Bank of China shares surge, hinting at big plans in the world of stablecoins!

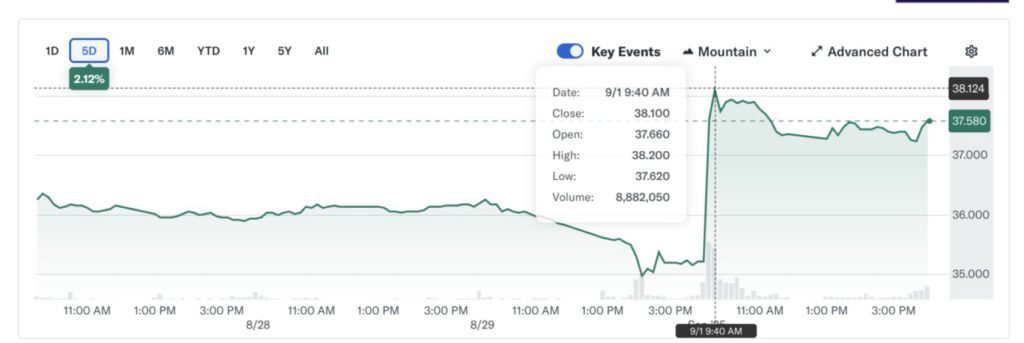

Jakarta, Pintu News – Shares of Hong Kong-listed Bank of China saw a significant rise of 6.7% to HKD 37,580 on Monday. The rise came after reports that Bank of China’s unit in the city is preparing to apply for a stablecoin issuer license.

The move comes weeks after Hong Kong introduced one of the world’s first dedicated licensing frameworks for stablecoins referenced to fiat currencies on August 1.

Bank of China prepares to apply for stablecoin license

The Bank of China (Hong Kong) has set up a dedicated team to explore stablecoin issuance and prepare application materials. While the bank has not responded to requests for comment, it has informed investors that it is researching digital asset applications and related risk management.

This shows the seriousness of Bank of China in adapting the latest digital finance innovations. The move comes amid increased competition in the digital finance sector, with major banks trying not to fall behind in the adoption of blockchain technology and cryptocurrencies. With this preparation in place, Bank of China looks to cement its position as a major player in the nascent stablecoin market.

Also Read: 5 Facts about Metaplanet’s Crypto Strategy: Save 20,000 BTC Even if the Stock Price Plummets!

Hong Kong’s New Framework for Stablecoins

With new regulations in place in Hong Kong, any entity looking to issue stablecoins in the city or linked to Hong Kong dollars overseas will need to get approval from the Hong Kong Monetary Authority (HKMA).

The framework sets out strict rules regarding the management of reserves, segregation of client funds, exchange guarantees of equal value, as well as compliance with audit, disclosure and anti-money laundering requirements.

The policy aims to create a safe and orderly environment for the growth and adoption of stablecoins, and to protect the interests of investors and users. With a clear framework in place, it is Hong Kong’s ambition to become a global hub for digital finance innovation, especially in the stablecoin sector.

Increased Investor Interest in Digital Assets in Asia

Along with the implementation of the new licensing framework, investor activity in the digital asset sector in Hong Kong has increased significantly. In July, listed companies raised around $1.5 billion for stablecoin and blockchain ventures.

OSL, one of the largest licensed digital asset platforms in the city, managed to secure $300 million through a share placement backed by sovereign wealth funds and hedge funds.

This increase shows the market’s great confidence in the growth potential of the digital economy in Asia, especially through innovations such as stablecoins. With strong regulatory support, Hong Kong is expected to attract more investment and innovation in the future.

Conclusion

Hong Kong’s increase in Bank of China shares and development of a stablecoin framework mark a new era in financial and technological integration. With these strategic moves, Hong Kong and Bank of China are demonstrating their commitment to leading the way in the digital financial revolution, promising a more stable and innovative future for global markets.

Also Read: Check out 4 US Economic Data that Potentially Affect the Crypto Market This Week!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bank of China Shares Surge 6.7% on Stablecoin License Buzz. Accessed on September 3, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.