Ethereum (ETH) Price Prediction for September: Will it Continue to Fall?

Jakarta, Pintu News – The cryptocurrency market is always full of surprises and unexpected price changes. Ethereum (ETH), one of the leading digital currencies, has decreased by 0.59% since yesterday. Currently, many market participants are trying to predict the next direction of the Ethereum (ETH) price.

Daily Technical Analysis

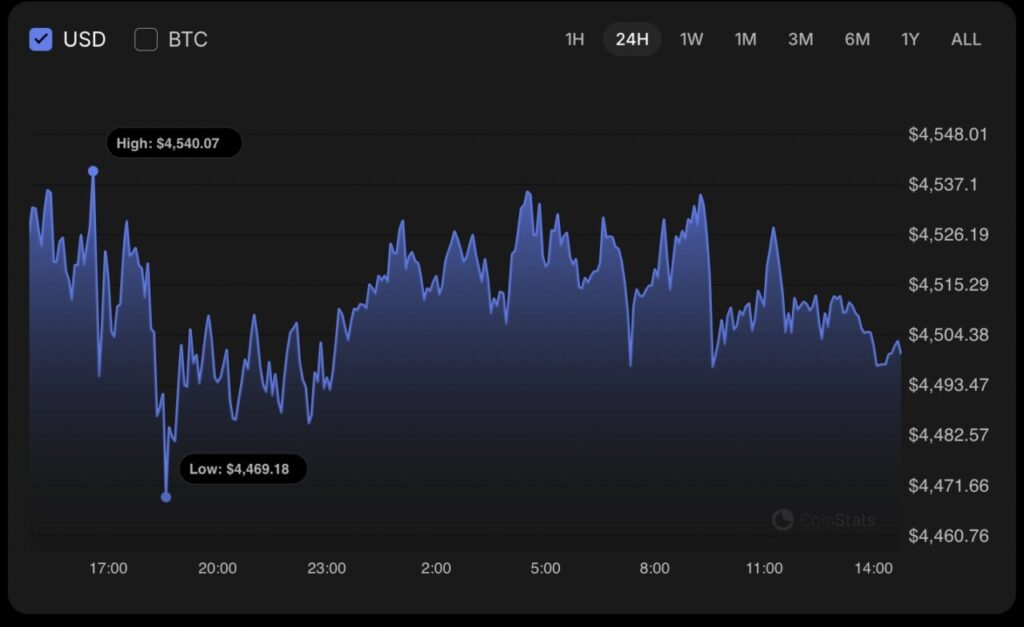

On the hourly chart, Ethereum (ETH) is near the local support of $4,493. If there is no price recovery by the end of the day, there could be a break of this support level and the price could continue to decline towards the $4,460 area. This suggests that the selling pressure is still quite strong and market participants should be wary of a potential further decline.

In the longer time frame, the downward trend in Ethereum (ETH) price is still continuing. If today’s candle close is below yesterday’s low, there is a high probability that the price will try to test the $4,400 zone in the near future. This signals that the bears still have control over the market.

Also Read: 5 Reasons Bitcoin Allocation on Wall Street Will Explode by the End of 2025

Medium Term Outlook

From a medium-term perspective, there is no clear dominance between buyers and sellers. This is evidenced by the declining trading volume. Under these conditions, sideways trading in the range of $4,300 to $4,600 is the most likely scenario. Market participants may need to be patient and observe further before making investment decisions.

This uncertainty makes many traders cautious about taking long-term positions. Price stability within the range may provide some opportunities for day traders, but long-term investors should probably wait for clearer signals before increasing their exposure in Ethereum (ETH).

Current Position and Price Prediction

Ethereum (ETH) is trading at $4,502 at the moment. Although there is some selling pressure visible, there is still a possibility for a recovery if the current support can be maintained. However, if this support breaks, there could be further declines to watch out for.

Investors and traders should monitor these support levels and adjust their strategies accordingly. Observing technical and fundamental indicators will be crucial in determining the direction of Ethereum (ETH) price in the days to come.

Conclusion

In the face of cryptocurrency market volatility, it is important for market participants to stay alert and informed. Monitoring recent developments and conducting in-depth analysis can help in making informed investment decisions. Ethereum (ETH), with all its recent price fluctuations, remains an attractive asset for many investors and traders.

Also Read: Maartunn Analyst Says December 2024 Crypto Market Pattern Repeats, What Does It Mean?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Ethereum (ETH) Price Prediction for September 16. Accessed on September 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.