Fed Rate Cut Prediction Triggers Crypto Market Optimism, Here Are the Details!

Jakarta, Pintu News – The crypto market is showing signs of bullishness following predictions of interest rate cuts by the Federal Reserve announced by Standard Chartered.

The latest analysis suggests that a rate cut of 50 basis points is likely, doubling the previous prediction of 25 basis points.

This was driven by the August jobs report which showed the weakest employment growth in almost four years.

Standard Chartered’s Prediction on Fed Policy

Standard Chartered has changed its prediction regarding the Federal Reserve’s interest rate policy, forecasting a 50 basis points cut at the upcoming policy meeting. This decision is based on the latest jobs report which showed an increase in the unemployment rate to 4.3% and slowing employment growth.

The bank compared the current conditions with last year, when the Fed surprisingly cut rates by half a point under similar conditions.

In its latest note to clients, Standard Chartered stated that the labor market has gone from “strong to weak in less than six weeks.” The bank’s analysts emphasized that decisive action from the Fed is needed to avoid further economic weakness.

Read also: MetaPlanet Japan Reaches Bitcoin Holdings Worth Over $2 Billion

Financial Market Reactions and Other Predictions

Although Standard Chartered gave an aggressive prediction, other banks such as Barclays and Bank of America expected smaller and more gradual cuts. Morgan Stanley and Deutsche Bank are still skeptical of an immediate 50 basis points cut, but all agree that policy easing is top of mind.

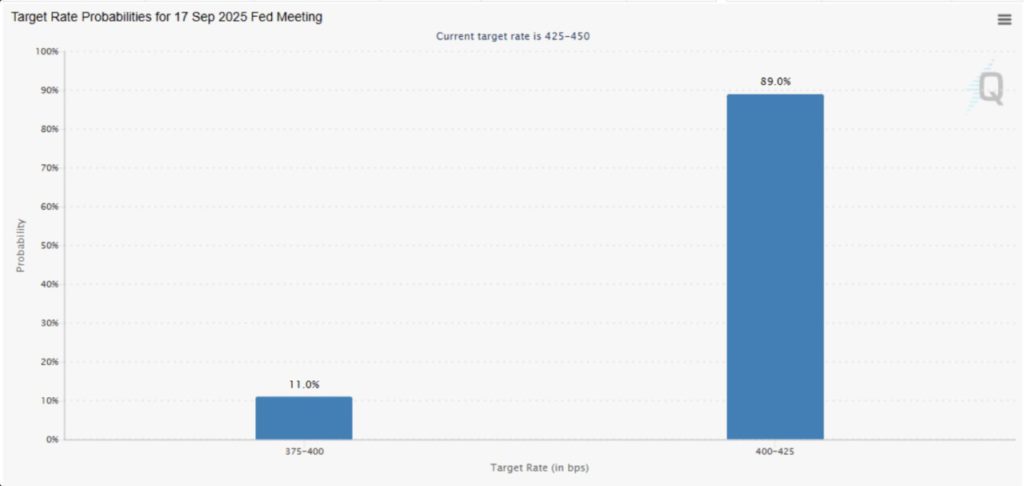

CME’s FedWatch tool shows a 90% probability of a 25 basis points cut, but only a 10% chance of a full 50 basis points cut at the upcoming FOMC meeting. CPI and PPI data to be released on September 10 and 11 will also influence the Fed’s decision.

Also read: XRP Price Prediction September 9, 2025: Just Hours Away, Where is it Headed?

Optimism in the Crypto Market

With the increasing likelihood of an interest rate cut by the Fed, the bullish sentiment in the crypto market is getting stronger. Looser monetary policy is expected to encourage investment in high-risk assets like Bitcoin (BTC), by lowering financing costs and steepening the yield curve.

Several Fed officials, including Governor Chris Waller and Governor Michelle Bowman, have expressed their support for a rate cut at the September FOMC meeting. They argue that this move is necessary to protect the weakening labor market and avoid a deeper erosion of the economy.

Conclusion

The predicted interest rate cut by Standard Chartered has built high anticipation not only on Wall Street but also in the crypto sector. If the Fed actually implements the cut, Bitcoin (BTC) and other digital assets will probably be the biggest beneficiaries.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Crypto Market Bullish as Standard Chartered Predicts 50bps Fed Rate Cut Next Week. Accessed on September 9, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.