September 2025 Fed Rate Cut: How Will it Impact the Crypto Market?

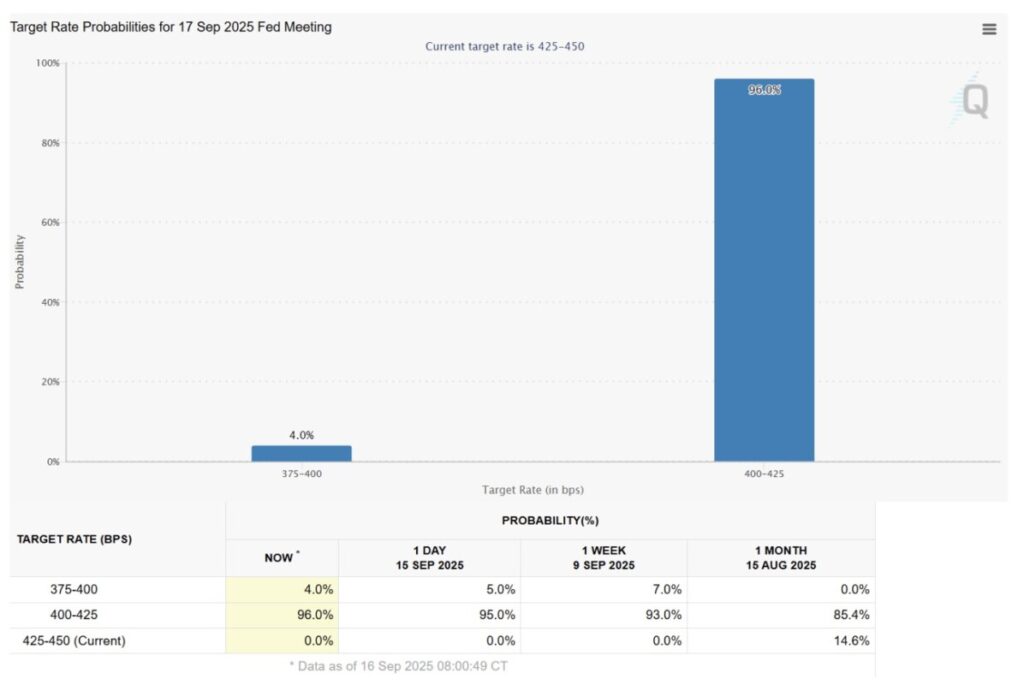

Jakarta, Pintu News – At its meeting scheduled for September 16-17, the US Federal Reserve is expected to make its first interest rate cut of the cycle. This decision has sparked debate in various markets, including the crypto market.

With expectations of a 25 basis point cut, which would lower the target range of interest rates to 3.75%-4.00%, crypto market participants are waiting to see if this will trigger a price increase or decrease.

The Effect of Interest Rate Cuts on Crypto

When the Federal Reserve cuts interest rates, borrowing costs become cheaper and market liquidity increases. This also impacts the crypto market, where access to margin loans or loans secured by crypto becomes easier. Investors tend to shift from low-yielding bonds to higher-risk assets.

In addition, lower interest rates reduce the opportunity cost of holding non-earning assets, such as Bitcoin (BTC). A weaker US dollar often benefits Bitcoin (BTC), which is often dubbed as “digital gold”, especially when confidence in fiat currencies declines.

Read also: 3 Reasons Why Investors Haven’t Maximized Results When the Altseason Index Surges

Market Sentiment: Between Bull and Bear

The real debate lies in how investors interpret the Fed’s move. The bulls (optimists) see this as a breath of fresh air that supports liquidity, while the bears (pessimists) see the risk of stagflation. How the crypto market will react depends on these interpretations and broader market dynamics.

If the Fed gives dovish signals indicating the possibility of further cuts, this could maintain risk appetite in the market. However, if the Fed emphasizes inflation risks and signals that further cuts may be limited, the upside potential for crypto could fade.

Read also: Aave Transforms: L2 Closure and $100 Million Push for GHO Spark Controversy

Practical Strategies for Retail Investors

While looser policies seem to be on the horizon, retail investors should remain wary of volatility. One way is to diversify portfolios to reduce risk. Investors are also advised to closely monitor market developments and not rely too heavily on leverage, especially during Fed week.

It is also important to pay attention to Jerome Powell’s press conference and the latest projections from the Fed. Comments and guidance from the Fed can be more influential than the rate cut itself. Investors should be prepared to adjust their strategies based on the nuances conveyed.

Conclusion

With interest rate cuts anticipated, the crypto market is at a crossroads. Although some analysts are optimistic about the near-term outlook, broader macroeconomic factors and market sentiment will largely determine the next direction. Investors are advised to remain vigilant and responsive to the latest developments.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Fed Rate Cut: Crypto Impact. Accessed on September 18, 2025

- Featured Image: Generated by Ai

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.