7 Astonishing Facts: Number of Crypto Billionaires to Rise 40% by 2025, Who Benefits?

Jakarta, Pintu News – In 2025, the cryptocurrency world will make history once again. According to Henley & Partners’ Crypto Wealth Report, the number of individuals with crypto wealth reached an all-time high.

This rise is attributed to the surge in the price of Bitcoin (BTC), Ethereum (ETH), as well as the increasing institutional adoption of digital assets. This article will review seven key facts that explain this trend in depth.

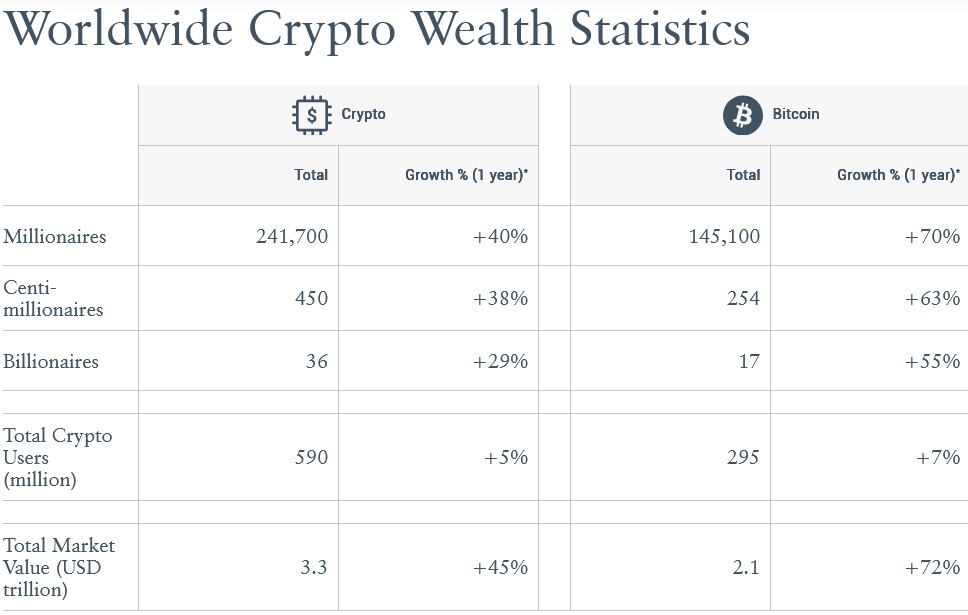

1. Number of Crypto Billionaires Hits 241,700, Up 40% in a Year

Henley & Partners noted that the number of crypto millionaires increased by 40% on an annualized basis, from 172,000 to 241,700 people by mid-2025. This increase is mainly driven by the surge in crypto market valuation, which exceeded $3.3 trillion or around Rp55,278 trillion.

The report also notes an increase in the ultra-rich: there are 450 crypto centimillionaires (with wealth above $100 million or Rp1.67 trillion), up 38%, and 36 crypto billionaires, an increase of 29%. This data was obtained through Henley’s internal wealth model as well as sources such as CoinMarketCap, Binance, and Etherscan.

Also Read: 5 Key Points of Arthur Hayes’ Analysis: Bitcoin (BTC) Could Reach Rp56 Billion by 2028?

2. Bitcoin (BTC) is the main driver of the rise in digital wealth

Bitcoin recorded rapid growth with the number of people holding assets worth at least $1 million increasing by 70% to 145,100. The report mentions that from July 2024 to June 2025, Bitcoin’s performance consistently outperformed the rest of the crypto market.

Higher wealth classes also saw a significant surge: BTC centimillionaires rose 63% to 254 people, while BTC billionaires rose 55% to 17 people. According to Phillipp Baumann, founder of Z22 Technologies, Bitcoin is now starting to be considered a “base currency for wealth accumulation” by global investors.

3. Institutional Adoption a Key Factor by 2025

The year 2025 was called a “watershed year for institutional adoption” by Henley & Partners. The entry of large public companies and financial institutions, especially from the United States, strengthens the legitimacy of crypto as a legitimate asset class.

The Trump administration’s crypto-friendly policies have given Wall Street players more confidence to invest. The inflow of funds into Bitcoin spot ETF products in the US increased from $37.3 billion to $60.6 billion (around Rp1,014 trillion), while the Ethereum spot ETF quadrupled to $13.4 billion (around Rp224.4 trillion).

4. Ethereum (ETH) Increasingly Favored by Hedge Funds and Brokers

Institutional investors’ interest in Ethereum surged sharply, especially in the second quarter of 2025. Hedge funds and investment firms recorded accumulation of spot ETH ETFs worth $1.35 billion and $688 million, respectively.

Meanwhile, brokers and private equity firms are also increasing their exposure to ETH, showing that Ethereum is not only a speculative choice, but also an asset that is being looked at for institutional portfolio diversification.

5. Despite the rise in billionaires, the number of global crypto users only increased by 5%

Henley notes that crypto user adoption globally has only increased by 5%, from around 561 million to 590 million users. This suggests that the surge in wealth was among the minority who had already adopted digital assets.

This means that value growth is uneven, and there is still plenty of room for public adoption to expand. Public awareness and education on cryptocurrencies is still a major challenge in many countries.

6. United States, Singapore, and Hong Kong are the favorite destinations of crypto billionaires

In Henley’s Crypto Adoption Index, the US, Singapore, and Hong Kong took the top spots as countries to which crypto investors are migrating. Factors such as regulation, infrastructure, and tax incentives are the main reasons for the region’s attractiveness.

Countries like Switzerland and the United Arab Emirates (UAE) are also in the top five. Meanwhile, smaller countries like El Salvador, Panama, and Uruguay are also developing crypto-friendly strategies to attract global investors.

7. Surge in Crypto Market Value Opens New Opportunities, But Also Challenges

The total crypto market valuation surpassed $3.3 trillion in mid-2025, reflecting the market’s confidence in digital assets. However, rising wealth does not guarantee stability, especially with market fluctuations and regulatory risks.

The analysts advised investors to remain cautious, as despite the increased opportunities, crypto volatility remains high. The report also highlights the important role of digital financial education for the public in addressing this trend.

Also Read: Deutsche Bank Predictions About Bitcoin (BTC) Becoming Central Bank Reserves in 2030!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Brayden Lindrea / Cointelegraph. Crypto millionaires at record level with ‘watershed year for institutional adoption’. Accessed September 25, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.