Bitcoin Sinks to $112,000 Today as $1.70 Billion Liquidation Wave Hits Markets

Jakarta, Pintu News – Bitcoin (BTC) prices fell below the $113,000 level on Monday (Sep 22) after failing to hold above an important support level the previous week. The correction triggered a wave of liquidation in the crypto market, with a total of $1.70 billion worth of positions erased in the last 24 hours, increasing bearish pressure on traders.

Despite the weakening price of BTC, Japanese investment firm Metaplanet is still adding BTC holdings to its reserves. Then, how will Bitcoin price move today?

Bitcoin Price Drops 2.03% in 24 Hours

On September 23, 2025, Bitcoin was trading at $112,071, equivalent to IDR 1,866,373,614, marking a 2.03% decline over the past 24 hours. During the same period, BTC hit a low of IDR 1,857,892,209 and a high of IDR 1,905,965,558.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 37,266 trillion, while its 24-hour trading volume has surged 116% to reach IDR 1,100 trillion.

Read also: ASTER Crypto Surges 9,900% After Support from Changpeng Zhao (CZ)

Mass Liquidation

According to FX Street, Bitcoin started the week on a negative note, hitting a low of $111,800 during Monday’s European trading session.

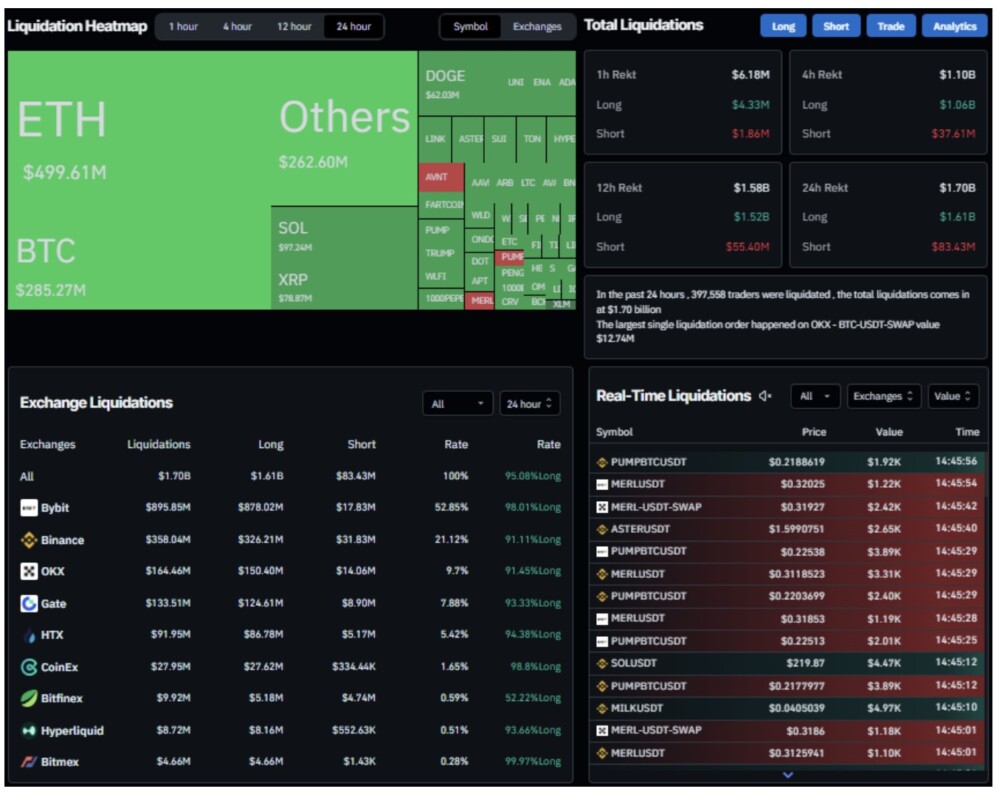

The sudden drop triggered a wave of liquidations in the crypto market, with more than 397,000 traders affected and the total value of liquidations reaching $1.70 billion in the last 24 hours, according to Coinglass data.

Interestingly, 95.08% of these were long positions, reflecting overly optimistic market conditions. The largest single liquidation occurred on the OKX exchange, where $12.74 million worth of BTC-USDT-SWAP positions were liquidated.

In addition, the Fear and Greed Index fell to 45 on Monday (22/9) after the latest price drop, signaling increasing caution and a shift in sentiment towards fear among market participants.

Institutional and Corporate Demand Remains Strong

Despite the price decline, institutional and corporate demand for BTC remains solid.

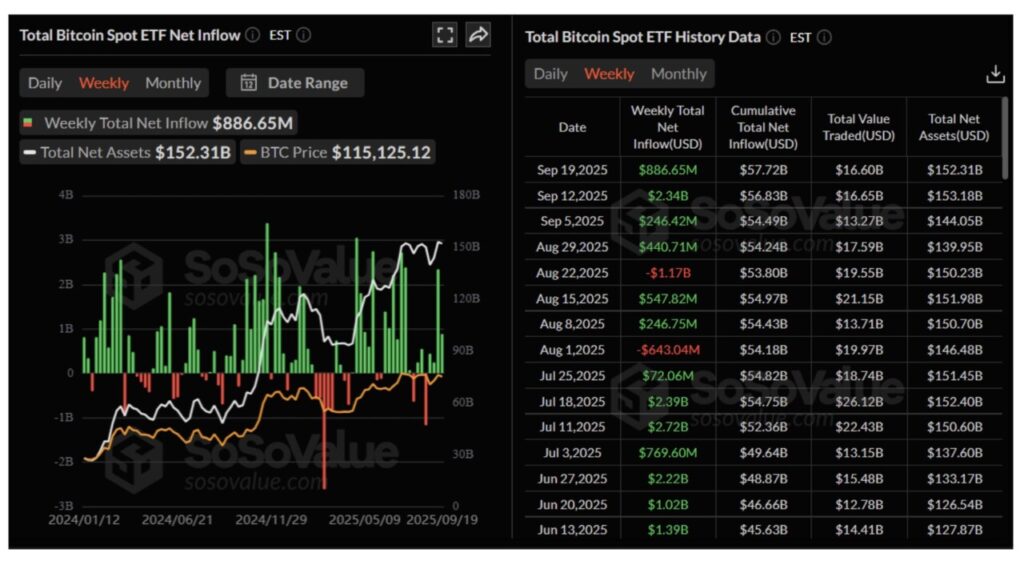

SoSoValue data shows that Bitcoin spot Exchange Traded Funds (ETFs) recorded inflows worth $886.65 million throughout last week, marking the fourth consecutive week of positive flows.

On the corporate side, demand is also on the rise. Japanese investment firm Metaplanet announced on Monday that it had purchased an additional 5,419 BTC, bringing their total holdings to 25,555 BTC.

In the same period, the European company known as First Bitcoin Treasury Company Capital B also increased its reserves by 551 BTC, bringing its total holdings to 2,800 BTC.

Read also: Ethereum Price Falls to $4,100 on September 23, 2025 — Is ETH at Risk of Dropping Below $4,000?

Bitcoin Price Prediction: Bear Pressure Heading Below $107,000

According to a report by FX Street (22/9), Bitcoin price broke through the daily support level of $116,000 last Friday and continued to weaken slightly throughout the weekend. On Monday’s trading, BTC continued its correction, dropping below the 50-day Exponential Moving Average (EMA) at $113,926.

If BTC closes daily trading below the 50-day EMA, the decline could potentially continue towards the next daily support level of $107,245.

The Relative Strength Index (RSI) indicator on the daily chart reads 43, which is below the neutral level of 50, signaling bearish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) line has started to narrow and has the potential to form a bearish crossover, further reinforcing the negative view.

However, if BTC is able to hold around the 50-day EMA at $113,926, the recovery could continue towards the daily resistance level of $116,000.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Bitcoin Price Forecast: BTC slips below $113,000 as liquidations mount. Accessed on September 23, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.