Bitcoin (BTC) is predicted by Tiger Research to reach $190,000 in the third quarter of 2025

Jakarta, Pintu News – According to a recent report from Tiger Research, Bitcoin (BTC) is expected to reach a fantastic value of $190,000 by the third quarter of 2025.

This price increase was driven by several key factors including increased institutional fund flows, record-setting global liquidity, and the opening of Bitcoin investment options in 401(k) retirement accounts in the United States.

This prediction marks a structural shift where the Bitcoin market is increasingly dominated by institutional investors rather than retail investors.

Key Catalysts for Bitcoin Price Increase

A report from Tiger Research suggests that there are three main catalysts driving this bullish outlook. First, the accelerating expansion of institutional capital is providing a significant boost to Bitcoin. Large institutions are starting to look at Bitcoin as a promising investment asset, especially in the face of global economic uncertainty.

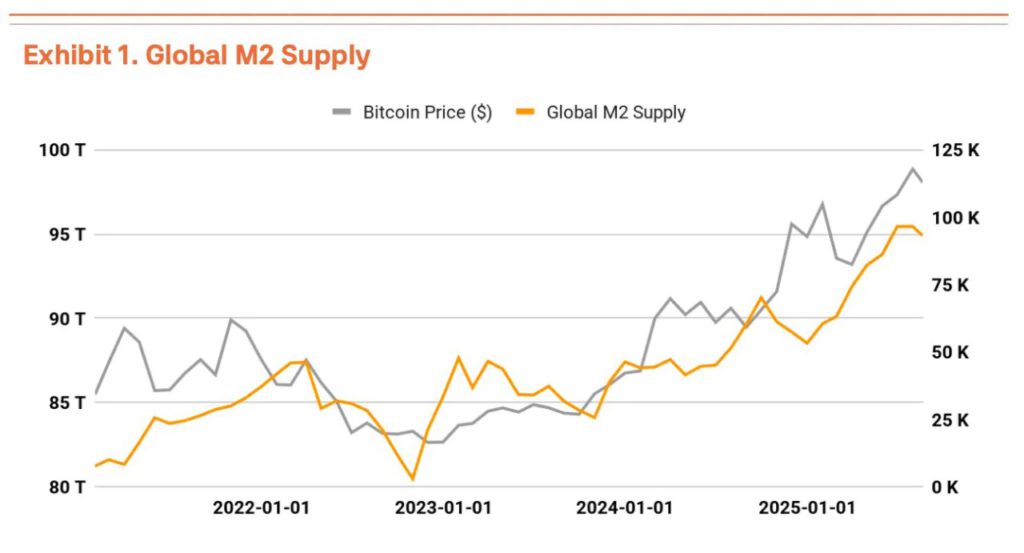

Secondly, unprecedented global liquidity is a strong supporting factor. With high liquidity, a lot of funds can be allocated for investment in crypto assets such as Bitcoin (BTC). This will certainly increase demand and the potential for Bitcoin’s price to rise in the future.

Also Read: 3 Reasons Why Altcoins Are Predicted By Analysts And Tapiero To Explode And Surpass Bitcoin (BTC)

401(k) Channel Opening as a Game Changer

One of the most significant catalysts is the opening of Bitcoin investment options in 401(k) retirement accounts in the US. With the sheer size of pension funds in the US, even a small allocation into Bitcoin could trigger huge long-term demand.

This is a revolutionary move that could change the dynamics of the Bitcoin market as a whole. Moreover, with more and more pension funds allocating their assets to Bitcoin, it will add validity and trust to Bitcoin as an investment asset class. This move is expected to attract more institutional investors to get involved in the crypto market.

Short-term Risks and Corrections

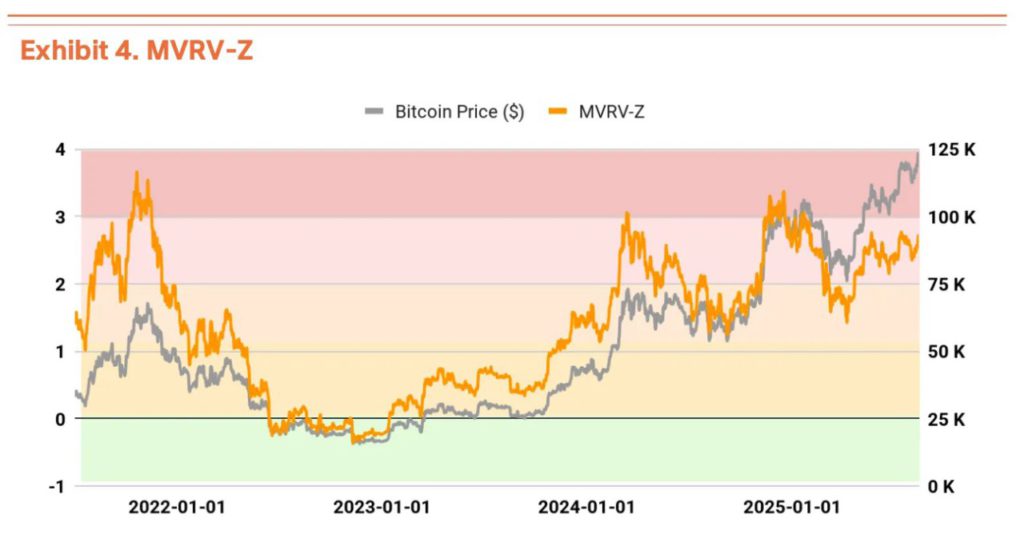

Although the long-term outlook is very bullish, Tiger Research also warns about the potential for a short-term correction. Indicators such as MVRV-Z show that Bitcoin is in an overbought zone, which could lead to a price pullback before resuming its rise. Investors are advised to observe good risk management in the face of market volatility.

In addition, Bitcoin’s price journey is still strongly linked to global macroeconomic conditions. Interest rate policies, geopolitical uncertainties, and shifts in liquidity are some of the factors that can affect Bitcoin’s price path. Therefore, it is crucial for investors to stay alert to changing market conditions.

Conclusion

Tiger Research’s Bitcoin price prediction for the third quarter of 2025 shows a very optimistic scenario. However, reaching the $190,000 mark still depends on various factors, including institutional capital flows, global liquidity, and unexpected macroeconomic variables. Investors are reminded to always consider the risk aspect in any investment decision.

Also Read: 3 Reasons Why Tom Lee Predicts Ethereum (ETH) Could Touch IDR196 Million by the End of 2025

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto markets such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Tiger Research. Bitcoin Will Reach $190K in This Quarter – Tiger Research. Accessed on August 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.