Ethereum (ETH) Endangered? Latest Findings Shock the Market!

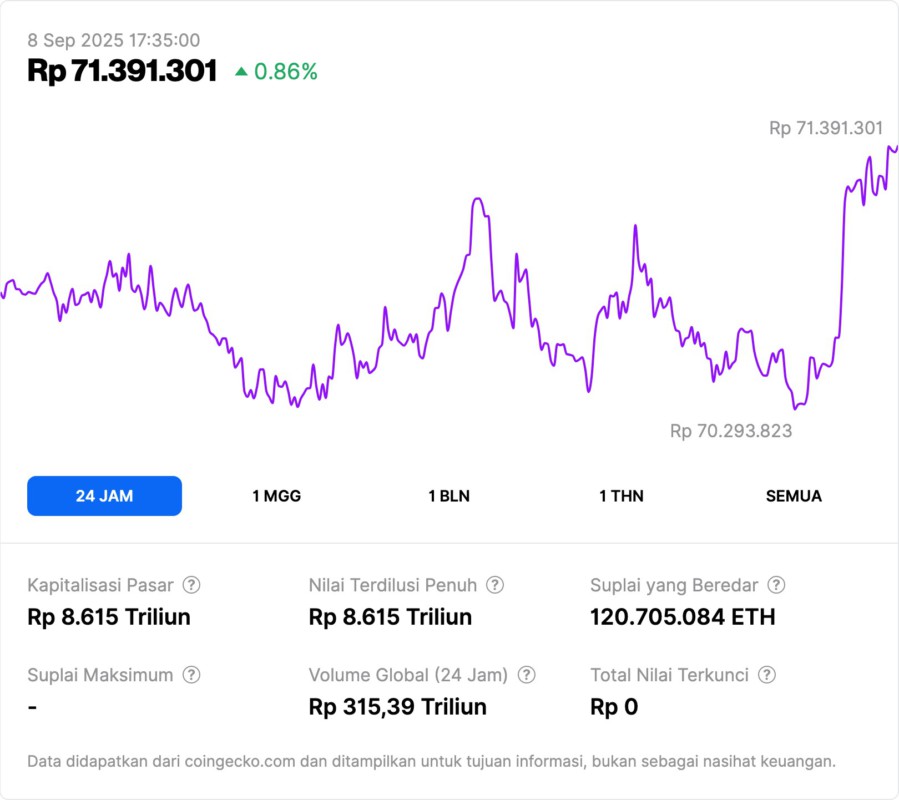

Jakarta, Pintu News – The cryptocurrency market was recently shocked by a report from AJC, a researcher at data analytics firm Messari, stating that the Ethereum (ETH) network is experiencing a significant decline. Although the price of Ethereum (ETH) experienced a considerable increase, the revenue generated by the network showed a drastic decline.

Ethereum Revenue: Drastic Decline

According to a recent report, Ethereum (ETH) revenue in August was only $39.2 million. This is a 75% drop compared to August of 2023 and a 30% drop from August of 2024.

This was one of the worst months for the network since January 2021 in terms of revenue. This decline has raised concerns among investors and market watchers. Despite the price increase, the lackluster revenue suggests deeper problems within the Ethereum (ETH) ecosystem.

Also Read: 3 Major Factors that Could Drive a September 2025 Bitcoin (BTC) Rally!

Reaction and Defense from Messari

After criticism from some Ethereum (ETH) supporters who accused Messari of bias, AJC revealed that not all members of the Messari team agree with his analysis. “Many people from Messari disagreed with me in the comments, so I’m not sure what you mean,” AJC said.

Another analyst from Messari pointed out that the number of active addresses is starting to show a positive trend. In addition, other trends such as the number of transactions and throughput are also showing encouraging developments, although revenue is still far from expectations.

Ethereum’s Strong Performance in the Third Quarter

Reported by U.Today, Ethereum (ETH) is currently on track to record its best performance in the third quarter since its launch. The value of Ethereum (ETH) has increased by 73% during this quarter.

However, this impressive price increase was not followed by a significant increase in network revenue. This raises questions about the sustainability of price increases in the long term if not supported by strong network fundamentals.

Conclusion: The Future of Ethereum

Although Ethereum (ETH) is showing significant price increases, the continuous decline in revenue could be an indicator of serious problems in the network. Investors and network users need to consider this factor in making investment decisions.

The cryptocurrency market is highly dynamic and fraught with uncertainty. Therefore, it is important for stakeholders to constantly monitor the latest developments and conduct in-depth analysis before taking strategic steps.

Also Read: 4 Reasons El Salvador Moved IDR11 Trillion in Bitcoin: Protection or Sell Signal?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Ethereum Is Dying, Researcher Says. Accessed on September 8, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.