (POL), and Shiden, and support e-commerce payments to cross-border transfers.

Thailand Utilizes Crypto to Attract Tourists

Your next vacation could be even more “crypto-friendly”! The Thai government launched TouristDigiPay, a new regulatory sandbox that allows foreign tourists to convert crypto to Thai baht and pay for goods through e-money providers, all overseen by the Bank of Thailand and the SEC of Thailand.

The move comes as the number of tourists is declining. In the first half of 2025, Thailand welcomed 16.8 million visitors, down from 17.7 million the previous year, with visits from China falling 34%, prompting the government to look for new ways to increase tourist spending and remain competitive.

Tourists wishing to use the service will have to pass KYC checks, with spending limits and restrictions on direct cash withdrawals. Full details will be announced this week by Deputy Prime Minister and Minister of Finance, Pichai Chunhavajira.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Crypto’s next bull run could start in Asia, not Wall Street – Here’s why. Accessed on August 19, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.