XRP Prediction Week 2 September: Ready for a 15% Rebound After Consolidation?

Jakarta, Pintu News – The crypto market is putting the spotlight back on Ripple (XRP) after the altcoin showed signs of recovery in early September 2025. After weeks of being stuck in a downward trend, XRP is now stable at around $2.85 or around Rp46,864 (exchange rate $1 = Rp16,453), still 25% below its record high.

However, technical analysis and on-chain data indicate that there is a chance of a rebound of up to 15% in the near future. Check out the XRP analysis and predictions for the week of September 2 by Victor Olanrewaju, crypto analyst at CCN, in the following article!

XRP Finds Strong Support

Since August 26, the price of XRP has steadily declined from $3.06 to a low of $2.75. However, the latest 4-hour chart shows that XRP managed to break out of the descending triangle pattern formed earlier.

The Moving Average Convergence Divergence (MACD) indicator also showed a bullish signal, with the 12 EMA breaking above the 26 EMA. This condition is often the first sign of a return of positive momentum. If buying pressure persists, XRP could potentially test resistance at $2.86 before continuing its rise towards $3.06.

Also read: 3 Favorite Crypto Whales Hunted in September, According to Nansen Data!

On-Chain Data Supports Bullish Outlook

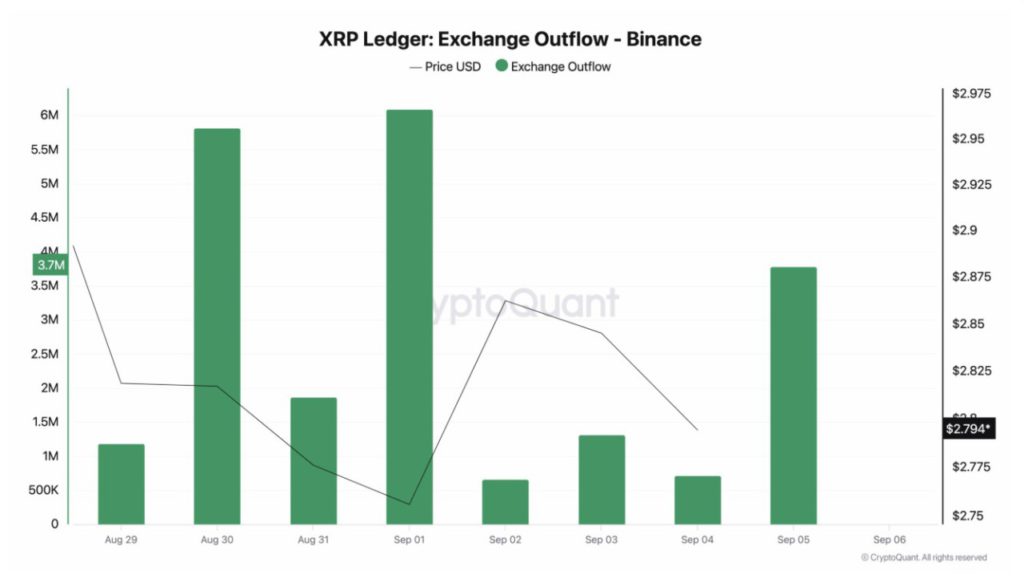

In addition to technical analysis, on-chain data from CryptoQuant reinforced market optimism. It was noted that on September 4, the exchange outflow of XRP was only 716,729 coins. However, the number jumped to 3.79 million coins a few days later.

A rise in outflows means more investors are moving their assets to private wallets, which translates to less selling pressure on exchanges. When supply dwindles while demand remains steady, prices tend to be pushed up. This spike in outflows indicates that the majority of holders are choosing to HODL, hoping for a price increase in September.

Also read: 6 Factors that Could Boost Crypto Prices in September 2025

XRP Target Price in September 2025

According to Olanrewaju’s analysis, in terms of daily technicals, XRP is still moving around the upper line of the descending triangle pattern. Strong support remains at the $2.75 level, while the Money Flow Index (MFI) indicator shows an increase in capital inflows.

If this momentum continues, XRP has the potential to break the resistance and rise towards $3.23 or around Rp53,074-equivalent to a 15% increase from current levels. In a more bullish scenario, the altcoin could even continue its rally to $3.67 or IDR60,374.

However, risks remain. If selling pressure intensifies again, XRP could lose support at $2.75 and fall to $2.40. This would invalidate the short-term bullish narrative that is forming.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. XRP Price Stabilizes After Consolidation – 15% Bounce Possible in September. Accessed September 6, 2025.

- Featured Image: VRITMES

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.