Who are the “Sultans” of Ethereum 2025? Here are the 7 biggest ETH owners and the secret of their dominance

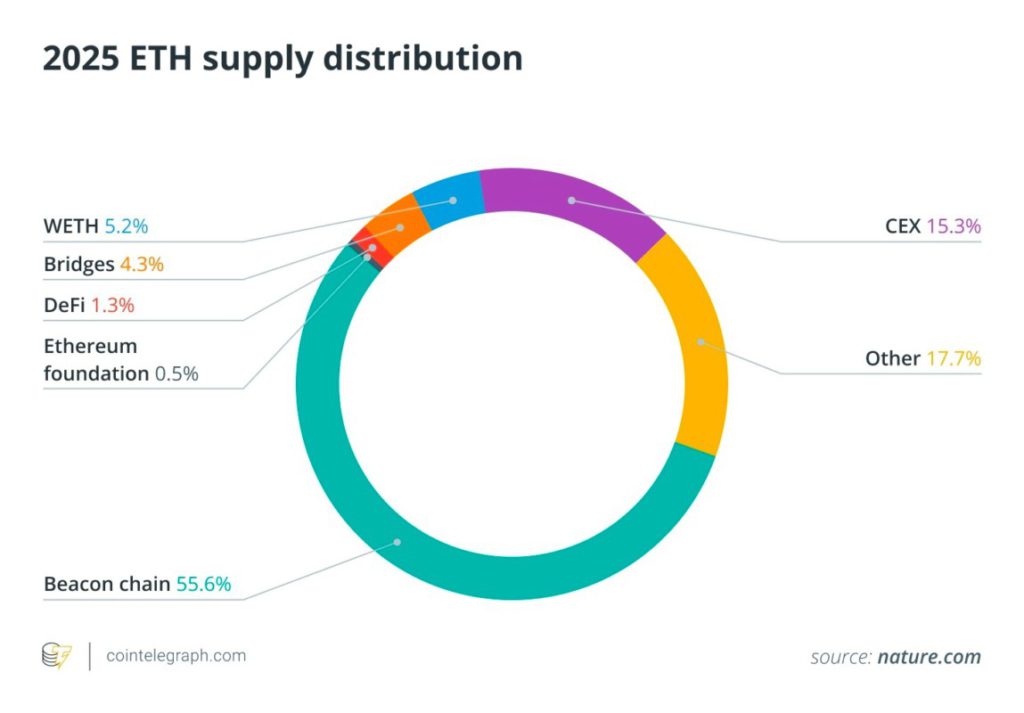

Jakarta, Pintu News – Ethereum (ETH) ownership is increasingly concentrated in the hands of institutions and smart contracts by 2025. According to a Cointelegraph report, around 70% of the total ETH supply is controlled by the 10 largest wallet addresses, the majority of which are smart contract staking and institutional wallets. Who are the biggest owners of ETH and how much is it? Here’s the full list based on on-chain data as of August 2025.

1. Smart Contract Beacon Holds Over Half of the ETH in the World

According to data from Cointelegraph, Beacon Deposit Contract is the largest holder of Ethereum, with around 65.88 million ETH, or the equivalent of IDR 4.32 quadrillion (1 ETH = $4,375 = IDR 71,951,125). This is equivalent to 54.58% of the total ETH supply, which is about 120.71 million coins.

This smart contract is used by validators to deposit a minimum of 32 ETH as a condition of participating in Ethereum’s Proof-of-Stake network. Although ETH withdrawals have been possible since 2023, the process remains delayed due to the unbonding period and the protocol’s sweeping system.

2. Coinbase, Binance, and Bitfinex are the biggest ETH holders among exchanges

Reputable crypto exchanges also dominate the list of the largest ETH wallets. Coinbase has around 4.93 million ETH, followed by Binance with 4.23 million ETH, and Bitfinex with 3.28 million ETH, according to August 2025 data.

In addition, other wallets belonging to Base Network, Robinhood, and Upbit hold more than 1 million ETH each. Most of these assets are used for liquidity, staking derivatives such as cbETH, and operations across blockchain networks.

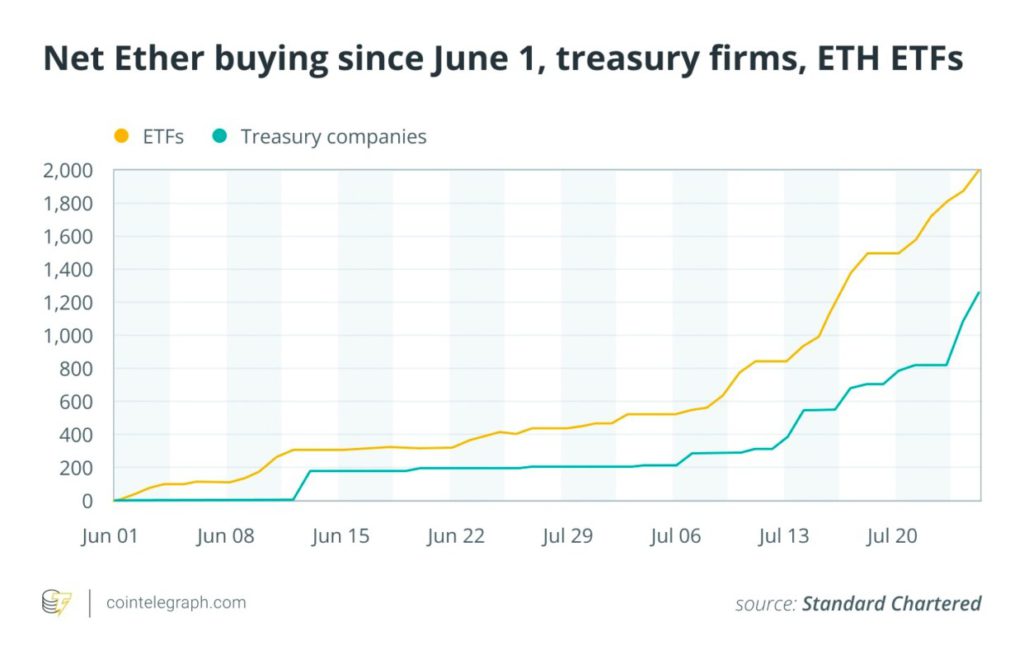

3. Ethereum ETFs encourage large institutions to hold more than 5 million ETH

The entry of institutional players into the crypto world is driving massive ETH accumulation via ETFs. Products like the BlackRock iShares Ethereum Trust (ETHA) have accumulated more than 3 million ETH as of August 2025, with inflows worth $9.74 billion .

In addition, Grayscale ETHE, Fidelity Ethereum Fund (FETH), and Bitwise are also building their exposure to Ethereum. These institutions’ accumulation totals over 5 million ETH, making ETH an increasingly serious treasury asset.

4. Public Companies Jump on the Ethereum bandwagon in Large Quantities

Some publicly traded companies have also started holding Ethereum (ETH) as part of their treasury strategy, similar to MicroStrategy’s approach to Bitcoin (BTC). For example, Bitmine Immersion Technologies (BMNR) holds more than 776,000 ETH, financed by $250 million in PIPE funding.

Other companies such as SharpLink Gaming (SBET), Bit Digital (BTBT), and BTCS each hold hundreds of thousands of ETH, most of which are staked to earn returns of around 3%-5% per year. They cite ETH’s programming capabilities and the stablecoin ecosystem as the main reasons for accumulation.

5. Vitalik Buterin Is Still the Most Famous Individual Whales

Ethereum founder Vitalik Buterin is believed to still hold between 250,000 and 280,000 ETH, equivalent to more than IDR 20 trillion. These assets are spread across several non-custodial wallets, including the infamous VB3 address.

In addition, Rain Lõhmus, co-founder of LHV Bank, owns 250,000 ETH that he lost access to since the 2014 ICO-the value of his coin is now nearly IDR 18 trillion. Founders like Joseph Lubin and Anthony Di Iorio are also listed as owning tens to hundreds of thousands of ETH.

6. Wrapped Ether (WETH) Enters the List of Largest Wallets

Not only people or institutions, Wrapped Ethereum (WETH) smart contracts are also among the largest ETH wallets with more than 2.26 million ETH. The amount represents about 1.87% of the total ETH supply, according to a Cointelegraph report.

WETH is used as the ERC-20 version of ETH for various DeFi needs such as lending, yield farming, and automated token exchange on platforms like Uniswap and Aave.

7. 1 ETH Already Gets You into the Top 1% of Global ETH Owners

Based on Etherscan data from early 2025, only about 1.3 million addresses had at least 1 ETH out of more than 130 million unique addresses recorded. That means, only about 1% of total Ethereum users own a full coin.

With the current ETH price at IDR71 million, owning 1 ETH is not just about investment, but also about exclusivity. In an increasingly competitive crypto world, being part of the “1% club” is an achievement in itself.

Also Read: Bitcoin Price Increase Prediction: Analyst Dave The Wave Reveals Potential Spike in September!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Bradley Peak / Cointelegraph. Who owns the most Ether in 2025? The ETH rich list, revealed. Accessed on September 2, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.