Ethena’s TVL Hits Record High, Yet ENA Price Drops 13%, What’s Up?

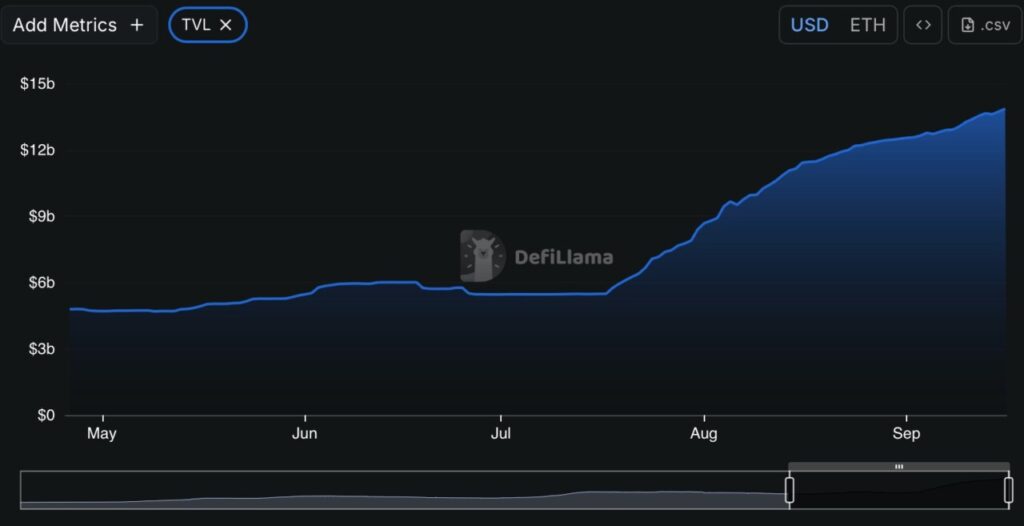

Jakarta, Pintu News – The cryptocurrency market is often unpredictable, and the latest case with Ethena (ENA) proves that. Despite Ethena’s Total Value Locked (TVL) reaching a new high of $13.88 billion, the price of the ENA token actually experienced a significant drop. This article will dig deeper into why this phenomenon happened and what might happen next.

Why is Ethena’s TVL Increase Important?

A high TVL usually signifies strong investor confidence in the platform. Ethena managed to lock in $13.88 billion in funds with an Annual Percentage Yield (APY) of 7.2%, showing that investors still believe in its long-term potential despite the token price showing a bearish trend.

This increase in TVL signifies that despite the uncertainty in the market, Ethena still has strong support from its community. However, despite the increase in TVL, the price of ENA has dropped by 13% in the past week.

This suggests a misalignment between the value locked on the platform and the market valuation of the token itself. Factors such as selling pressure in the spot market and increased fund flows to exchanges may have affected the token’s price.

Also Read: Jake Claver, CEO of Digital Ascension Group’s Shocking Prediction: XRP Will Break $25!

On-Chain Activity and Bullish Sentiment

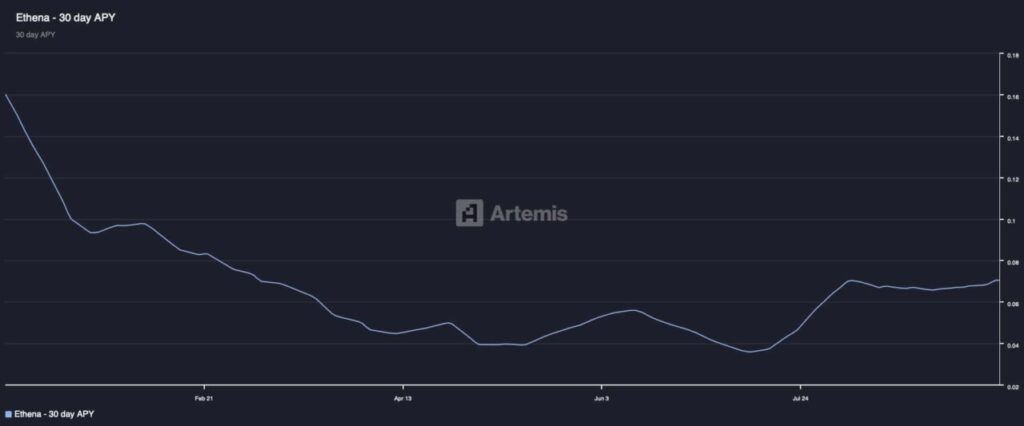

Ethena’s on-chain activity showed a significant increase, which should be a positive indicator for the token price. Transaction volume on the Ethena blockchain increased sharply, and the 30-day APY reached its highest point since March. This indicates that there is more interaction with the platform, which usually has a positive impact on the value of the token.

However, despite the increase in on-chain activity, the price of ENA still continues to decline. This may be due to external factors such as broader macroeconomic conditions or bearish global market sentiment. Investors may also be taking advantage of the high APY, while ignoring the long-term price appreciation potential of the token itself.

Off-Chain Investors Bet Against ENA

On the other hand, activity in the spot market suggests that there is continued selling pressure against ENA. Data showed that $5.4 million flowed into the exchange, which increased ENA’s reserves on the exchange.

This may signal that investors prefer to secure their profits rather than endure uncertainty. In addition, the balanced funding level indicates that short positions are more dominant than long positions.

This could be an indicator that investors are anticipating further price declines or a lack of confidence in ENA price recovery in the near future. This adds complexity to ENA market analysis and requires further monitoring.

Conclusion

Despite Ethena’s TVL reaching record highs, ENA’s price dynamics show that the cryptocurrency market remains fraught with uncertainty and volatility. Investors may need to re-evaluate their strategies by considering both on-chain and off-chain factors before making investment decisions. Going forward, it will be crucial to monitor both of these aspects to get a clearer picture of ENA’s future direction.

Also Read: Maartunn Analyst Says December 2024 Crypto Market Pattern Repeats, What Does It Mean?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethena’s TVL hits ATH but ENA price slides 13% – Here’s why. Accessed on September 18, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.