US Crypto News: Recession Canceled? Bitcoin and AI — Two Sectors in the Spotlight!

Jakarta, Pintu News – Global financial markets continue to face economic uncertainty, but two sectors seem to be unaffected: Bitcoin (BTC) and artificial intelligence (AI). Analysts are divided in their views, but investment trends show a significant shift of capital towards these two areas.

Recession Prediction VS Market Optimism

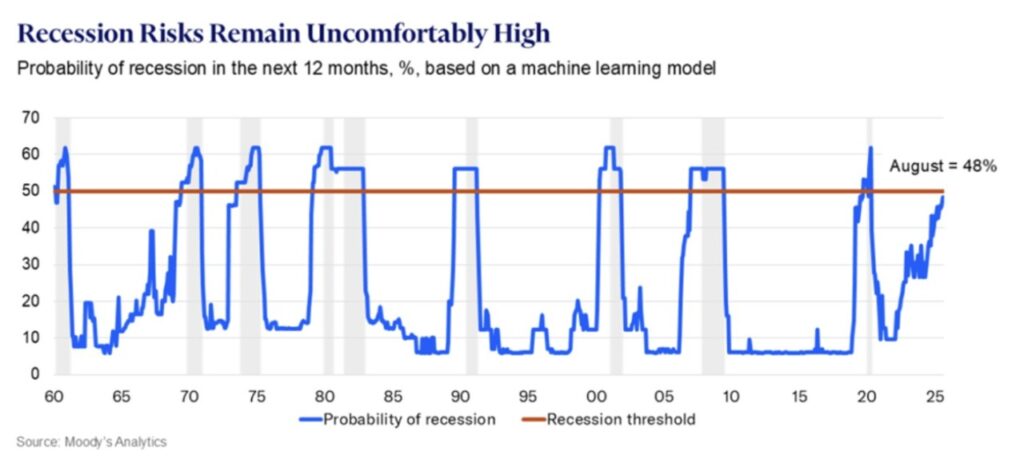

Despite concerns about a recession in the United States, some economists such as Mark Zandi of Moody’s Analytics estimate there is a 48% chance the US will go into recession in the next 12 months. However, the resilient growth data shows the unexpected resilience of the economy.

Strong retail sales and mixed labor market data gave investors mixed signals. On the other hand, there was an increase in jobless claims and the uncertain path of inflation. This situation creates uncertainty in the market, yet investors seem to be starting to ignore the drumbeat of recession and focus on new investment opportunities.

Read also: Failed altcoins confuse Treasury strategy, says David Bailey

Bitcoin and AI: Two of the Most Promising Sectors

According to analyst Visser, there are currently only two investments that really matter: Bitcoin (BTC) and AI. “Everything else is just noise,” Visser said. He points out that there are technical upgrades on Ethereum (ETH), Dogecoin (DOGE), and Sui that signal broader market participation, not just in Bitcoin (BTC).

Visser also emphasized that MicroStrategy’s premium, which is the difference between the value of Bitcoin (BTC) held by the company and its equity valuation, is an indicator of market sentiment. When this premium widens, it signals that investors are again taking risks in the crypto complex.

Also read: Bitcoin (BTC) price approaches $115,000, what does this level mean?

Market Reaction and Portfolio Reallocation

With the end of the year approaching, Visser predicts that portfolio reallocation will play a key role. Institutional investors who missed out on Bitcoin’s (BTC) surge past $100,000 may be forced to increase their allocations before closing the books in 2025. “The bears are crying in the casino,” Visser said, describing how the market might react.

If liquidity conditions remain favorable, both equities and Bitcoin (BTC) could rally together. This suggests that while traditional macro signals still point to risks, the dynamics of the new regime are increasingly tied to the technological revolution and alternative assets.

Conclusion

In the face of global economic uncertainty, Bitcoin (BTC) and AI are emerging as two sectors that are not only resilient to market turmoil, but also offer significant growth opportunities. Investors who understand this shift will probably find that ignoring the noise and focusing on these two areas could be a very profitable strategy.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Recession Cancelled: Bitcoin, AI, US Crypto News. Accessed on September 16, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.