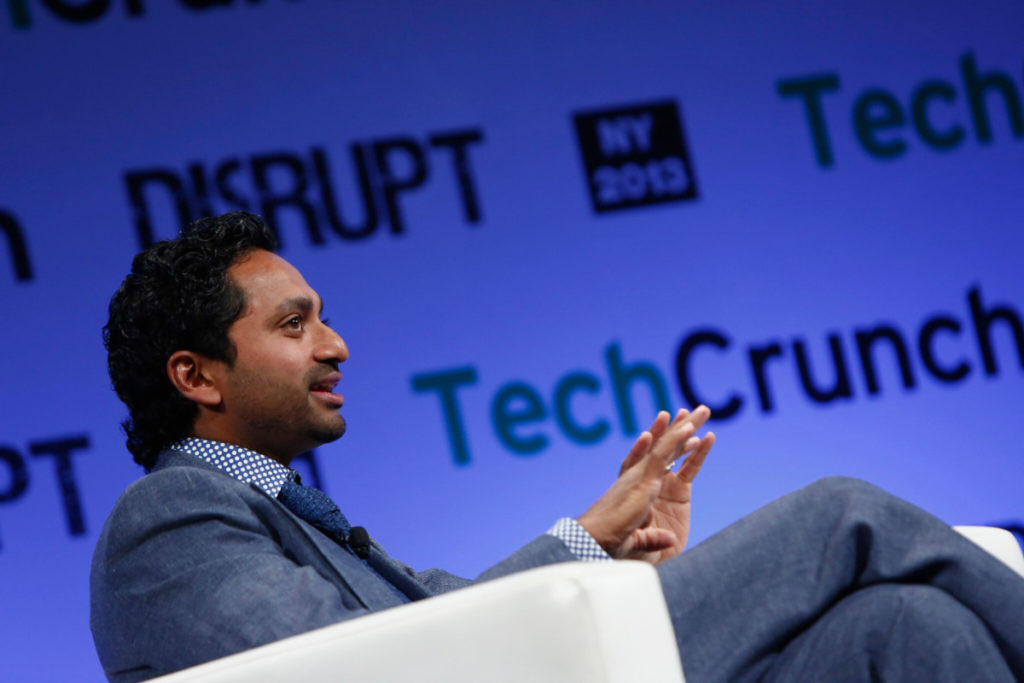

Chamath Palihapitiya Launches New $250 Million SPAC, What will it be Used for?

Jakarta, Pintu News – Chamath Palihapitiya, a leading venture capitalist, recently announced the launch of a new blank check company (SPAC) under the name American Exceptionalism Acquisition Corp.

The SPAC has filed for a $250 million IPO and aims to invest the funds in strategic technology sectors that will define the future global leadership of the United States.

The main focus of this SPAC is on artificial intelligence (AI), decentralized finance (DeFi), defense, and energy.

Check out the full information below!

New SPAC Vision and Mission

In its S-1 documents filed with the SEC, American Exceptionalism Acquisition Corp. describes its mission to support US global leadership by investing in what it calls “strategic sectors of the 21st century”.

These SPACs seek to identify and onboard companies that have great potential in shaping the future of technology, security, and infrastructure. These SPACs offer an alternative for companies to go public without going through the traditional IPO process.

With this strategy, the selected companies are expected to accelerate their growth while gaining access to capital and broader strategic support.

Also read: Michael Saylor relaxes stock sale rules, what does this have to do with Bitcoin?

Target Sectors: AI, DeFi, Defense, and Energy

Artificial intelligence and decentralized finance are two of the four sectors that the SPAC is targeting. AI is considered key to the development of future technologies, while DeFi offers innovations in a more open and decentralized financial system.

Both sectors have significant growth potential and could provide strategic advantages for the US. The defense and energy sectors are equally important.

With rising geopolitical tensions and the need for sustainable energy security, investments in defense technologies and innovative energy solutions are crucial. This SPAC seeks to support companies that can provide innovative and efficient solutions in both these areas.

Also read: Volkswagen Singapore Now Accepts Crypto Payments, How is the Process?

Track Record of Chamath Palihapitiya

Chamath Palihapitiya is known for his success in launching SPACs that have taken companies like Virgin Galactic, Opendoor, and Clover Health public. His experience and success in managing previous SPACs gives confidence that this new SPAC will also be successful.

In his latest commentary, Palihapitiya highlights the uneven results in traditional exit scenarios, such as that of Circle employees who reportedly lost $3 billion in value despite CRCL’s strong market gains. This shows the importance of the right strategy in selecting and supporting companies that are going public.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Chamath Palihapitiya Files $250M SPAC Aiming at America’s Strategic Tech Sectors. Accessed on August 20, 2025

- Featured Image: Bloomberg

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.