Check it out! Big Tech Companies Investing in Bitcoin in 2025

Jakarta, Pintu News – Bitcoin (BTC) is becoming an increasingly desirable digital asset for large corporations around the world. With institutional interest on the rise, several prominent companies have started to disclose the amount of Bitcoin (BTC) they hold, signaling a wider adoption of this crypto asset.

Largest Bitcoin (BTC) Holders in the Tech Industry

Tesla and SpaceX, two companies owned by Elon Musk, have revealed that they own a large amount of Bitcoin (BTC). Tesla has around 11,509 Bitcoin (BTC) while SpaceX has 8,285 Bitcoin (BTC). The two companies total 19,794 Bitcoin (BTC), which is worth billions of dollars in 2025.

Other companies such as Figma and Mercado Libre are also not left behind in Bitcoin (BTC) investments. Figma has 845 Bitcoin (BTC) and Mercado Libre has 720 Bitcoin (BTC), showing that they also see the long-term potential of this digital asset.

Bitcoin (BTC) Adoption by Other Companies

In addition to Tesla, SpaceX, Figma, and Mercado Libre, there are also companies like Rumble that have chosen to invest in Bitcoin (BTC). Rumble currently owns 211 Bitcoin (BTC), showing confidence in the long-term value of Bitcoin (BTC) despite facing market volatility.

The ownership of Bitcoin (BTC) by these companies signals an important shift in corporate finance strategies. Bitcoin (BTC) is increasingly seen as a reliable storage asset, especially in the dynamic and fast-changing technology industry.

Bitcoin (BTC) Price Predictions for the Next Five Years

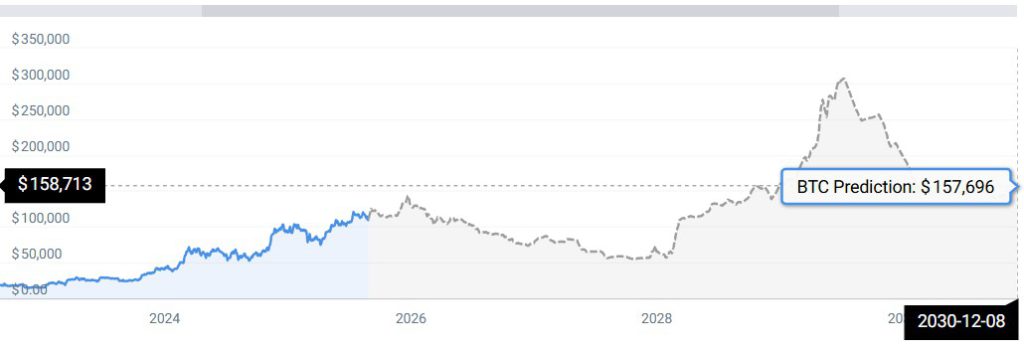

Currently, the price of Bitcoin (BTC) is around $112,000, showing a bullish trend. According to data from CoinCodex, it is expected that the price of Bitcoin (BTC) will experience a significant increase, estimated to reach $157,696 by 2030.

This prediction is based on technical analysis which shows that the current market sentiment is neutral with the Fear and Greed Index showing a reading of 51 (neutral). In the last 30 days, Bitcoin (BTC) has recorded 13 days with a positive trend and price volatility of 2.21%.

Conclusion

Investments by major corporations in Bitcoin (BTC) show a growing confidence in the cryptocurrency as a long-term investment option. With promising price predictions and growing adoption, Bitcoin (BTC) looks set to continue to be a popular choice among tech companies and institutional investors in the future.

Also Read: 3 Reasons Why Tom Lee Predicts Ethereum (ETH) Could Touch IDR196 Million by the End of 2025

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Watcher Guru. How Much Bitcoin Do SpaceX, Tesla, and Figma Own in 2025. Accessed on August 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.